Nord Finance ($NORD) Review: A Data-Driven Legitimacy and Risk Assessment of Its Potential

What Is Nord Finance: An Introduction

Nord Finance positions itself as an advanced decentralized financial (DeFi) ecosystem built primarily on the Ethereum network. Its stated goal is to simplify DeFi investing by integrating traditional finance attributes into a multi-service platform. This comprehensive ecosystem aims to provide users with savings, lending, advisory, and swapping functionalities—all while promoting interoperability across multiple blockchains. To achieve this, projects often employ multi-chain deployment strategies.

Despite its ambitious vision, current available data suggests that Nord Finance is in the early or possibly pre-launch stage. This article offers an impartial analysis by examining its team, security, tokenomics, ecosystem activities, and risks—based on audit reports, project summaries, and observed on-chain data.

The Team and Vision Behind Nord Finance

The publicly available team members’ profiles include roles such as CEO, CTO, CMO, lead blockchain developers, and Solidity experts. Key team figures like Amarnath Reddy and Jignesh Vasoya possess substantial experience in crypto funds, blockchain development, and engineering, indicating credible expertise that could underpin project execution.

However, the project’s public-facing documentation and developer details do not clearly specify their backgrounds beyond basic descriptions. Transparency in team's track record across past successful projects remains limited, making it challenging to assess their ability to meet roadmap milestones confidently.

- Roadmap Milestones:

- V1 of Nord.Savings launched Q1 2021

- Multi-chain deployment (Polygon, Avalanche) through 2021

- Partnerships with Polygon, Chainlink, and others

- Upcoming features include NFT loans, fixed deposit products, and multi-chain integrations

Overall, the team’s background indicates potential technical capability, but the transparency gaps and absence of recent, concrete product launches may impact their perceived reliability.

Assessing the Security and Integrity of Nord Finance

The security analysis is primarily based on the audit report from QuillAudits, which covers Nord Finance's smart contract codebase. The audit confirms that the platform's platform-specific contracts are audited, but no detailed vulnerabilities or scores are listed in the provided summary. Understanding such reports is crucial for investor confidence.

Key findings include:

- Audit conducted by reputable firm QuillAudits, indicating a baseline of trust

- Audit details accessible via full report

- Other audits, such as by Zokyo, are also mentioned but with limited publicly available data

Given only one major audit, the security evaluation's comprehensiveness is limited. The absence of known vulnerabilities from the publicly shared audit suggests a baseline level of security; however, the project's overall safety cannot be fully verified without access to detailed vulnerability assessments or subsequent audits. To properly assess this, one would need to understand QuillAudits smart contract audits.

Implication for investors: While security audits are positive, the limited audit data warrants caution—especially in the highly exploited DeFi landscape where new vulnerabilities frequently emerge.

A Breakdown of Nord Finance Tokenomics

The project’s token, $NORD, is reportedly capped at a total supply of 9,100,000 tokens. Key points include:

- Total Supply: 9,100,000 $NORD tokens

- Circulating Supply: Currently no data suggests tokens are actively circulating—shown as "0" on the platform.

- Market Cap: Listed as "$0," reflecting either pre-launch status or lack of data updates.

- Utility: Voting rights, staking, yield farming, and governance participation

- Distribution: Roadmap indicates allocations for team, advisors, partnership incentives, and community rewards, but specific vesting details are not outlined comprehensively.

The lack of circulating tokens or live trading volume indicates that the ecosystem may currently have minimal active economic activity, raising questions about immediate utility and sustainability. A deep dive into these aspects is necessary to grasp the project's future viability; understanding the specifics of Nord Finance tokenomics provides critical insights.

Economic sustainability Apple: The tokenomics model relies on a future active ecosystem to generate value. However, with current inactive metrics, the project’s reward and incentive mechanisms may not yet be functional or widely adopted, posing potential risks to long-term viability.

