Olympus (OHM) Review: A Data-Driven Legitimacy and Risk Assessment

What Is Olympus: An Introduction

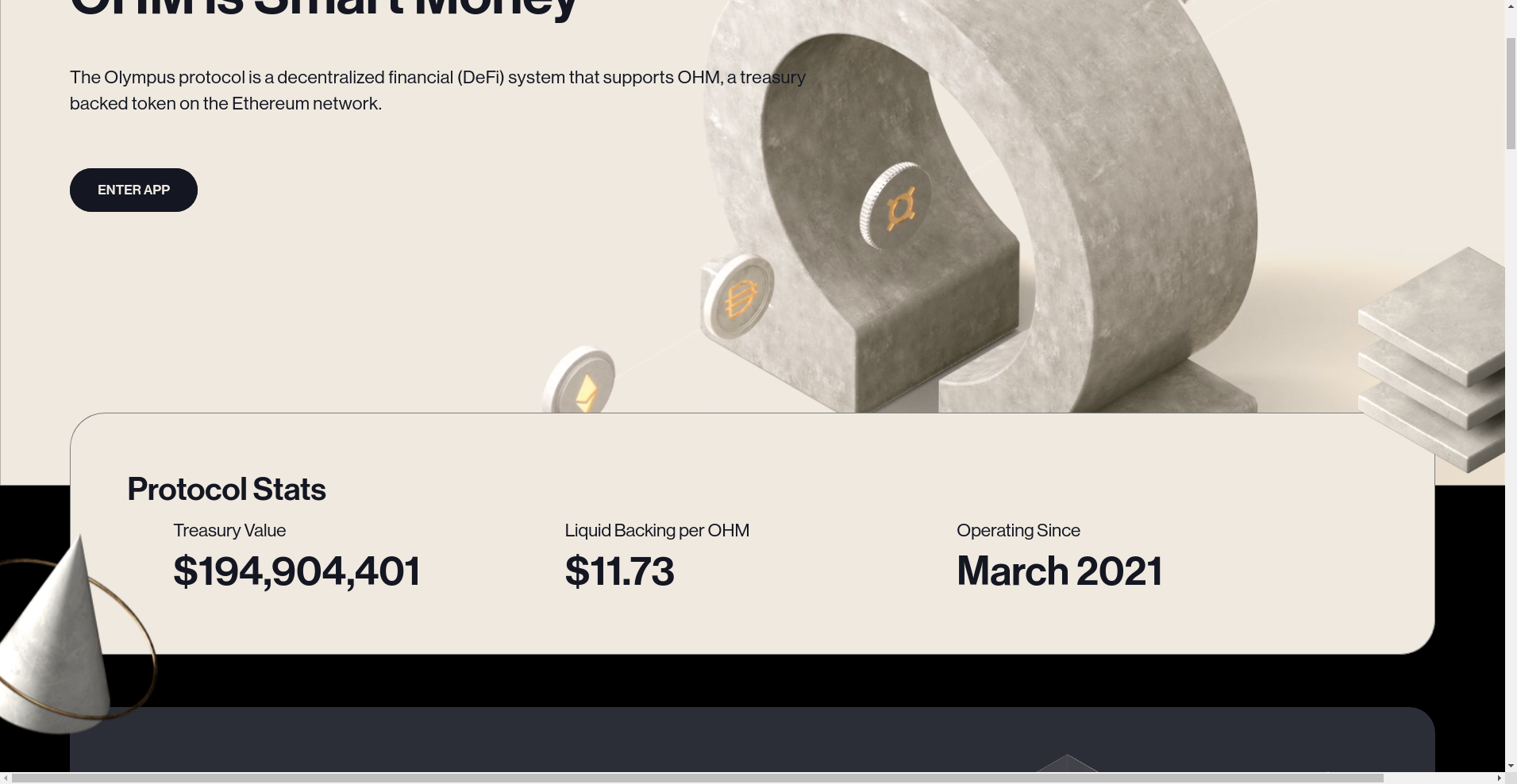

Olympus DAO is a decentralized finance (DeFi) project built on the Ethereum blockchain. Its primary objective is to create a treasury-backed, censorship-resistant digital currency called OHM, which aims to serve as "smart money" within the broader DeFi ecosystem.

The project emphasizes autonomy, community governance, and innovative monetary policy mechanisms. Unlike traditional stablecoins, OHM is a free-floating asset maintained through algorithms and treasury assets, positioning itself as a "flatcoin" designed to preserve purchasing power independently of fiat pegs.

This review offers an impartial analysis of Olympus’s core strengths and potential vulnerabilities, based solely on available data, audits, tokenomics, and community transparency reports.

The Team and Vision Behind Olympus

The team behind Olympus DAO is largely anonymous, typical of many DeFi projects aiming for decentralization. They have established a clear roadmap, emphasizing treasury growth, protocol-owned liquidity, and community governance. The key milestones include developing the RBS (Range Bound Stability) system, launching Cooler Loans, and expanding cross-chain capabilities.

Key evaluated roadmap milestones include:

- Q2 2023: Expansion of governance proposals and treasury asset diversification.

- Q3 2023: Implementation of the RBS mechanisms and cross-chain integrations.

- Ongoing: Deployment of Cooler Loans and protocol-owned liquidity enhancements.

Overall, the team demonstrates a focus on transparency via community channels, audits, and regular reports, although the lack of publicly verified identities adds a layer of an inherent trust challenge. This is a common discussion point when analyzing DeFi governance models with anonymous teams.

