Oddz ($ODDZ) Review: A Data-Driven Look at Its Legitimacy, Risks, and Potential

What Is Oddz: An Introduction

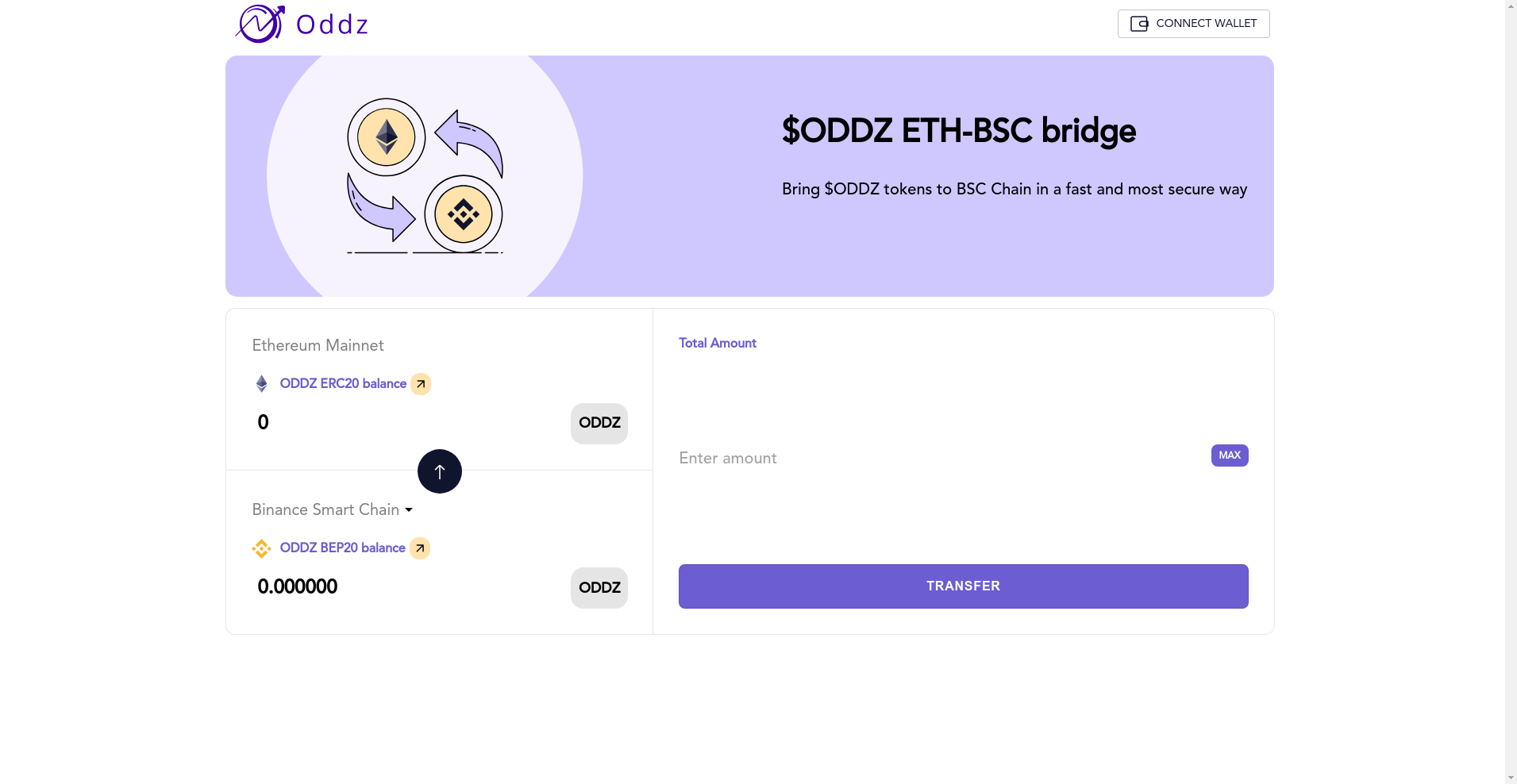

Oddz is positioned as a comprehensive DeFi platform focused on enabling trustless, on-chain derivatives trading across multiple blockchains. The project emphasizes the creation and settlement of various financial instruments such as options (calls and puts), futures, and conditional tokens, enhancing decentralized access to derivatives markets. Its core proposition is a multi-chain infrastructure supporting fast, transparent, and non-custodial trading experiences.

