Hord ($HORD) Review: A Data-Driven Look at Its Legitimacy, Risks, and Long-Term Viability

What Is Hord: An Introduction

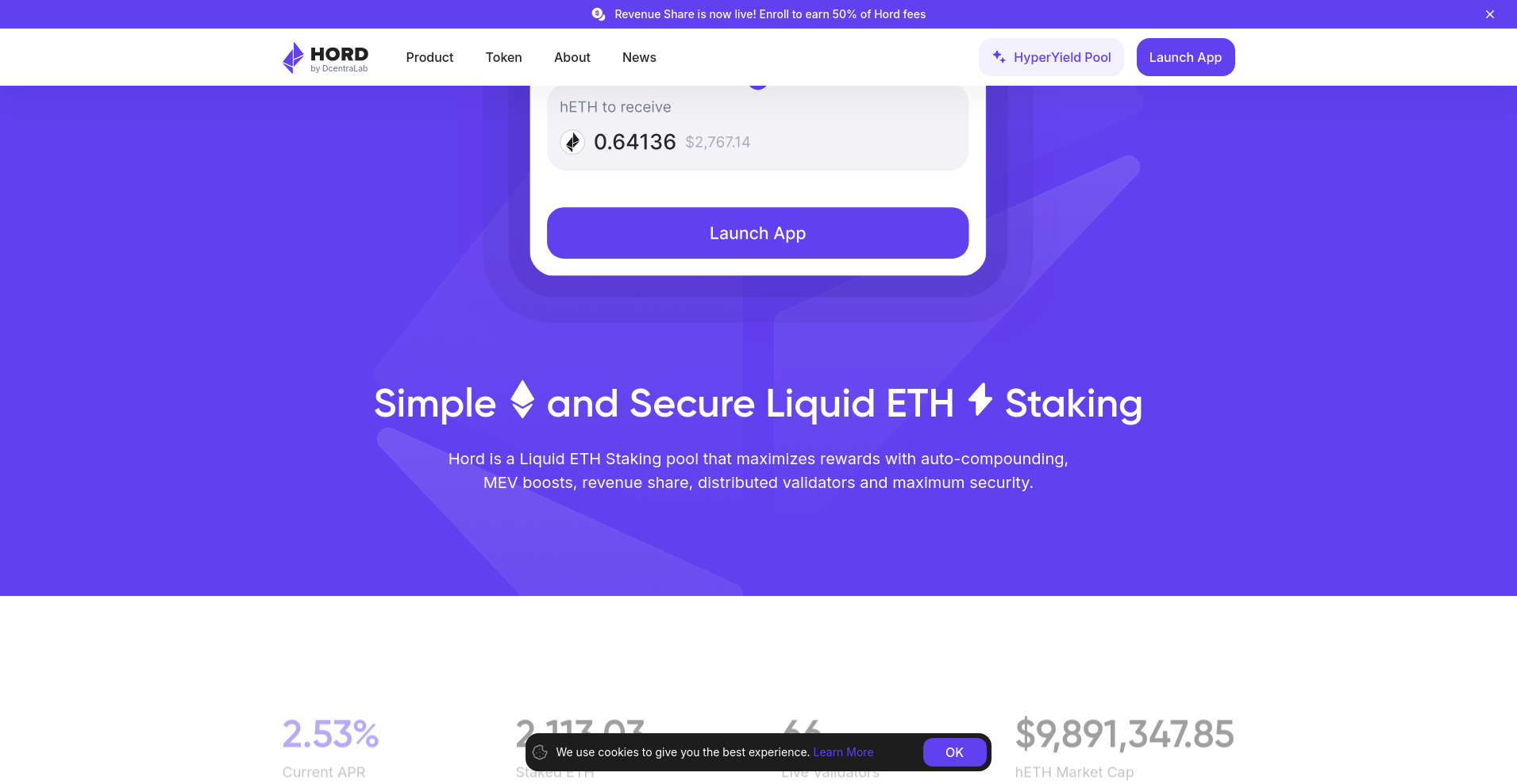

Hord is a decentralized liquid ETH staking platform that aims to optimize staking yields through innovative features like auto-compounding, MEV boost participation, revenue sharing, and distributed validators. Its core proposition is to provide users with a simple, secure, and flexible way to stake ETH while earning additional rewards from platform fees and validator activities.

