LiveArt ($ART) Review: A Data-Driven Examination of Its Legitimacy and Risks in Art Tokenization

Project Overview: Transforming High-Value Art into Liquid Digital Assets

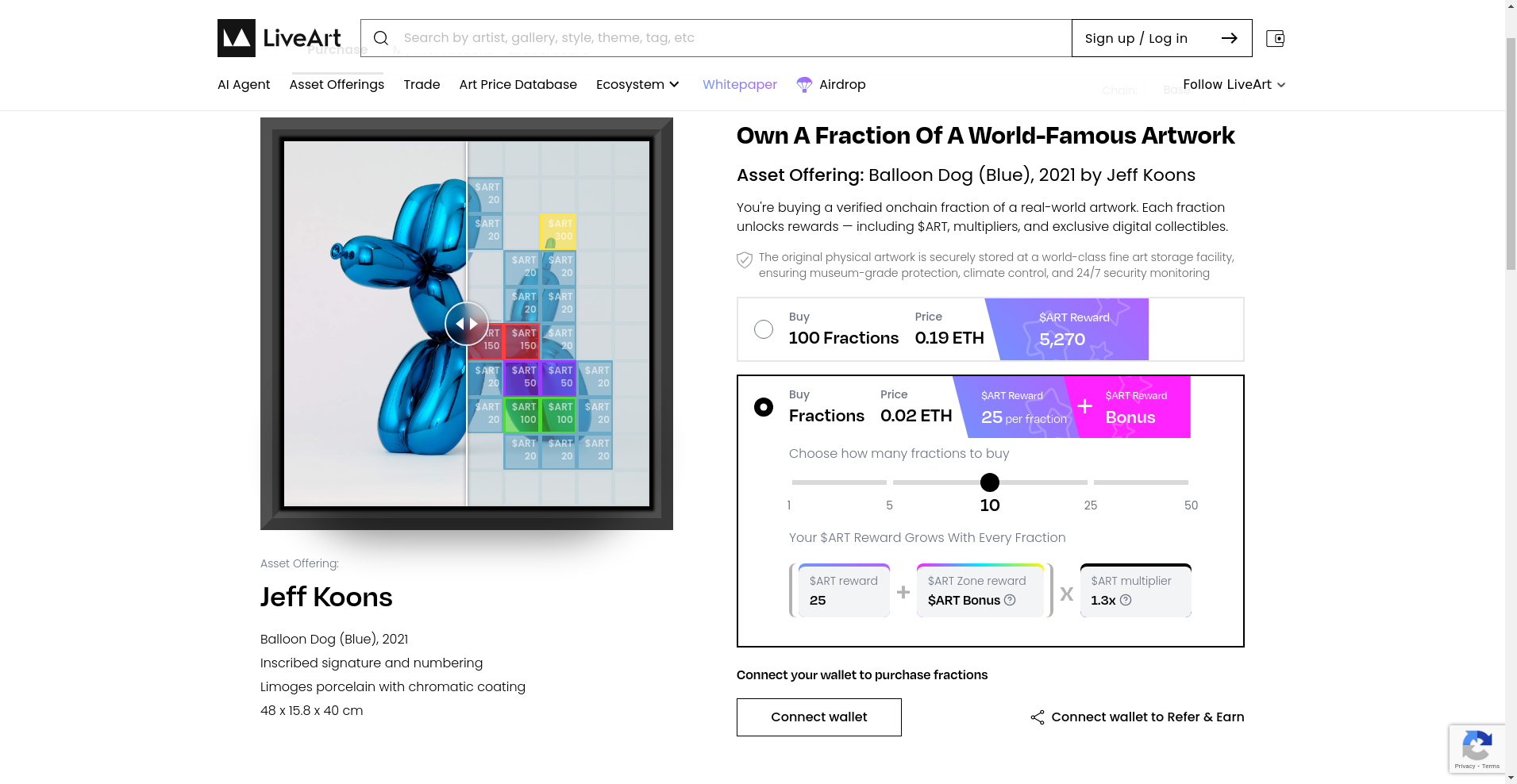

LiveArt positions itself as a pioneering platform at the intersection of traditional art markets and blockchain technology. According to its publicly available documentation, the platform aims to tokenize and fractionalize high-value artworks—ranging from masterpieces by Picasso and Warhol to luxury collectibles such as cars and watches—turning them into liquid, tradable on-chain assets. Powered by AI-driven valuation engines, data oracles, and multi-chain infrastructure, LiveArt endeavors to democratize access to the $10-trillion global art and luxury market. Their core proposition is to enable investors, collectors, and institutions to participate in art ownership and trading with enhanced transparency, efficiency, and liquidity.