From the available data, Oddz aims to carve out a niche in the competitive DeFi derivatives space by offering unique features like zero gas fees (claimed), guaranteed exercise rights within holding periods, and a permissionless environment free of KYC requirements. This review delivers an impartial assessment, weighing its strengths against potential vulnerabilities and regulatory considerations to help investors evaluate its legitimacy and long-term viability.

The Team and Vision Behind Oddz

Based on the available information, the team behind Oddz appears to operate with transparency, providing links to an official website, GitHub repositories, and detailed documentation. The audit reports further support a degree of technical scrutiny, with professional audits conducted by SlowMist and PeckShield. However, explicit details regarding team members' identities or backgrounds are not provided in the outer material, which is common in early-stage or decentralized projects.

**Roadmap Highlights include:**

- Integration with major DEXs like GMX, Hyperliquid, and Aevo (May 2024)

- Development of native perpetual (perp) contracts with mainnet launch slated for late 2024 to Q1 2025

While the roadmap indicates a strategic vision aligned with current DeFi trends, the project's ability to deliver on these milestones remains a critical metric in assessing credibility.

Assessing the Security and Integrity of Oddz

According to the Cer.live audit report, the platform has undergone at least one major security review conducted by SlowMist, a reputable security auditor in the crypto space. The audit covers the overall platform but provides limited details in the accessible excerpt, though a PDF link to the full report suggests formal scrutiny.

**Key findings include:**

- Audit coverage score: 80% (indicative of core security checks being completed but possibly with room for improvement)

- Presence of bugs or incidents: Yes, indicating identified vulnerabilities or past issues need further review

- Absence of insurance coverage, thus relying on the solidity of code and audit fixes for security assurance

- Active bug bounty program, demonstrating ongoing efforts to identify vulnerabilities

The sole audit source from SlowMist, complemented by PeckShield's review, suggests a moderate level of security commitment. However, the lack of additional audits or formal formal verification raises questions about operational safety, especially in a trustless derivatives environment vulnerable to smart contract exploits and cross-chain risks.

A Breakdown of Oddz Tokenomics

Oddz’s native token, $ODDZ, has a total supply of 100 million tokens with a circulating supply around 89 million as per the latest data. The token plays a fundamental role in the platform's governance, fee distribution, and staking rewards. Its current market cap is approximately $172,081, with a relatively low trading volume of about $265,791 in recent data, indicating modest liquidity and adoption.

**Tokenomics highlights include:**

- Total Supply: 100,000,000 ODDZ

- Circulating Supply: approx. 89,405,704 ODDZ

- Market Cap: ~$172K (recent decline of ~8.44%)

- Price: ~$0.00192833

- Use cases encompass governance participation, staking, fee sharing, and potentially incentivizing liquidity provision

- Fee collection and distribution are referenced but not detailed—raising questions about economic sustainability and whether fee models support long-term incentives for holders

- Vesting schedules for team and investors are not specified, which could influence market dynamics and token utility over time

While the tokenomics suggests modest market activity and a niche utility, the low market cap and liquidity imply high volatility and risk. These factors, coupled with the project’s upcoming plans for active development, require cautious positioning from an investment perspective.

Assessing Oddz's Development and Ecosystem Activity

The project demonstrates ongoing development, with active plans to integrate prominent DEXs and enhance its cross-chain derivatives offerings. Its roadmaps point towards future mainnet launches, expanding functionality, and strategic partnerships—an encouraging sign of ambition and active engagement.

