dHEDGE Vaults Review: An Objective Analysis of Their Strategies, Risks, and Long-Term Viability

Project Overview

dHEDGE is a decentralized platform that enables on-chain asset management through a vault-based structure. Its core proposition is to facilitate diverse trading strategies, including leveraged positions, yield farming, and stablecoin protocols, across multiple blockchains. The protocol emphasizes transparency, community governance, and interoperability, positioning itself as an on-chain alternative to traditional hedge funds.

At its heart, dHEDGE allows professional managers and retail users to deploy vaults—autonomous management vehicles that utilize DeFi primitives like lending, borrowing, and derivatives. Its multi-chain deployment aims to tap into the broader DeFi ecosystem, providing users access to assets across Ethereum, Layer-2 networks, and other compatible chains. This review offers an impartial look at its technological robustness, governance structure, tokenomics, and inherent risks.

Team and Roadmap Evaluation

The foundational team behind dHEDGE includes a mix of public and potentially anonymous developers, with notable contributions from security auditors and community governance participants. The project’s transparency is supported by documented audits from reputable firms like Certik and iosiro, and ongoing bug bounty programs reinforce its commitment to security.

- Audits conducted by iosiro and Certik, with publicly available reports indicating recognized security scrutiny.

- Active bug bounty programs suggest a proactive approach to vulnerability mitigation.

- Community governance protocols, including proposals and voting mechanisms, enable stakeholder involvement in decision-making.

- Roadmap milestones focus on multi-chain expansion, automated trading strategies, and enhancing governance frameworks, though precise timelines and deliverables vary in clarity.

Overall, while the team’s actual composition remains partially opaque, the governance infrastructure and external audits suggest a credible pathway toward fulfilling their strategic promises.

Security and Trust Analysis

This analysis is primarily based on Cer.live's audit report, which covers the smart contracts deployed within the dHEDGE protocol. The report signifies the presence of recognized security evaluations, yet details on vulnerabilities or remediation steps are not explicitly provided here. The platform maintains active bug bounty programs, indicating ongoing vulnerability assessment efforts.

- Audits from iosiro and Certik validate baseline security standards with public reports linked.

- The bug bounty initiative remains ongoing, offering incentives for external auditors to identify flaws.

- Potential concerns include the high risk ratings of vault strategies, particularly those involving leverage, which can amplify vulnerabilities if not carefully managed.

- Centralization points are minimal but could exist in governance structuring or governance decision execution, requiring further review.

Altogether, while external audits and bug bounty programs bolster trust, high-risk strategies like leveraged vaults warrant cautious consideration, especially regarding smart contract vulnerabilities or liquidation risks.

Tokenomics Breakdown

The native governance token, DHT, serves as a core component for protocol governance and voting. An additional layer includes "Legacy DHT," suggesting a token migration or upgrade process, with the legacy token still holding significant governance influence. The current token supply details and distribution models are not explicitly documented here but are critical for assessing economic sustainability.

- Total Supply: 100 million DHT tokens, as publicly listed in audit data.

- Utility: DHT grants voting rights, proposal submission, and governance influence. Token holders can stake or lock tokens to increase voting power.

- Distribution: Community, team, and early investors are presumed stakeholders, but the specifics require verification.

- Vesting & Rewards: The protocol emphasizes governance participation rather than significant staking rewards, with some reports indicating rewards have been discontinued.

- Legacy DHT indicates a prior token version, likely replaced or phased out, with potential implications for token migration or governance continuity.

Economically, the token model aligns with typical DAO governance schemes; however, the reliance on governance token influence without clear economic incentives might impact long-term decentralization and participation.

Ecosystem and Development Activity

The dHEDGE ecosystem shows active development, supported by extensive GitHub repositories, regular security audits, and ongoing bug bounty initiatives. The platform’s codebase and SDKs (notably @dhedge/v2-sdk) facilitate developer integrations, third-party tool building, and community-driven enhancements.

Recent repository commits, issue resolutions, and audit updates underpin a vibrant development cycle, although exact metrics require direct inspection of their repos and audit reports. The deployment of multi-chain vaults and strategic themes (leveraged tokens, yield optimization, stablecoins) reflects consistent feature expansion aligned with DeFi trends.

Market activity, measured via on-chain transaction data and vault performance, indicates ongoing user engagement and asset flow, although liquidity levels and depositor metrics need further quantification for comprehensive analysis.

Review of Terms and Conditions

The protocol’s legal and operational conditions outline standard DeFi disclosures, including user responsibilities, risk warnings, and governance participation terms. Notably, the discontinuation of staking rewards and the presence of high-leverage vaults highlight inherent risks.

- No explicit disclaimers indicating restrictions or liabilities, but transparency in audit reports and governance proposals implies adherence to best practices.

- Potential concerns include the high-risk nature of leveraged vaults, which could lead to significant losses or liquidation events during market turbulence.

- Insurance coverage exists in some vaults, as stated in audit documentation but requires verification for scope and effectiveness.

Nothing unusually alarming was observed, but users should scrutinize specific vault terms, especially concerning leverage, liquidation, and insurance coverage guarantees.

Final Analysis: Risks and Rewards in Perspective

dHEDGE offers a compelling suite of vault strategies—ranging from leveraged tokens to yield farming—built on multi-chain infrastructure and governed by a community token (DHT). Its security posture is strengthened by audits and active bug bounty programs, promoting trustworthiness in a high-risk DeFi environment.

