Function X ($FX) Review: A Data-Driven Legitimacy and Risk Assessment of Its Cross-Chain Ecosystem

What Is Function X: An Introduction

Function X (ticker: $FX) positions itself as a comprehensive multi-chain and omnichain platform designed to bridge traditional assets, DeFi, NFTs, and real-world use cases through a decentralized, cross-chain infrastructure. Its core promises revolve around enabling seamless asset movement and deployment of smart contracts across multiple blockchains—Ethereum, Cosmos, Solana, Layer 2s—and traditional payment systems. The project emphasizes building a user-friendly ecosystem that integrates wallets, bridges, DApps, and governance mechanisms aimed at mainstream adoption.

This review provides an impartial analysis of Function X’s technological foundation, governance structure, security posture, and ecosystem maturity. By examining available data, including recent audits and incident reports, we aim to assess the project's legitimacy and potential risks alongside its strengths and future outlook.

The Team and Vision Behind Function X

The core team features notable figures with backgrounds in blockchain, legal, and technological sectors. Key members include:

- David Ben Kay – President; former Ethereum Foundation governing board member, ex-Microsoft China General Counsel, with legal and governance experience.

- Zac Cheah – CEO of Pundi X and co-founder of Function X; involved in W3C Standards and security-centric development.

- Indra Winarta – Ecosystem Lead; early contributor with expertise in token listing, process optimization, and blockchain deployment.

- The advisory and governance councils comprise professionals from academia, enterprise tech, and community leadership, suggesting a diversified and credible leadership structure.

The roadmap mentions multiple technological milestones—cross-chain integrations, omnichain contract deployment, and scaling TPS—although some historical dates (2021–2022) are referenced, raising questions about current progress. Overall, the team’s credentials support a level of legitimacy, but the ability to deliver on a multi-year roadmap remains to be seen, especially considering recent incidents.

Assessing the Security and Integrity of Function X

This evaluation relies primarily on a Cer.live audit which confirms that Function X’s platform has been platform-audited, with ongoing bug bounty programs and professional security oversight. Notably, the recent security report reveals:

