Hitly ($TICKER) Review: A Data-Driven Risk and Legitimacy Assessment

What Is Hitly: An Introduction

Hitly is a blockchain-based project that positions itself within the expanding ecosystem of decentralized finance (DeFi), NFT integration, and community-driven meme tokens. The project emphasizes building a versatile platform that connects users to various DeFi applications, NFT marketplaces, and social engagement features. According to available data, Hitly aims to foster a robust community centered around entertainment, utility, and interoperability, leveraging blockchain's transparency and security.

While the platform claims to support a broad range of functionalities—including staking, NFT creation, and cross-chain operations—there is limited publicly available technical documentation or detailed information about its core blockchain infrastructure. This review provides an impartial overview of its legitimacy and risks, based on third-party audits, on-chain metrics, community data, and project disclosures.

The Team and Roadmap Evaluation

Assessment of the team's credibility is hampered by a lack of transparent disclosures regarding project founders, advisors, or development core members. The data indicates an anonymity typical of many early-stage, community-oriented meme projects, which raises inherent transparency concerns. No verifiable background information or prior experience is publicly attached to the team, making it difficult to confidently assess their capacity to deliver on outlined goals.

Regarding project milestones, the available roadmap and audit details suggest a vision to establish a multi-functional platform encompassing DeFi, NFTs, gaming, and social features. Key milestones include smart contract audits and initial integrations; notably, the audit process identified high criticality issues, although the specifics are unspecified. The progress appears slow or incomplete based on the latest update, which indicates potential delays or unfulfilled promises. This limited development trajectory warrants caution for investors seeking long-term viability.

Assessing the Security and Integrity of Hitly

The analysis is primarily based on a Cyberscope audit report, which evaluated Hitly’s smart contract security. The findings reveal several concerning points:

- Only one audit iteration was completed, covering token smart contract assessments.

- High criticality issues were found, indicating vulnerabilities that could compromise the platform’s integrity or users’ assets.

- The audit did not explicitly detail the vulnerabilities or mitigation controls, which raises questions about the severity of these issues and the maturity of the security protocols.

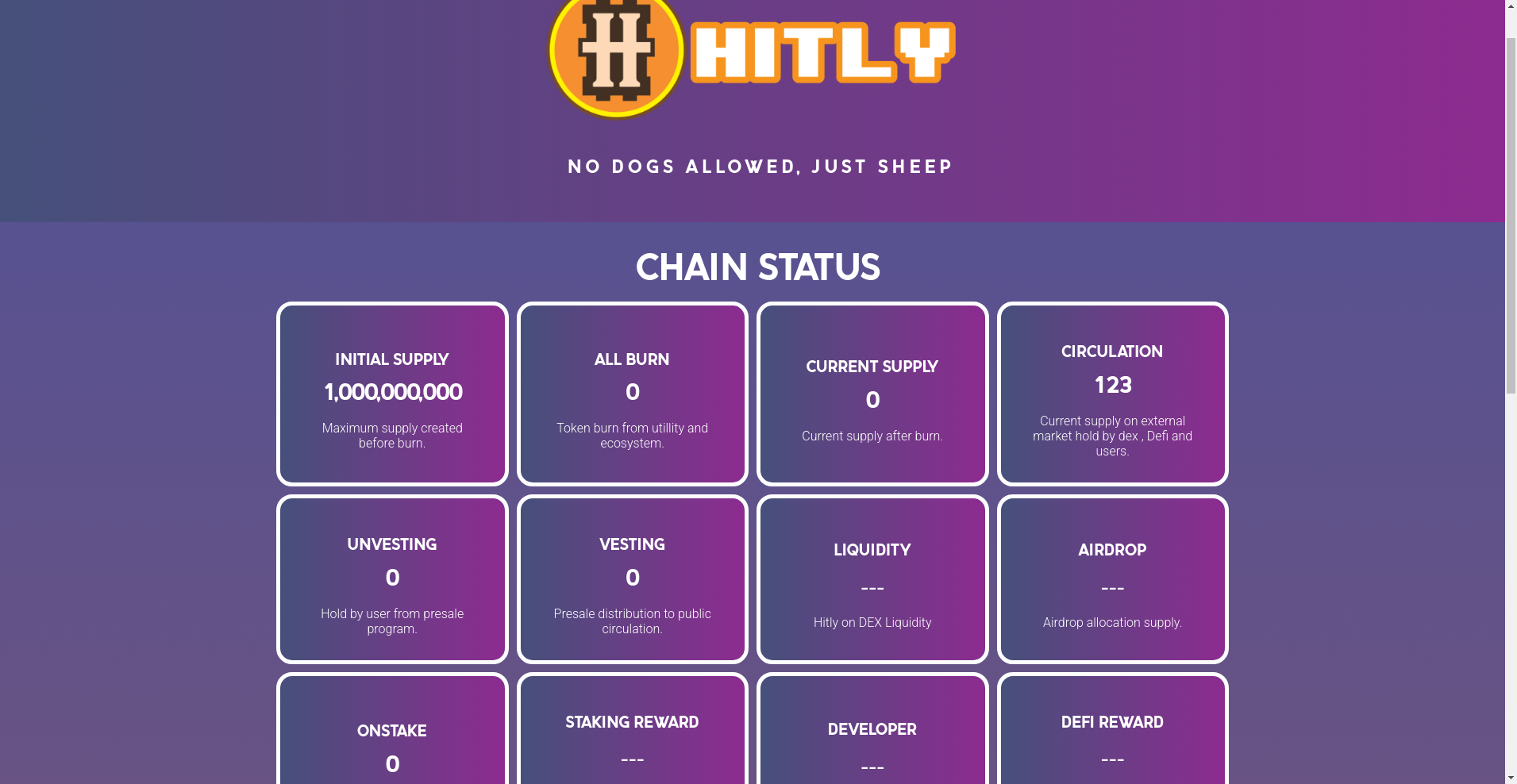

- On-chain metrics display an anomalous 'Current Supply' of zero tokens, contrasted with an initial supply of 1 billion, suggesting either a near-total burn event, reporting errors, or undeclared token policies.