This review provides an impartial analysis of LiveArt’s claims, technological foundations, tokenomics, and potential risks, based solely on the data and disclosures publicly available from their documentation and audit reports.

The Team and Roadmap Evaluation

From the compiled materials, the LiveArt team’s publicly listed identities are not explicitly detailed, and no direct biographical data are provided within the sources. This could imply an anonymous or pseudonymous team, a common trait among emerging blockchain projects but one that warrants caution for investors concerned with accountability and long-term delivery. Nonetheless, the project’s roadmap reveals ambitious milestones across multiple phases:

- Phase 1 (Q1 2025): Launch of AI-enabled asset discovery, initial IAOs for high-end art, and establishing custody partnerships.

- Phase 2 (Q2 2025): Scaling to multi-chain environments, governance activation, AI-powered portfolio tools.

- Phase 3 (Q3 2025): Launch of LiveChain, a dedicated RWA-focused blockchain; $ART becomes the native token for trading, staking, and governance.

- Phase 4 (Q4 2025): Institutional onboarding with hedge funds and wealth managers; expanding into new asset classes.

- Phase 5 (2026+): Achieving over $1 billion in assets Under Management (AUM); establishing a full-stack RWA infrastructure for global scale.

Overall, while the technical milestones and phased growth are formalized, the lack of publicly available leadership backgrounds and team credentials suggests a degree of opacity that potential investors should scrutinize further, especially concerning anonymous teams.

Security and Trust: Analyzing the Audit and Technical Risks

The security analysis relies solely on the available Cyberscope audit report, which—according to the structured audit data—flagged a “high criticality” issue during the assessment. The audit’s score indicates general trustworthiness, with several points of vulnerability or reliance on robust smart contract security measures. Notably, the audit emphasizes:

- Score: 94.37%, suggesting a relatively high security posture but not immune to exploitation risks.

- High Criticality Alerts: identified by the audit, requiring attention to potential smart contract bugs or vulnerabilities that could be exploited for malicious gain.

- Decentralization score: 73.4%, indicating moderate decentralization; some reliance on custodial or semi-centralized components.

Given the project's focus on high-value assets (artworks stored in physical vaults), custody and asset protection are mission-critical. The audit’s single-source status and the critical vulnerabilities flagged suggest that stakeholders should require ongoing third-party audits, verifiable custody arrangements, and transparent security practices before substantial financial engagement. Understanding the details of Cyberscope's audit methodology can provide further context.

Tokenomics Breakdown: Understanding ART, Incentives, and Risk Factors

LiveArt’s ecosystem revolves around its native utility token, $ART. While precise total supply figures, vesting schedules, and distribution metrics are not explicitly disclosed in the provided data, core utility functions are inferred:

- Participation: ART tokens are used to access features such as IAOs, staking, rewards, and governance, aligning incentives across collectors, artists, and institutions.

- Rewards: Users earn ART tokens through participation in quests, minting activities, and community engagement, with reports of substantial reward multipliers (e.g., a 1.3x boost via Zone multipliers).

- Economic Model: The platform aims to tokenize up to $1 billion in assets within 24–36 months, implying a demand-driven utility for ART tokens tied to asset onboarding and trading activity.

- Potential Risks: Without transparency around total supply, inflation/deflation mechanisms, or staking rewards, there exists a risk that token supply dynamics could impact holders’ value. Over-reliance on community participation-driven rewards may also introduce volatility or incentivize gaming tactics.

Overall, the token economics appears to be designed to incentivize ecosystem growth but warrants independent verification, especially concerning total token issuance and governance rights. The role of utility tokens in general is crucial to understanding these mechanics.

Asset Universe and Value Creation: From Art to Luxury Collectibles

LiveArt’s asset universe spans:

- Fine Art: Masterpieces by Picasso, Warhol, Monet, Magritte, and others. The platform highlights high-profile art, with some assets like Jeff Koons’ Balloon Dog and Banksy’s Girl with Balloon being explicitly cited.