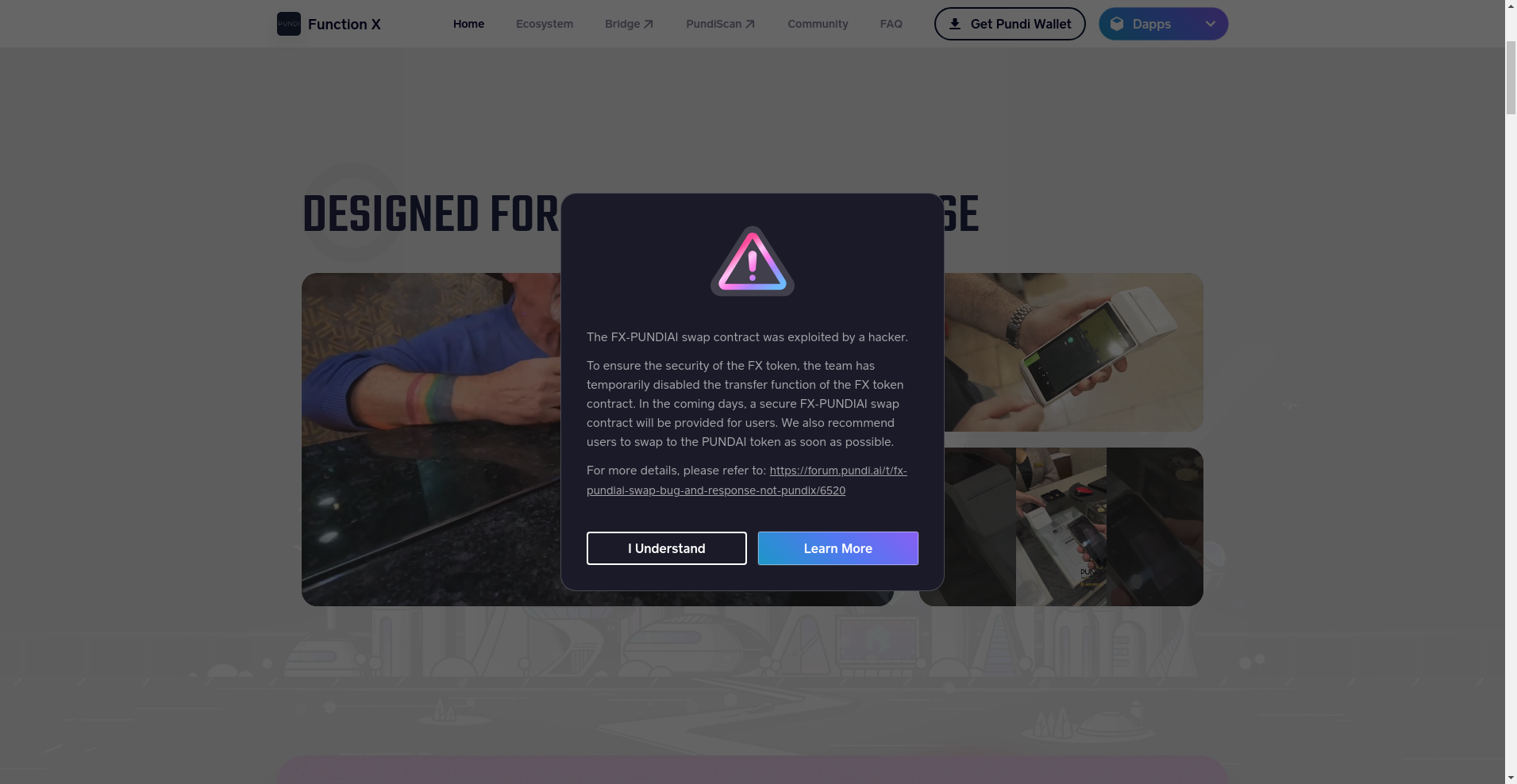

- Incident: The FX-Pundiai swap contract was exploited by a malicious actor, leading to a temporary disablement of FX token transfers.

- Response: The team responded immediately by disabling token transfers to protect users, and a new, secure swap contract is planned.

- Implication: The incident exposes a specific vulnerability related to cross-chain swaps or contract logic, which is a critical attack surface if not thoroughly addressed.

- Audit findings: While the platform has been audited, details of the vulnerabilities found, severity, and fixes are limited publicly. Continuous monitoring and follow-up audits are essential for ongoing security assurance.

Given the incident, prospective investors must consider the current security risks. The platform’s transparency about the breach and remediation plans lends some trust, but the vulnerability highlights the importance of rigorous, ongoing security assessments—particularly for cross-chain bridges and token contracts which are common attack vectors. Understanding the specifics of this event is crucial, which can be learned from a detailed post-mortem analysis.

A Breakdown of Function X Tokenomics

The FX token functions as the governance and security token within the ecosystem. Its key attributes are:

- Total Supply: Approximately 66.2 million FX tokens, with no current evidence of inflationary issuance or burn mechanisms explicitly detailed in the provided data.

- Interoperability: FX has been on Ethereum (since 2019) and on Function X (since 2021), supporting cross-chain transfer of ownership, assets, and governance rights.

- Staking and Delegation: The system allows token delegation into fx core nodes to enhance network security. A UI fragment suggests delegation actions with "0 FX" and "0% APR," implying that staking mechanics exist but may not yet be active or currently rewarding. This process of delegation is a key aspect of securing many blockchain networks and can be further understood through token delegation explainer.

- Token Utility: Governance voting, collateral for synthetic assets (planned), and cross-chain transfer facilitation. These features are in a roadmap or developmental stage.

- Risks: The fixed supply and interoperability promise must be corroborated by current liquidity and participation metrics. The recent incident and partiality of the token’s deployment history suggest a need to monitor actual on-chain activity and holder distribution.

Economic sustainability hinges on active governance, liquid markets, and the utility of FX for collateral and governance. The absence of explicit inflation or reward schedules, combined with the recent security incident, warrants caution regarding long-term value stability.

Assessing Function X's Development and Ecosystem Activity

The platform promotes an ecosystem built around multi-chain deployment, cross-chain bridges, and user tools such as Pundi Wallet and Pundi Scan. Development activity appears phased, with major milestones like omnichain deployment, validator integration, and cross-chain support scheduled for or past dates in 2021–2022.