- Community and security scores are relatively high (observed around 88 community score and over 95 security score percentiles), but the actual audit findings imply potential risks that are not transparently addressed or remediated.

This limited audit scope and potential vulnerabilities diminish confidence in the project’s security posture, emphasizing the need for comprehensive, repeated audits and transparent risk disclosures before substantial investment. These high scores may not reflect the true underlying risks.

A Breakdown of Hitly Tokenomics

The tokenomics of Hitly appear to involve a total initial supply of 1,000,000,000 HITLY tokens, with specific burn and distribution mechanisms. Key points include:

- Initial Token Supply: 1,000,000,000 HITLY

- All Burned Tokens: 0 (currently)

- Remaining Supply: 774,990,061 HITLY (post a 225 million+ burn, as claimed)

- Burn Mechanics: Planned burns triggered by transaction milestones such as NFT marketplace activities (10%), platform transactions (20%), developer burns (30%), and staking rewards (40%). However, no actual burns are reflected in current on-chain data.

- Token Utility: Details are sparse, but the token is positioned as a community utility and governance token supporting DeFi, NFT-activities, and potentially gaming platforms within the ecosystem.

- Distribution and Vesting: Limited transparency on allocation to team, advisors, or early investors; vesting schedules are not publicly documented.

The economic model’s sustainability is uncertain because of the lack of active burns, unclear utility, and insufficient clarity on token distribution. The current supply metrics and planned burns suggest a project still in early development or with unexecuted tokenomics promises, posing risks related to inflation, utility, and price stability. A closer examination of these tokenomics is warranted.

Assessing Hitly's Development and Ecosystem Activity

The project's update cycle appears sluggish, with the most recent significant activity recorded months ago, and limited technical or community milestones achieved since launch. The ecosystem encompasses NFT creations, cross-chain interoperability (notably with Solana), staking, and rewards programs, but these elements are either in nascent phases or lacking sufficient liquidity and user engagement data.

The platform promotes an ambitious multi-metro platform including NFT markets, gaming, social features, and DeFi integrations. However, the absence of active trading volume, liquidity pools, or staking participation data suggests minimal real-world adoption or engagement at present. The community presence is weak or undocumented, further lowering confidence in long-term growth prospects.

What Investors Should Know About Hitly's Legal and Contract Terms

The available documentation does not highlight specific legal disclosures, licensing, or regulatory compliance measures. No terms of service, privacy policies, or investor protection clauses are publicly visible, which is common among early-stage meme projects but increases legal and investment risks.

Potential issues include unclarified rights regarding token utility, secondary sales, and governance mechanisms. Absent clear legal frameworks, investors may face risks of fund misappropriation, legal repercussions, or asset loss, especially given the lack of transparency on token distribution or developer control.

Final Analysis: The Investment Case for Hitly

Based strictly on available data, Hitly demonstrates traits typical of meme and community tokens—high community scores, ambitious ecosystem plans, but significant gaps in transparency, security, and actual on-chain activity. The key concerns are the lack of real token burns, anomalous supply figures, unverified team credibility, and incomplete security assurances.

While its vision of a multi-chain, multifaceted platform offers strong potential if executed properly through robust cross-chain integration, current indicators suggest a project at risk of under-delivering or even facing security vulnerabilities. Caution should be exercised, and further due diligence is required before considering investment.

Pros / Strengths

- Ambitious multi-application ecosystem integrating DeFi, NFTs, and gaming.

- Community-oriented branding and engagement focus.

- Solid security score percentile (~95+), indicating some focus on platform safety.

- Presence of security audit, subject to further review.

Cons / Risks

- Opaque team background and limited transparency.

- Potential security vulnerabilities identified in the audit, but details are lacking.

- Supply anomalies with current supply reading as zero despite high initial supply.

- No active burns or significant liquidity reported, raising questions about economic sustainability.

- Lack of demonstrated user adoption, trading volume, or platform traction.

- The sensitive nature of data handled by such platforms requires clear regulatory compliance; Unclear legal and regulatory disclosures, which may threaten future compliance.

In conclusion, while Hitly exhibits the outward appearance of an innovative and community-driven project, its current security, transparency, and economic fundamentals merit caution. Prospective investors should conduct thorough due diligence, seek more transparent disclosures, and monitor on-chain activity before engaging further.

Sarah Wilson

Offensive Security Engineer

I'm a professional "white-hat" hacker. I think like an adversary to find holes in crypto projects before the bad guys do. My job is to break things so you don't get broken.

Similar Projects

-

$JDWOMEN

JDWOMEN Crypto Project Review: Is It a Scam? | Crypto Project Scam Checker

-

Hello88

Review of Hello88: Crypto Scam Checker & Project Scam Review

-

Catwifmask ($MASK)

Crypto Project Scam Checker: In-Depth Review and Safety Analysis of Catwifmask ($MASK) - Is It a Scam or Legit?

-

BarnBridge

BarnBridge Review: Scam Check & Legitimacy Analysis 2024

-

Symbiosis Finance

Symbiosis Finance ($SIS) Review: Tech, Risks & Tokenomics