Monolith ($TKN) Review: A Data-Driven Legitimacy and Risk Assessment

What Is Monolith: An Introduction

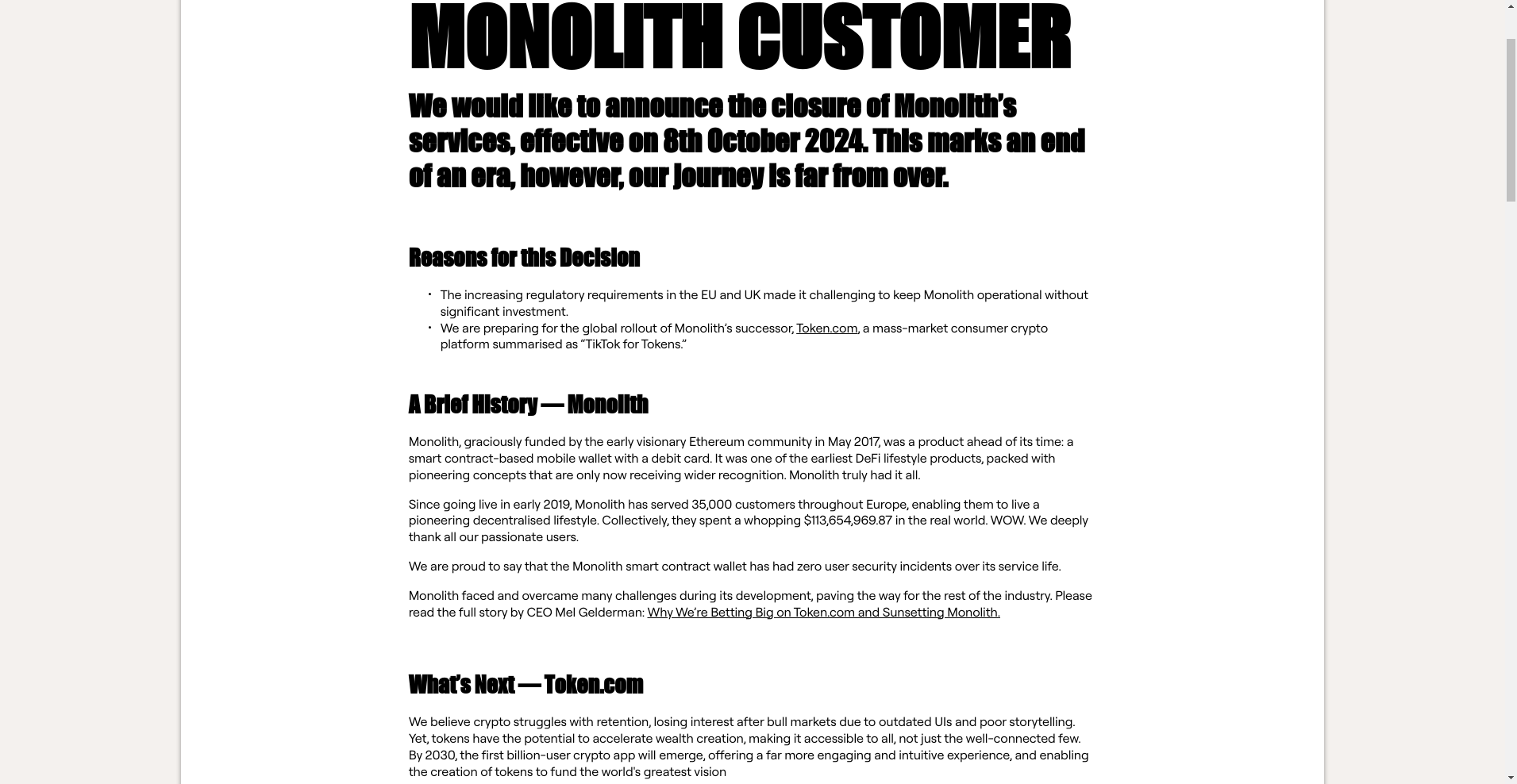

Monolith is a cryptocurrency project that historically aimed to bridge the gap between digital currencies and everyday life, facilitating real-world crypto spending and storage. Founded with significant early Ethereum community backing in May 2017, the project launched its services in early 2019, targeting users primarily across Europe. Monolith positioned itself as a pioneer in the DeFi lifestyle segment, offering a smart contract-based mobile wallet integrated with a debit card, enabling users to utilize cryptocurrencies seamlessly in their daily transactions.

