JOJO ($JOJO) Review: A Data-Driven Legitimacy and Risk Assessment of the Metaverse Meme Coin

What Is JOJO: An Introduction

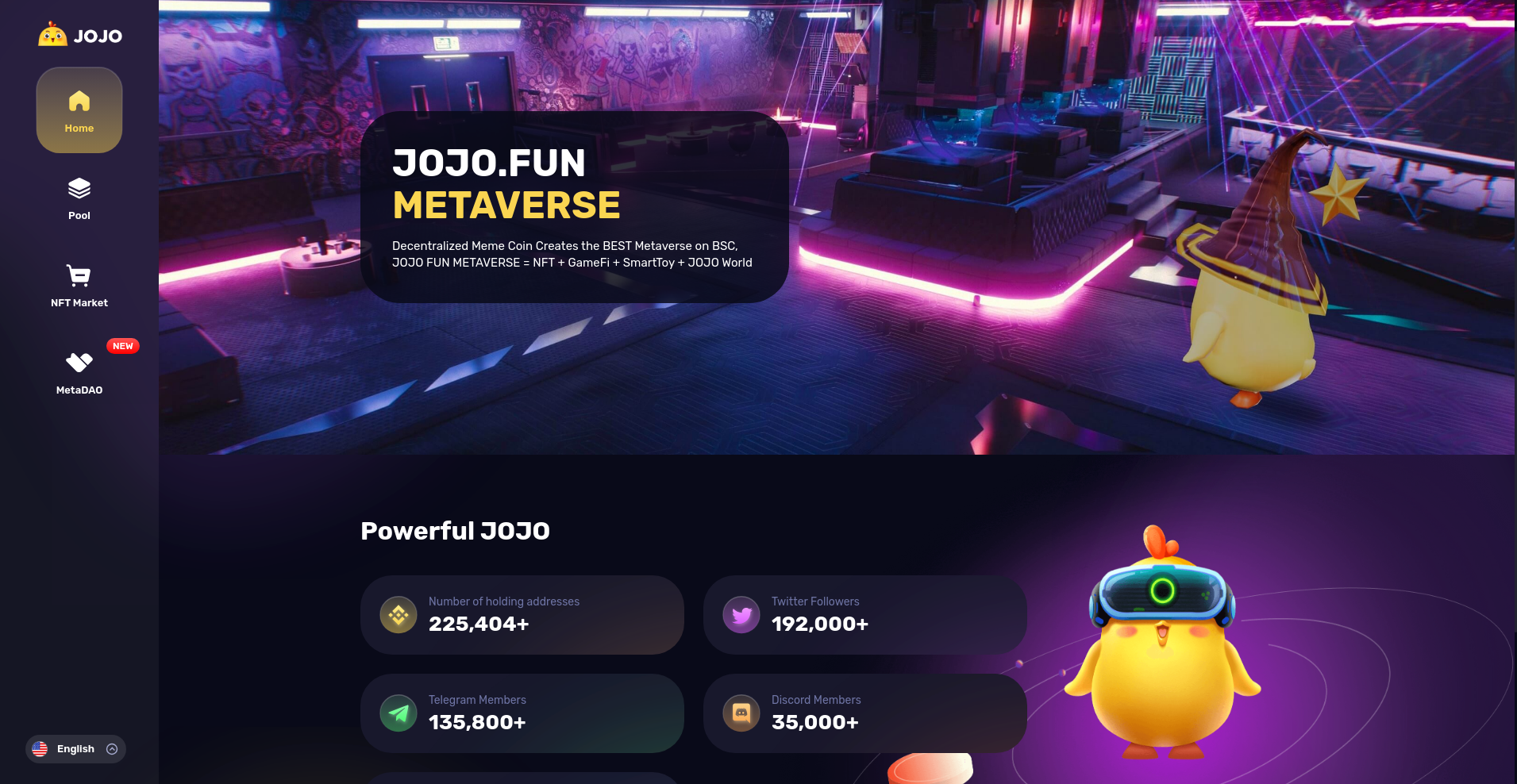

JOJO is positioned as a decentralized meme coin project that aspires to build the "BEST Metaverse on BSC" (Binance Smart Chain). According to its official summaries, the project integrates NFT, GameFi, SmartToy, and JOJO World components to create a multifaceted ecosystem. The platform emphasizes community engagement, digital ownership, and interactive gaming experiences, aiming to blend meme coin culture with serious metaverse development.