However, the publicly available data indicates that much of the current activity may be at the developmental or announcement phase rather than widespread real-world deployment or user adoption. The relatively low trading volume and the older documentation referencing features that are not yet live underscore this stage of maturity.

In terms of ecosystem traction, the presence of community channels (Telegram, Medium, Twitter) suggests a foundational outreach. Still, verification of active user participation, transaction volume, or liquidity pools remains limited. The true measure of development activity will hinge on upcoming launches, security audits' outcomes, and how well the platform can attract liquidity providers and traders at scale.

What Investors Should Know About Oddz’s Terms

The publicly shared materials do not explicitly highlight legal clauses or risk disclosures. However, the absence of detailed legal terms within the provided documentation implies that potential users should exercise caution. Projects dealing with derivatives, cross-chain assets, and decentralized governance inherently face regulatory uncertainties, especially given the absence of KYC and the trustless, permissionless design.

Potential risks include:

- Regulatory crackdowns on derivatives hosting or DeFi platforms operating without KYC

- Smart contract vulnerabilities impacting user funds and liquidity pools

- Cross-chain bridge risks, notably bridge hacks or exploits, as indicated by incidents in the broader DeFi ecosystem

- Token volatility and liquidity constraints that may affect staking and governance participation

Before engaging or investing, users should review official legal disclosures, understand their jurisdictional stance, and consider the platform's audit reports and operational transparency, using resources such as guidelines for evaluating DeFi derivatives platforms.

Final Analysis: The Investment Case for Oddz

In sum, Oddz presents itself as an ambitious multi-chain derivatives ecosystem with promising features tailored to advanced DeFi traders. Its focus on trustless, non-custodial trading, combined with plans for a Bitcoin Layer 2 deployment, underscores a strategic vision aligned with evolving DeFi infrastructure trends.

Nonetheless, the project faces notable challenges and risks. The security audits, while indicative of due diligence, are not exhaustive, and the ongoing incident history hints at potential vulnerabilities. Its low current market cap, modest liquidity, and pending feature rollouts suggest that much of its promise is still in development rather than proven in live, high-volume environments.

**Pros / Strengths:**

- Multi-chain support with clear future expansion plans

- Focus on trustless, permissionless trading (no KYC)

- Security auditing from credible firms (SlowMist, PeckShield)

- Active bug bounty programs indicating ongoing security efforts

- Robust roadmap targeting mainstream deployment (Bitcoin L2, mainnets)

- Integration with leading DeFi liquidity providers

**Cons / Risks:**

- Limited current user adoption and low trading volume

- Dependence on successful future development and deployment

- Potential regulatory scrutiny due to unlicensed derivatives

- Smart contract and cross-chain bridge security vulnerabilities

- Market and liquidity risks stemming from low cap and liquidity

- Unclear token distribution and vesting schedules

In conclusion, Oddz holds promise as a multi-chain derivatives platform with innovative features, but investors should approach with caution. Deep due diligence, verification of security audits, and awareness of the project’s developmental status are essential before considering an allocation.

Michael Brown

Head of Protocol Security & Audits

Systems engineer applying mission-critical principles to DeFi. I stress-test smart contracts and economic models to find the breaking points before they find your wallet.

Similar Projects

-

Flux

Flux ($Flux) Review: Technology, Security & Risks Explored

-

ATSCOIN

ATSCOIN Review: Scam or Legit Crypto? Red Flags Uncovered

-

Exeedme

Exeedme ($XED) Review: A Data-Driven Analysis of Its Risks & Potential

-

Chainlink

Chainlink Review: Scam or Legit Crypto? Crypto Project Investigation

-

BRICS GOLD

BRICS GOLD Review: Is This Crypto Project a Scam or Legit? Crypto Scam Checker & Detailed Review