As of late 2024, Monolith has announced its operational termination, with plans to transition users toward its successor initiative, Token.com. This review provides an impartial analysis based on available audit data, technical reports, and the project's publicly available information, aiming to assess its legitimacy, security posture, and potential risks for investors or users considering its ecosystem.

The Team and Vision Behind Monolith

The Monolith project was initially driven by a team actively involved in DeFi innovations and product development. Specific details about the founders' identities are limited, although the project is registered as UAB “Belela” in Lithuania, thus subject to local regulatory oversight as a Virtual Currency Deposit and Exchange operator.

Key milestones from their roadmap included:

- 2017: Funding by Ethereum community, establishment of foundational infrastructure.

- 2019: Launch of the smart contract wallet and debit card service, pioneering DeFi lifestyle features.

- 2024: Announced the sunset of Monolith services effective October 8th, alongside preparations for Token.com.

The project team appears to have a credible operational history, with no publicly reported security incidents during its active period. Their roadmap indicates a focus on innovative product deployment and user base growth, but the recent closure raises questions about their sustainability and ability to adapt to regulatory pressures. While the core team’s background remains partly opaque, their strategic pivot suggests a focus on long-term vision over short-term execution.

Assessing the Security and Integrity of Monolith

Security analysis relies primarily on a recent audit report from Cer.live, complemented by additional audits from Trail of Bits and Alchemy. While the limited publicly available audit data suggests a generally positive security posture, some concerns warrant discussion.

According to Cer.live, the platform's audit coverage is at approximately 80%. The platform has undergone ongoing bug bounty programs, with active engagement, signaling a proactive stance on security.

- Audit Scope: Focused on the smart contract infrastructure and overall platform security.

- Vulnerabilities: No critical vulnerabilities publicly reported. The bug bounty program remains active, allowing community oversight.

- Audit Scores: The platform received a rating of 7.45 out of 10, indicating moderate security confidence but room for improvement.

- Centralization Concerns: Limited detail is available, and the audit does not disclose detailed code reviews, leaving some analytical gaps.

- Operational Security: The project maintained zero security incidents during its active period, which is a positive indicator of operational prudence.

While these findings imply a baseline level of security, the partial audit coverage and absence of full transparency suggest a degree of residual risk. For potential users or investors, reliance solely on available reports without comprehensive code reviews could pose vulnerabilities, especially around upgradeability and governance backdoors.

A Breakdown of Monolith Tokenomics

The Monolith token, denoted as $TKN, has a total supply of approximately 30 million tokens, with detailed insights into its distribution and utility being critical for assessing economic health.

- Total Supply: 30,000,0448.179 tokens, with a circulating supply of zero as of the audit date, indicating that token distribution may be restricted or in transition.

- Market Cap and Liquidity: Due to the zero circulating supply, market valuation remains at zero, and trading volume is minimal (approx. $5.4), which raises liquidity concerns.

- Allocation: Specific allocations to team, advisors, VCs, or the community are not detailed publicly. The lack of clarity impedes transparency regarding potential token centralization or inflationary pressures.

- Vesting and Lockup Schedules: No explicit details provided, though typical vesting mechanisms are essential to prevent immediate dumping.

- Token Utility: Primarily used within the Monolith ecosystem for transaction fees and access, but its intrinsic value is uncertain given the platform's shared operational status.

The economic model appears to face sustainability risks due to the unclear token distribution, tokenomics, very low liquidity, and the overall project phase-out. Without a functioning ecosystem and transparent tokenomics, $TKN holds limited intrinsic or speculative value at present.