Assessing Nord Finance’s Development and Ecosystem Activity

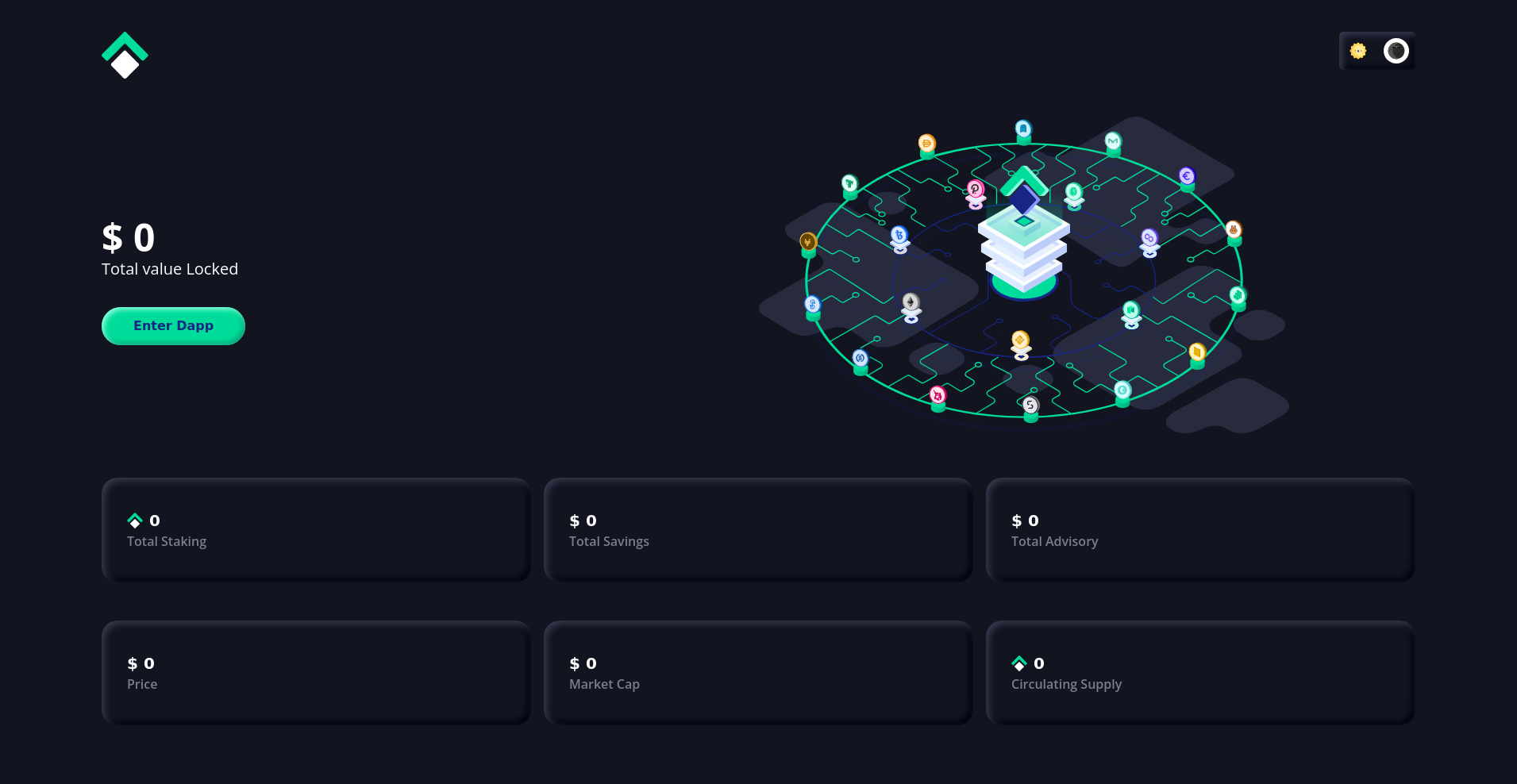

The latest data shows a stark reality: the platform displays "$0" for Total Value Locked (TVL), total staking, total savings, advisory assets, as well as the token's price and market capitalization. Essentially, no on-chain activity or user engagement is currently visible.

This indicates that either the platform is still in development, undergoing maintenance, or has not yet been fully released to the public. The "Enter Dapp" button is the primary interface, but without active usage metrics, the platform’s real-world traction remains unproven.

Furthermore, a recent token price of approximately $0.014 and low trading volume (around $19,283) suggest very limited liquidity or market interest at this stage. The overall ecosystem activity is thus predominantly aspirational, depending on future product launches and community growth.

Analyzing the Terms and Conditions

The provided documentation or terms from the project do not highlight any explicit unusual clauses or risky legal conditions. However, the significant gaps in data—such as undefined token utility, absence of active user base, and minimal on-chain metrics—imply a need for thorough review before committing funds.

Potential issues include:

- Lack of clarity on token vesting or lock-up periods

- Uncertain legal jurisdiction or regulatory standing

- Limited transparency about ongoing development and governance processes

In conclusion, the project’s legal documentation does not currently expose clear red flags but does underscore a pressing need for further verification, especially related to token rights and project governance.

Final Analysis: The Investment Case for Nord Finance

Based on the available data, Nord Finance presents a compelling ambition—to be a multi-chain DeFi platform simplifying complex financial services. Yet, the current on-chain metrics and documentation highlight that it remains in a nascent or pre-launch phase, characterized by:

- Limited or no active user engagement

- No current market activity or token liquidity

- Preliminary security audits with no publicly known vulnerabilities

While the team’s credentials and strategic partnerships suggest potential, the absence of tangible operational metrics introduces significant risks, notably around project execution, adoption, and economic sustainability.

Pros / Strengths:

- Experienced team with relevant technical backgrounds

- Partnerships with reputable entities like Chainlink and Polygon

- Security audits conducted by trusted firms

- Ambitious multi-chain strategy and broad product vision

Cons / Risks:

- Minimal current on-chain activity or user engagement

- Unclear token utility and ongoing ecosystem development

- Market cap and liquidity effectively nonexistent at present

- Potential delays or failure in achieving roadmap milestones

In sum, prospective investors should approach Nord Finance with cautious optimism, recognizing its strategic potential yet remaining aware of its substantial developmental and operational gaps. Due diligence and ongoing monitoring are essential to evaluate its progression from concept to realized platform.

Ultimately, this review aims to empower an informed stance, emphasizing that any investment in early-stage projects carries inherent risks balanced against future potential.

Daniel Clark

On-Chain Quantitative Analyst

I build algorithmic tools to scan blockchains for signals of manipulation, like whale movements and liquidity drains. I find the patterns in the noise before they hit the charts.

Similar Projects

-

Cyptobit Network

In-Depth Review of Cyptobit Network: Crypto Scam Checker & Project Scam Review

-

Oh My God Coin (OMG)

In-Depth Review of Oh My God Coin (OMG): Crypto Scam Checker & Project Analysis

-

Xitcoin

Xitcoin Review: Crypto Scam Checker and Project Analysis

-

HippoSwap

HippoSwap Review: Is This DeFi Project a Scam or Legit? Crypto Scam Checker & Full Project Review

-

BlaroThings

BlaroThings Review: Scam Check & Legitimacy Analysis