On the ground, public activity includes:

- Deployment of non-custodial, multi-chain wallets supporting Ethereum, Binance Smart Chain, and others.

- Cross-chain bridge functionality, with ongoing plans to reinforce security after the FX-Pundiai incident.

- Active community engagement via social channels, including Telegram, Medium, Discord, and community governance forums.

However, observable real-world adoption metrics—such as transaction volumes, merchant integrations, or developer DApps—are not explicitly detailed in the supplied data, suggesting that the project may still be in the deployment or testing phases rather than full production or commercialization. The heavy marketing focus on omnichain features, though promising, should be substantiated by tangible user activity over time.

What Investors Should Know About Function X's Terms and Conditions

The project’s legal and operational disclosures are typical of crypto projects, with a notable emphasis on transparency after recent incidents:

- The FX-Pundiai swap incident indicates a security vulnerability that the project is actively addressing, including temporary suspension of token transfers and a planned contract replacement.

- Terms & Conditions are last updated September 2024, reflecting ongoing policy management.

- Cookie policies, including necessary, Beamer (for announcements), and Analytics cookies, highlight compliance with modern privacy norms, but the “unofficial distribution” status of certain apps introduces trust considerations.

- Investors should verify official contract addresses, security updates, and ensure they are interacting with authenticated versions of the platform—especially given the incident history.

In summary, transparency about security events and active remediation bolsters credibility, but the limited public detail on code audits, bug fixes, and operational metrics leaves some risk factors unquantified.

Final Analysis: The Investment Case for Function X

Function X emerges as a technically ambitious project aiming to unify multiple blockchains under a single omnichain deployment model. Its core architecture focuses on cross-chain bridges, a PoS-secured fx core network, and the ability for developers to deploy smart contracts once and run natively across Cosmos, Ethereum, Solana, and Layer 2 networks.

The project shows strong governance credentials, including reputable team members and structured councils, which lend legitimacy. Yet, recent security vulnerabilities involving high-impact cross-chain swaps highlight an attack surface that could threaten user assets if not thoroughly secured. The incident’s handling, including disabling transfers and planning future contract upgrades, demonstrates active risk management but also underscores the vulnerability inherent in cross-chain operations. The FX-Pundiai swap contract exploit, in particular, serves as a cautionary tale for such incidents.

The active ecosystem, announced partnerships, and product suite (wallet, explorer, bridge) suggest a strategic drive toward real-world adoption. However, the absence of publicly available detailed audits, current activity metrics, and transparent token distribution data tempers optimism with caution.

This analysis recommends ongoing diligence: monitoring the security posture, verifying development milestones, and assessing actual on-chain activity before forming a conclusive opinion on its long-term viability.

Pros / Strengths

- Innovative omnichain deployment enabling one-time contract deployment across multiple ecosystems.

- Strong team with credible backgrounds and a structured governance framework.

- Integration of cross-chain bridges supporting Ethereum, Binance Smart Chain, Solana, and Cosmos.

- Existing user tools such as Pundi Wallet and Pundi Scan promoting accessibility.

- Transparency about recent security incident and remediation efforts.

Cons / Risks

- Recent security breach related to the FX-Pundiai swap indicates attack surface concerns; ongoing security audits needed. Details such as those in a potential post-mortem are critical for understanding.

- Limited publicly available detailed audit reports and current real-user activity metrics, raising questions about maturity.

- Outdated roadmap references and unclear current deployment milestones.

- Uncertainty around tokenomics details such as liquidity, reward rates, and participation metrics, making concepts like token delegation harder to assess in context.

- Potential for technical bugs and exploits in cross-chain contracts, a common attack vector in multi-chain setups.

In conclusion, Function X presents a compelling technological vision with substantial foundational credibility. Yet, security concerns and the lack of transparent, current usage data highlight the need for cautious, ongoing evaluation. Stakeholders should verify the latest security reports, assess real-world adoption, and monitor project updates before making high-stakes commitments.

Jessica Taylor

NFT Market Data Scientist

Data scientist specializing in the NFT market. I analyze on-chain data to detect wash trading, bot activity, and other manipulations that are invisible to the naked eye.