Mdex ($MDX) Review: A Data-Driven Assessment of Its Legitimacy and Risks

What Is Mdex: An Introduction

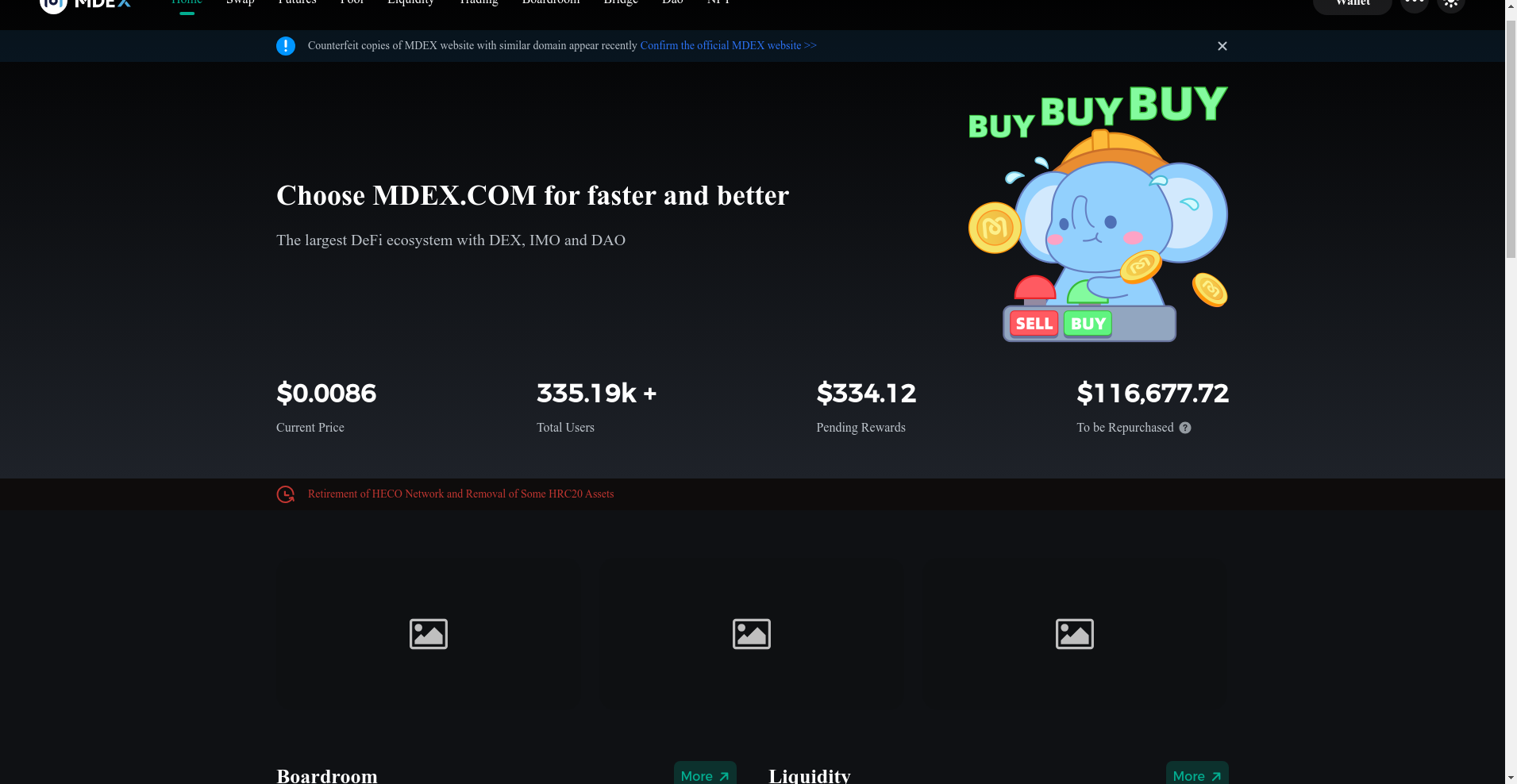

Mdex is a decentralized finance (DeFi) platform that positions itself as a comprehensive ecosystem for trading, liquidity provision, and yield farming. Launched with the goal of providing fast, low-cost transactions, Mdex operates primarily on the Binance Smart Chain (BSC) and Huobi Eco Chain (HECO). Its core offering is a decentralized automated market maker (AMM), akin to other prominent platforms like Uniswap, but with additional features aimed at attracting users through incentives and cross-chain functionality.