- Luxury Collectibles: Limited-edition watches, cars, wine, and other tangible assets are targeted for tokenization and fractionalization.

- RWA Focus: The core narrative centers on RWA tokenization; physical assets are stored securely in vaults, with blockchain representation enabling liquidity and broader participation.

The platform asserts that fractional ownership via “Shards” reduces barriers and democratizes access. Its AI valuation engine aims to offer transparent market-based pricing, potentially reducing asymmetric information—a key obstacle in traditional art auctions or private sales. However, the reliability of AI in art valuation can introduce its own set of risks.

Potential risks include custody risks of physical assets, valuation inaccuracies owing to AI model limitations, and regulatory challenges concerning fractionalized physical assets across jurisdictions, which fall under the umbrella of regulating fractionalized physical assets in DeFi.

Ecosystem, Partnerships, and User Engagement

LiveArt emphasizes its extensive partner network, including:

- Large institutional investors and family offices actively engaging in RWA onboarding.

- Major blockchain infrastructure providers like Coinbase, TRON, and Linea, bolstering cross-chain capabilities, which is relevant to Solana SPL token interoperability.

- Media and community partners (Discord, Telegram, Galxe, Layer3) to facilitate broad user onboarding and community rewards.

Its ecosystem components—such as Creator Hubs, Fine Art Trading Floors, and the Art Price Database—are designed to support a comprehensive, transparent, and data-rich environment for art investment and trading. The platform’s integrated social media and app download pathways suggest a focus on user onboarding and engagement. Its approach to incentivizing users might be viewed through the lens of gamified crypto rewards mechanisms.

Risks and Caveats: Navigating the Challenges

- Transparency and Regulation: Lack of clear team credentials and trans-regional legal frameworks might pose compliance risks, especially in fractionalized physical asset markets.

- Custody and Provenance: Physical asset storage and custody protocols need credible third-party assurance; otherwise, legal disputes or asset misappropriation remain risks.

- Security: The audit flagged high-criticality issues, indicating smart contract vulnerabilities that could be exploited. This highlights the importance of understanding access control vulnerabilities in smart contracts.

- Market Liquidity: Secondary market depth for fractionalized art and luxury assets remains uncertain; liquidity shocks could impair investor exit strategies. This connects data on liquidity in low market cap tokens.

- Valuation Risks: AI-driven valuations may not fully account for market nuances or rare asset risks, impacting investor confidence.

Most importantly, the novelty of combining art, luxury assets, and DeFi introduces untested regulatory territory, demanding cautious, staged participation from investors.

Final Assessment: Strengths and Limitations

- Pros / Strengths:

- Bold vision of democratizing high-value art via blockchain.

- Explicit focus on RWA tokenization with secure custody partnerships.

- Use of AI for transparent valuation and market insights.

- Broad ecosystem integrating community, data, and cross-chain interoperability.

- Ambitious roadmap with phased development toward liquidity, institutional onboarding, and ecosystem expansion.

- Cons / Risks:

- Limited team transparency and verification of credentials.

- Potential smart contract vulnerabilities and security concerns flagged in audits.

- Uncertain secondary market liquidity for fractionalized assets.

- Regulatory ambiguities around physical asset custody, fractional ownership, and cross-jurisdictional compliance.

- Tokenomics lacks full disclosure on total supply, inflation mechanisms, and governance rights.

In conclusion, LiveArt’s model offers a compelling synthesis of AI, art, and blockchain but remains in developmental or pre-launch phases with significant operational, regulatory, and security risks. Investors and researchers should monitor ongoing audit results, team transparency, and marketplace activity before forming firm conclusions about its long-term legitimacy and viability. Identifying general red flags in blockchain projects is always advisable with emerging platforms.

Christopher Anderson

Smart Contract Auditor & Legal Tech Analyst

I have a dual background in law and computer science. I audit smart contracts to find the critical gap between a project's legal promises and its code's reality.

Similar Projects

-

GentleDogsCoin

In-Depth Review of GentleDogsCoin: Crypto Scam Checker & Project Analysis

-

BasedKiKong

BasedKiKong ($BAKIK) Review: Key Insights on Its Collapse and Risks

-

DISTRIBUTE

DISTRIBUTE Project Review: Crypto Scam Checker & Future Insights

-

Baby RatsCoin

Crypto Scam Checker Review: Baby RatsCoin - Is It a Legit Project or a Scam?