Assessing Olympus Security Audit Results

Based solely on Cer.live audit data, Olympus has been subjected to multiple audits, primarily by firms like Nexus Mutual, OmniScia, and PeckShield, with the latest audit URL: see report here. It’s noteworthy that only one major publication (PeckShield’s review) explicitly covers core smart contracts, with a rating score of 7.3 out of 10, indicating moderate confidence.

Key technical findings include:

- Audit Coverage: Covered critical areas like Olympus V3 smart contracts, governance, and treasury management.

- Vulnerabilities: No major exploits reported; minor issues related to upgrade procedures are documented with plans for remediation.

- Insurances: Olympus maintains insurance coverage through Nexus Mutual for approved risks, enhancing security trust.

- Ongoing Bug Bounty Program: Continues to incentivize community and white-hat testing efforts.

While audits serve as vital security indicators, they are not an absolute guarantee against future exploits or flaws. The transparent reporting, combined with ongoing bug bounty programs, enhances trust but does not eliminate all risks inherent in complex smart contract systems.

A Breakdown of Olympus Tokenomics

The tokenomics of OHM reveal a complex, inflationary model designed to foster treasury growth and market stability, though with inherent risks. Key data points include:

- Total Supply: Approximately 17.7 million OHM tokens outstanding.

- Market Cap: Around $354 million, with 0.0251 increase in market cap over recent periods.

- Price: Approximately $21.61, although recent downward adjustments (-10.3%) reflect market volatility.

- Token Utility: Bonding, providing liquidity, governance voting, and access to Cooler Loans.

- Inflation and Distribution: No fixed cap; inflationary issuance is used to incentivize liquidity provision and treasury growth. The initial treasury backing is valued at over $195 million, with liquid backing per OHM at $11.73.

- Allocation: Significant portions allocated to team, governance, and community rewards—though specific vesting details are not publicly specified in all sources, implying potential inflation risks for holders if treasury growth stalls.

The economic model relies heavily on treasury asset appreciation and continuous protocol growth. While innovative, the inflationary issuance poses potential risks of dilution and market oversupply, particularly if market confidence wanes. Understanding cryptocurrency token burns can provide context for different supply management strategies.

Assessing Olympus's Development and Ecosystem Activity

Official development activity appears steady, with regular updates on governance proposals and protocol enhancements documented on community channels like Discord and Medium. Notable progress includes:

- Implementation of the RBS mechanism to stabilize OHM's price range.

- Deployment of Cooler Loans, adding utility for users to borrow against treasury backing.

- Expansion into cross-chain operations to increase liquidity and resilience.

However, market activity does not always translate into real decentralized on-chain usage, and reported trading volumes (~$254K in recent data) are modest relative to the treasury size. A significant portion of the activity seems driven by protocol incentives and community engagement rather than wide adoption.

Genuine growth would ideally be reflected in increased liquidity, active governance proposals, and treasury expansion, which are progressing but not yet fully matured or verified through external DeFi adoption metrics.

Reviewing the Terms and Conditions

Based on the existing documentation, no unusual or risky legal clauses are immediately evident. The protocol emphasizes community governance, transparent audit disclosures, and continuous bug bounty incentivization. Risks include typical smart contract vulnerabilities, governance decision centralization risk due to anonymous leadership, and inflationary token supply pressures. As with most DeFi protocols, user funds are subject to smart contract exploits, which, though mitigated through audits, cannot be entirely eliminated.

Final Analysis: The Investment Case for Olympus

Olympus DAO presents itself as a pioneering, community-driven effort to create a non-pegged, treasury-backed monetary system. Its unique approach, combining protocol-owned liquidity, algorithmic stability via RBS, and utility through Cooler Loans, offers innovative value propositions. Security audits indicate a moderate level of confidence but highlight areas for ongoing improvement.

Despite its technological and community strengths, a series of risks remain:

- Market Volatility: OHM’s price remains volatile, influenced by treasury value, market sentiment, and inflation dynamics.

- Inflationary Model: Continuous token issuance could dilute value if treasury growth does not keep pace.

- Governance Risks: Anonymous leadership and potential governance centralization could impact decision-making quality.

- Security Vulnerabilities: While audits mitigate risks, smart contract exploits are always possible.

- Adoption & Liquidity: Current trading volumes suggest limited on-chain activity and liquidity depth, posing risks for large investors seeking stability.

Investors should weigh Olympus’s innovative ethos and treasury backing against these risks. Its commitment to transparency and ongoing development initiatives are positive indicators but warrant continuous monitoring.

The decision to engage with OR hold $OHM depends on individual risk appetite, confidence in community governance, and belief in its long-term treasury growth strategy. Due diligence remains paramount, as with all high-risk DeFi ventures.

David Martinez

Quantitative Risk Modeler

Quantitative analyst focused on crypto. I cut through the hype by modeling tokenomics and risk from a purely mathematical standpoint. If the numbers don't work, nothing else matters.

Similar Projects

-

Moo.Army

Crypto Scam Review: Is Moo.Army a Legit Project or a Rug Pull?

-

OppiWallet

In-Depth Review of OppiWallet: Crypto Project Scam Checker & Risk Analysis

-

Pugabull

Pugabull ($PUGA) Review: Analysis of Its Security and Community Factors

-

Luna Inu

Luna Inu: Post-Mortem Analysis & Lessons from Its Disappearance