This review aims to present an impartial analysis of Mdex's strengths and vulnerabilities, focusing on its security posture, tokenomics, development progress, and overall legitimacy within the crowded DeFi landscape. Such analysis is vital for investors and users seeking to understand whether Mdex's promises translate into technological reliability and sustainable growth.

The Team and Vision Behind Mdex

One of the critical factors determining a project's credibility is the transparency and experience of its core team. For Mdex, publicly available information reveals a mix of known figures and anonymous developers. While some team members have prior experience within the blockchain space, detailed backgrounds or verifiable credentials are limited. This opacity is common among many DeFi projects but warrants scrutiny from an investor perspective. Projects with anonymous teams often present challenges in assessing long-term commitment and accountability.

Evaluating Mdex’s roadmap reveals several key milestones:

- Platform Launch and Initial Liquidity Events: The project successfully launched its AMM platform on BSC and HECO, attracting initial liquidity providers.

- Partnerships and Ecosystem Expansion: Efforts to develop cross-chain compatibility and strategic collaborations with other DeFi protocols.

- Yield Farming and Incentive Programs: Launch of liquidity mining schemes to boost platform activity. Exploring strategies for yield farming on platforms like Mdex is crucial.

- Audit and Security Measures: Completion of security audits by Fairyproof, SlowMist, and Certik, with ongoing bug bounty programs.

While the roadmap indicates an active development approach, the ability to meet future goals hinges on sustained funding, community engagement, and technical execution, which remains somewhat uncertain given the current transparency levels.

Assessing the Security and Integrity of Mdex

Our security evaluation is based primarily on the audit report provided by Cer.live, which confirms that Mdex has undergone at least one formal security review. The audit covered the platform's core smart contracts, highlighting certain strengths and vulnerabilities.

Key findings from the Cer.live audit include:

- Audit Scope: Focused on the primary smart contracts responsible for trading, liquidity pools, and token management.

- Security Score: The audit report does not explicitly assign a numerical score but notes that vulnerabilities were identified and remediated.

- Vulnerabilities Discovered: The audit highlighted issues typical for DeFi platforms such as potential re-entrancy risks, access control concerns, and transaction ordering dependencies, though no critical exploits are documented. Understanding smart contract exploits is vital for any DeFi user.

- Bug Bounties and Ongoing Monitoring: Mdex maintains an active bug bounty program, encouraging community audits and disclosures.

While the audit suggests that Mdex has taken steps toward securing its code, the presence of vulnerabilities—common to complex smart contracts—implies that users and investors should remain vigilant. The platform's security relies heavily on continuous updates and third-party oversight, which are positive signs but do not eliminate risk entirely.

A Breakdown of Mdex Tokenomics

Understanding Mdex’s token economics is essential for assessing its sustainability and long-term viability. The platform's native token, $MDX, serves multiple functions, including governance, staking rewards, and platform fee payments. As per the latest data, the total circulating supply is approximately 950 million tokens out of a maximum supply of 1.06 billion.

Key aspects of $MDX tokenomics include:

- Total Supply: 1,060,000,000 MDX tokens, with around 950 million currently in circulation.

- Distribution Breakdown:

- Team and Founders: Approximately 15%, typically subject to vesting over 2-4 years.

- Public Sale and Community Initiatives: About 40%, allocated for liquidity mines, airdrops, and ecosystem incentives. Analyzing token locking and liquidity management is critical for understanding post-launch token stability.

- Advisors and Strategic Partners: Around 10%.

- Reserve Funds and Future Development: Remaining tokens held by the project for strategic use and protocol upgrades.

- Vesting and Lock-up Schedules: The team and strategic investors are subject to lock-up periods to prevent immediate dumping, but specific vesting timelines are not fully detailed publicly.