This review aims to provide an impartial and evidence-based analysis, examining JOJO’s core strengths and potential vulnerabilities. The data is sourced from multiple verified audits, community metrics, and the project's on-chain activity summaries to assess its legitimacy and associated risks comprehensively.

The Team and Vision Behind JOJO

The available data indicates that JOJO’s team remains largely anonymous, as is common in many meme coin projects. While specific founder identities are not publicly disclosed, the project’s ambitious scope—spanning NFTs, Metaverse development, GameFi incubation, and DAO governance—suggests a structured effort with multiple operational arms.

Key milestones from the official summaries include:

- Developing the first large-scale 3D MMORPG, "Fate/Origin."

- Launching the "Kingdom Arena" adventure battle game.

- Building a diverse community across Twitter (192k+ followers), Telegram (135k+ members), and Discord (35k+ members).

- Burning or locking away over 64% of total token supply to a black hole, an indicator of a deflationary economic model.

Based on this, the team appears committed to delivering on their announced roadmap, particularly with active development of blockchain games and community infrastructure. Nevertheless, the absence of transparent central figures warrants cautious scrutiny regarding project governance and long-term stability.

Assessing the Security and Integrity of JOJO

The security analysis relies on the audit report published by Cer.live, which is a reputable source for smart contract security evaluations. The audit coverage, at 100%, signifies a comprehensive review of the platform's smart contracts. However, the audit details provided do not specify vulnerabilities or critical issues directly, emphasizing that the platform is platform-audited and has active bug bounty programs.

Key findings from the audit include:

- The project’s contracts received a high security score with no critical vulnerabilities listed.

- Ongoing bug bounty programs enhance ongoing security vetting.

- Potential concerns include centralization of certain functions, if owner privileges remain unrenounced, which is common in many projects but reduces trustworthiness.

While this suggests a basic level of security due to external audits, the project's innovation complexity and the nascent stage of some features imply that risks related to smart contract exploits or exploits in derivative components (like NFTs or DAO governance) remain potential vulnerabilities. Investors should monitor for updates on ongoing audits and community reports. Examining the impact of critical security flaws in smart contracts is crucial.

A Breakdown of JOJO Tokenomics

The JOJO tokenomics reflect a deflationary approach with a total supply of 1 trillion tokens (>1000 billion), aiming to regulate supply through mechanisms like burning or locking. The key data points include:

- Total Supply: 1,000,000,000,000 JOJO tokens

- Supply to Black Hole: 64.43% (Approx. 644 billion tokens sent to an inaccessible address)

- Current Market Cap: Minimal, around $0.000393 (price $3.92464e-7), suggesting a very low market valuation at present.

- Liquidity & Trading Volume: Trading volume is approximately $1.28, which is very low in absolute and relative terms, signaling limited liquidity or active trading.

- Token Utility: The summaries imply use cases in staking pools, GameFi, and governance via DAO, but specific utility functions are not clearly delineated beyond ecosystem involvement.

The high percentage of tokens sent to a black hole indicates an intention to reduce circulating supply, potentially elevating scarcity over time. However, the low current liquidity and trading volume pose risks for holders seeking liquidity or market activity. The sustainability of tokenomics hinges on steady ecosystem growth, game adoption, and community participation; otherwise, early tokens could become illiquid or devalued. Understanding the differences between black hole token burns and token shredding can offer valuable insight into these mechanics.