Assessing Monolith's Development and Ecosystem Activity

Despite the project’s sunset announcement, available data indicates that Monolith had substantial real-world traction, with over $113 million in total spend by more than 35,000 European customers. This demonstrates active adoption of their spend-and-store crypto services.

However, the recent closure and app delisting — scheduled for February 17th, 2025 — suggest a halt to development activities and ecosystem growth. The publicly available statement emphasizes a strategic shift towards Token.com, a new platform aimed at revamping user engagement through social and storytelling elements in crypto. This transition aligns with the general trend of community-driven development in crypto projects, although Monolith's current phase is more of a managed decline and transition.

While the previous product had real-world usage, current development activity is negligible, pointing to an ongoing transition rather than active ecosystem expansion. The beta phase of Token.com, already launched in Brazil, signals initial progress, but its global adoption potential remains to be seen.

The Fine Print: Analyzing Monolith’s Terms

The legal documentation highlights that Monolith’s company structure is compliant with Lithuanian regulations as UAB “Belela”, operating as a licensed Virtual Currency Deposit and Exchange operator. Nonetheless, certain clauses warrant note:

- Limited Protection: Crypto assets held in non-custodial wallets are explicitly unprotected by traditional deposit insurance schemes, increasing risk of asset loss without recourse. This emphasizes the importance of understanding non-custodial wallet risks and user responsibilities.

- Operational Risks: The decision to sunset services amid increasing regulatory barriers underscores vulnerability to legal and operational risks, a common challenge in the crypto platform sunset process.

- User Obligations: Users relying on seed phrases for asset recovery bear significant responsibility for security and backup, as no custodial support exists for wallet recovery.

No adverse clauses or atypical legal ambiguities are publicly reported, but the absence of comprehensive user protection mechanisms emphasizes the inherent risks linked to non-custodial crypto management.

Final Analysis: The Investment Case for Monolith

Monolith presents a mixed profile from legitimacy and risk perspectives. Its historical operational track record and security-aware approach suggest a project that initially had credible innovation within the DeFi lifestyle space. However, the recent formal closure of services, partial audit transparency, and opaque token distribution introduce significant caution signals.

Moreover, the transition to Token.com reflects a strategic pivot, seemingly driven by external pressures like regulation and market dynamics. The lack of active development, low liquidity, and unresolved details about tokenomics further dampen current investment viability.

-

Pros / Strengths

- Early innovator in DeFi and crypto lifestyle integration with a notable user base

- Zero security incidents during active years

- Active bug bounty programs and partial audits indicate security awareness

- Clear legal registration as a Lithuanian licensed crypto company

-

Cons / Risks

- Recent operational shutdown and app delisting, indicating project sunset and ecosystem halt

- Limited full audit transparency and 80% scope coverage

- Opaque token distribution and very low liquidity for $TKN

- Regulatory risks that led to service closure, suggesting vulnerability in compliance and operational longevity

- Assets in non-custodial wallets carry asset recovery and security responsibilities solely on users

In conclusion, while Monolith’s historical efforts demonstrate credible innovation, current conditions and incomplete disclosures imply a high risk for users and potential investors. The project’s future success hinges on the successful rollout and adoption of Token.com, but as of now, the ecosystem exhibits notable vulnerabilities and uncertainties.

Christopher Anderson

Smart Contract Auditor & Legal Tech Analyst

I have a dual background in law and computer science. I audit smart contracts to find the critical gap between a project's legal promises and its code's reality.

Similar Projects

-

Moonwell Artemis

Moonwell Artemis Review: Scam Check & Legitimacy Analysis

-

Gamster

Gamster ($GOIN) Review: Assessing Its Safety and Risks

-

Lith Token

Lith Token Review: Scam Check and Legitimacy Analysis

-

USD Coin

USD Coin (USDC) Review: Legitimacy, Risks & Ecosystem Insights

-

SPP7

Review of SPP7: Crypto Project Scam Checker & Investment Risk Analysis