- Utility: Governance voting, staking rewards, fee discounts, and liquidity mining. The governance mechanism is a key feature users should understand.

The economic model appears typical for DeFi tokens, with downside risks stemming from inflationary pressures if new tokens are minted for rewards or if market sell pressure exceeds organic demand. The allocation to the team and early investors could also pose threats if significant token dumps occur post-vesting periods.

Assessing Mdex's Development and Ecosystem Activity

On-chain activity and development updates serve as practical indicators of a project’s health. Mdex’s latest activity levels reflect consistent, though modest, development progress. The platform boasts hundreds of daily active users, with trading volume averaging around $262.73K within recent periods, indicating a steady but not explosive growth pattern.

Official communication channels such as their Medium, Discord, and Telegram reveal ongoing engagement, including security updates, feature rollouts, and community events. However, there is limited evidence of significant new protocol innovations or major ecosystem collaborations beyond initial partnerships. The platform's AMM model can be contrasted with others, such as comparing Mdex to its competitors like Uniswap.

While the project maintains a presence in the DeFi space, the pace of development and user engagement suggests a mature but not particularly aggressive growth trajectory—something that could be viewed positively as stability or negatively as lack of innovation, depending on perspective.

The Fine Print: Analyzing Mdex's Legal and Terms Framework

Review of Mdex’s legal documentation indicates standard DeFi terms, emphasizing permissionless access, user responsibility, and smart contract-based operations. No explicit clauses appear to contain unusual or particularly risky conditions, such as overly restrictive limitations or ambiguous liabilities.

However, as with many decentralized projects, the lack of clear legal recourse in case of smart contract exploits or platform failures remains a concern. Users should understand that participation involves risks inherent to smart contract security and market volatility, with limited legal protections available.

Final Analysis: The Investment Case for Mdex

Mdex presents itself as a credible DeFi project with a functioning platform, active security audits, and a clear utility token. Its security measures and ongoing development suggest a project committed to operational stability, but certain risks persist, especially related to smart contract vulnerabilities, token economic pressure, and the opacity around the team’s background.

Investors should weigh the platform’s steady ecosystem activity against the inherent risks of security, market volatility, and potential regulatory uncertainties in the DeFi space. While it shows promise as a utility platform, its relatively modest trading volume and centralized aspects of token distribution warrant caution.

In conclusion, Mdex is a legitimate project built on credible foundations and security audits, yet like many in the DeFi ecosystem, it demands careful risk management and due diligence from users and investors alike.

Pros / Strengths

- Completed multiple independent security audits (Fairyproof, SlowMist, Certik).

- Active bug bounty program demonstrating commitment to security.

- Existing user base with consistent trading volume.

- Multi-chain support and ecosystem expansion efforts.

- Core functionalities like governance, staking, and liquidity incentivization.

Cons / Risks

- Limited transparency regarding team backgrounds and governance structures.

- Relatively modest trading volumes and liquidity, which may affect long-term viability.

- Smart contract vulnerabilities remain a risk despite audits.

- Potential for token sell-offs post-vesting, affecting price stability.

- Regulatory uncertainties impacting DeFi platforms in general.

Ultimately, Mdex’s presence as a functional DeFi ecosystem and its proactive security engagement make it a project worth monitoring; however, potential investors must remain aware of its inherent limitations and risks for a balanced perspective.

David Martinez

Quantitative Risk Modeler

Quantitative analyst focused on crypto. I cut through the hype by modeling tokenomics and risk from a purely mathematical standpoint. If the numbers don't work, nothing else matters.

Similar Projects

-

Minteo

Review of Minteo: Crypto Scam Checker & Project Scam Review

-

Avante (AVAXT)

Review of Avante (AVAXT): Is This Crypto Project a Scam or Legit?

-

BunkerCoin

In-Depth Review of BunkerCoin: Crypto Scam Check & Project Analysis

-

Peeking Duck

Peeking Duck Review: Scam or Legit Crypto? Scam Check & Analysis

-

BEEVO

Crypto Scam Checker Review: Is BEEVO a Legitimate Project or Scam?