Built atop both Ethereum and Arbitrum networks, Hord facilitates staking with no minimum amount, offering liquidity through its derivative token, hETH. Designed to appeal to both retail and institutional participants, the project emphasizes security, decentralization, and earning potential via its integrated technologies and revenue mechanisms.

This article provides an impartial, evidence-based analysis of Hord's strengths and weaknesses, assessing its legitimacy, risks, and long-term prospects based on available data and technical audits.

The Team and Vision Behind Hord

The publicly available information about the Hord team suggests a focus on transparency, with references to developers and support resources such as a Help Center, Docs, and open positions. However, explicit details regarding individual team members, their backgrounds, or prior experience are limited, which is common in early-stage DeFi projects. The use of DcentraLab as an affiliated entity hints at some overarching organizational support, but concrete evidence of a seasoned, experienced leadership team remains sparse. In the context of DeFi, understanding team transparency is crucial, particularly when considering projects with anonymous teams.

Assessing the project’s roadmap reveals several notable milestones:

- In Progress: Integration of SSV (Secret Shared Validators), launch of Balancer hETH/ETH pools, security audits.

- Next Planned: Eigenlayer integration, referral programs, governance enhancements, and new product features.

- Historical Updates: Revenue share mechanism introduction, UI improvements, wallet integrations, and security upgrades.

The roadmap demonstrates a clear strategic progression, emphasizing technological integration and user reward optimization. Nonetheless, the execution capability largely hinges on the team’s ability to deliver these features on schedule, which remains somewhat uncertain given the limited publicly verified team credentials.

Assessing the Security and Integrity of Hord

Our security assessment hinges primarily on the audit report by Cyber Unit, as listed on Cer.live, the major available audit source for Hord’s smart contracts. The platform’s focus on continuous audits and security consciousness is noteworthy, but the data reveals some limitations and potential vulnerabilities.

Key findings from the audit include:

- Coverage: 50% - indicating that only half of the platform’s code was inspected during the audit, leaving open areas of unverified code.

- Security Rating: 5.4 out of 10 – suggesting moderate concern levels.

- Identified Incidents: Yes – indicates past or present vulnerabilities, although details are unspecified.

- Vulnerabilities: The audit highlights areas such as reentrancy risks, permission issues, and potential single points of failure, but no critical exploits are publicly reported.

- Platform Audits: Multiple audits over time suggest ongoing security scrutiny, with the latest being the "Zokyo Withdrawal Audit".

While no critical vulnerabilities are indicated explicitly, the partial coverage and reported incidents imply a need for ongoing vigilance. For investors, reliance solely on the audit report may be insufficient; the platform’s security posture should be monitored continuously, especially given the complex DeFi interactions involved.

A Breakdown of Hord Tokenomics

The HORD token plays a central role in governance and revenue sharing within the ecosystem. Understanding its economic model is crucial for assessing its sustainability and potential risks for token holders.

- Total Supply: 320,000,000 HORD tokens.

- Market Cap: Approximately $505,776 (based on current price of ~$0.00199579), with a market rank of 376, indicating a relatively small market presence.

- Token Distribution:

- Team & Founders: Not explicitly detailed, but typically a portion is reserved for team, advisors, and early supporters.

- Venture Capital & Strategic Partners: Unspecified, raising questions about centralized control or influence.

- Public Sale & Liquidity: A significant portion remains in circulation or accessible via trading venues like Uniswap and 1Inch.

- Vesting & Lock-up: No explicit vesting schedules are publicly disclosed, which could indicate risks of token dumping or market manipulation.

- Utility & Revenue Sharing: Tokens enable governance participation and entitle holders to a share of platform revenues, earned from validator rewards, protocol fees, and other income streams.