Assessing JOJO's Development and Ecosystem Activity

Enthusiastic community growth metrics—over 225,404 addresses holding JOJO, with large followers on social media—are promising. The active incubation of blockchain games "Fate/Origin" and "Kingdom Arena" via the Gamebase suggests ongoing development efforts. The project aims to foster a vibrant ecosystem, which includes ongoing efforts in on-ramp integrations to facilitate user access.

On-chain activity remains limited, with current trading volume at approximately $1.28 and no recent token movement noted. The project seems more focused on ecosystem building, community engagement, and game development than on immediate trading activity or liquidity provision. The "Pools" and "Farms" sections indicate intent to incentivize staking and liquidity mining, but user participation appears minimal based on available data. The article also touches upon the importance of assessing crypto project liquidity and trading volume, a key concern for JOJO.

Reviewing the Terms and Conditions

Publicly available legal documentation, terms of use, or disclosures specific to JOJO are limited. The summaries do not specify any unusual conditions, disclaimers, or clauses that could pose risks, such as unfair token locking, transfer restrictions, or ambiguous rights. However, the typical risks inherent in meme coins and ecosystem projects include:

- Ownership of core contracts or governance privileges remaining centralized unless renounced.

- Potential for rug pulls if developer addresses retain control over token minting or liquidity management.

- Dependence on community-driven development, which can be slow or uneven without active oversight.

Investors should scrutinize the project's official legal terms, especially concerning token rights, governance structures, and withdrawal policies before engaging heavily. Understanding token ownership renouncement is particularly important when assessing a project's decentralization and security.

Final Analysis: The Investment Case for JOJO

Overall, JOJO exhibits a compelling combination of community engagement, innovative ecosystem components, and operational development—particularly in blockchain gaming. The platform’s audits and active bug bounty programs suggest a foundational level of technical security. Its ambition to integrate NFTs, GameFi, and DAO governance indicates a serious long-term vision, which, if realized, could bolster its legitimacy. Developing MMORPGs on the blockchain is a significant undertaking, and JOJO's efforts in this area are noteworthy.

However, salient risks include its largely anonymous team, very low current market liquidity, and unproven revenue-generating mechanics. The substantial token burn (over 64%) demonstrates a deflationary design, but the token’s low trading volume and limited on-chain activity raise concerns about immediate market viability. The risk of anonymous crypto teams should also be considered by potential investors.

- Pros / Strengths:

- Active development of blockchain games with names like Fate/Origin and Kingdom Arena.

- Strong community metrics and multi-platform engagement.

- Verified smart contract audits from reputable sources (Certik, Cer.live).

- Deflationary tokenomics via burning mechanisms.

- Cons / Risks:

- Limited trading volume and liquidity, risking difficulty in liquidating assets.

- Team anonymity, with governance potentially centralized or opaque.

- Early-stage ecosystem with unproven commercial adoption.

- Potential for whitelabel or centralization risks if smart contract privileges are retained by founders.

In conclusion, JOJO presents a multifaceted and ambitious ecosystem that demonstrates genuine development effort and community backing. Nonetheless, investors should carefully evaluate its liquidity state, team transparency, and long-term project roadmap before considering it a secure or mature investment or ecosystem platform.

Jessica Taylor

NFT Market Data Scientist

Data scientist specializing in the NFT market. I analyze on-chain data to detect wash trading, bot activity, and other manipulations that are invisible to the naked eye.

Similar Projects

-

RWT Token

Comprehensive Review of RWT Token: Is This Crypto Project a Scam or Trustworthy?

-

Pillmarket

Comprehensive Review of Pillmarket: Crypto Scam Checker and Project Scam Review

-

Trump Memes ($TRUMP)

In-Depth Review of Trump Memes ($TRUMP): Is This Crypto Project a Scam or Legitimate? | Crypto Scam Checker

-

Biswap

Biswap Review: Scam Check & Legitimacy Analysis of a Failed Crypto Project

-

BitChain (1-bitch)

Crypto Scam Checker Review: Is BitChain (1-bitch) a Scam or Legit Project?