The economic design relies heavily on the platform’s ability to generate consistent income and grow in value. The relatively low market cap and modest circulating volume suggest room for growth but also potential volatility. Potential risks for holders include inflationary pressures, dilution from future token issuance, or governance risks if token distribution is overly centralized.

Assessing Hord's Development and Ecosystem Activity

On-chain activity and development updates reflect ongoing momentum. Metrics such as trading volume (~$16,722) and staked ETH (over 2,113 ETH) indicate a modest but active user base. The presence of multiple audits, security upgrades, and feature expansions imply continuous development effort.

What distinguishes Hord is its attempt to bridge the gap between sophisticated DeFi yield mechanisms and user accessibility. The introduction of features like balance pools, governance integrations, and network upgrades suggest a strategic focus on growth and sustainability. Some DeFi platforms leverage MEV-Boost to enhance validator returns, a feature Hord also incorporates.

However, the limited public data on daily active users, transaction counts, or ecosystem partnerships leaves questions about its real-world traction. The project’s progress appears aligned with typical early-stage DeFi projects—focused on technological development and community building without yet demonstrating widespread adoption or market dominance.

The Fine Print: Analyzing Hord's Legal and Terms Framework

Review of the available documentation reveals no explicitly unusual or risky clauses. The terms emphasize standard DeFi protocols: no guarantees, risk disclosures, and community governance participation. The transparency around audits and continuous updates adds to its legitimacy.

Potential issues include the lack of detailed vesting schedules or comprehensive legal disclosures, which are common in early-stage projects. Investors should remain aware of risks related to regulatory changes, especially given the platform’s active revenue-sharing mechanisms and cross-network operations. The impact of regulatory ambiguity on such models can be significant.

Final Analysis: The Investment Case for Hord

Hord presents itself as a technically innovative liquid ETH staking platform with attractive features like auto-compounding, MEV boosting, and revenue sharing. Its approach to decentralization through distributed validators and continuous security audits suggests a commitment to security and robustness. However, the project’s relatively low market cap, partial audit coverage, and limited team transparency introduce notable risks.

Its economic model depends heavily on consistent inflows and platform growth, which are still emerging. The security audit results advise caution, given the moderate rating and the presence of incidents. Investors should see Hord as a high-risk, high-reward opportunity that requires careful monitoring of development milestones, platform security, and market dynamics.

- Pros / Strengths:

- Innovative auto-compounding and MEV boost features increase potential yields.

- Decentralized validator approach via SSV technology enhances security & decentralization.

- No minimum stake, increasing accessibility for users.

- Revenue sharing aligns incentives between platform and token holders.

- Multiple audits and ongoing security focus.

- Cons / Risks:

- Limited public team transparency and detailed vesting info.

- Partial audit coverage with moderate security rating; vulnerabilities possible.

- Small market cap and low liquidity amplify volatility risks.

- Potential regulatory uncertainties around revenue-sharing models.

- Execution risk on roadmap milestones remains uncertain.

In conclusion, Hord embodies promising innovation within the DeFi staking space, but its current developmental and security profile warrants thorough scrutiny for potential investors. A cautious approach, complemented by continuous monitoring, is advisable for those considering involvement. Understanding potential smart contract exploits is essential in this space.

Amanda Harris

Technical Security Educator

Security professional passionate about the "human firewall." I translate complex crypto threats into simple, actionable security habits for everyday users.

Similar Projects

-

Felysyum

Felysyum Review: Scam or Legit Crypto? Find Out Now

-

Scorpion Casino

Scorpion Casino Review: Is It a Legit Crypto Project or Scam? Crypto Scam Checker

-

SynaBonk

SynaBonk ($SYNA) Review: A Deep Dive into Its Tech & Risks

-

Neo Pepe

Neo Pepe Review - Is This Crypto Project a Scam or Legit? Crypto Scam Checker

-

sEUR

sEUR ($SEUR) Review: Tech, Security & Risks Analyzed