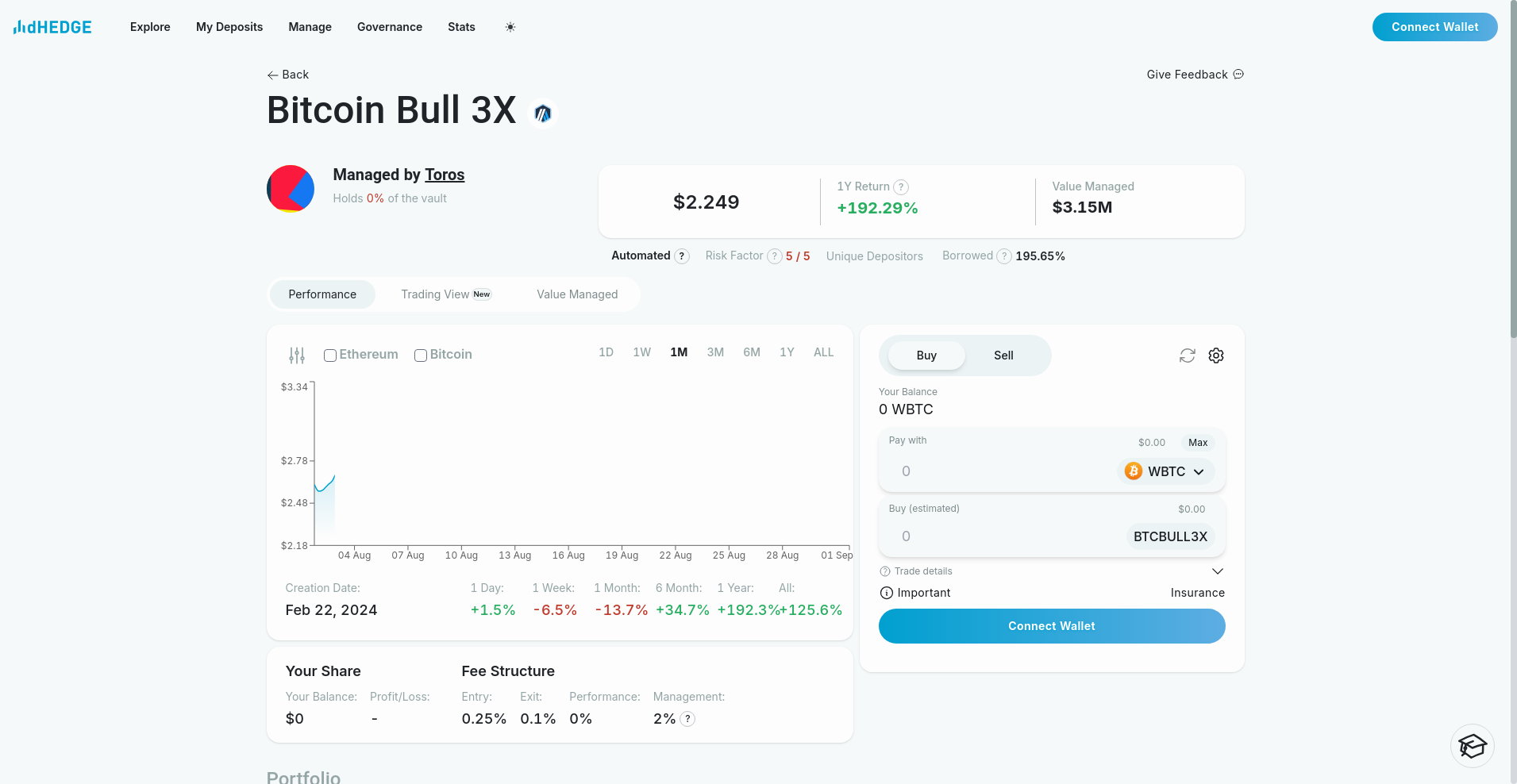

Nevertheless, the high leverage employed by many vaults elevates the inherent risk profile. Recent performance data indicates substantial volatility, with long-term gains contrasted by short-term drawdowns, typical in leveraged crypto strategies. Commission structures are relatively modest but can erode gains during downturns.

The governance system, anchored by DHT and Legacy DHT tokens, provides an on-chain decision-making framework, although the transition from legacy tokens warrants clarity. Developer resources and transparent audit trails bolster credibility, yet the opaque details around certain vault-specific mechanics (leverage, collateralization, insurance coverage) require deeper scrutiny.

- Pros / Strengths:

- Multi-chain deployment gives diverse asset and user access

- Active governance community with proposal and voting framework

- Regular security audits and bug bounty programs

- Rich ecosystem tooling and SDK availability

- Transparent documentation and community engagement channels

- Cons / Risks:

- High leverage increases vulnerability to market swings and liquidations

- Performance volatility and recent drawdowns are significant

- Opaque details on vault mechanics, collateralization, and insurance scope

- Dependence on governance token and community participation for sustainability

- Potential protocol centralization points and governance fatigue

In summation, dHEDGE presents a comprehensive and actively maintained DeFi ecosystem with innovative vault strategies. Its high-risk vaults appeal to experienced users comfortable with leverage, but cautious investors should closely examine leverage mechanics, security audits, and insurance provisions before engagement. The platform’s commitment to transparency and community involvement supports its legitimacy but does not eliminate the intrinsic risks associated with complex DeFi strategies.

Christopher Anderson

Smart Contract Auditor & Legal Tech Analyst

I have a dual background in law and computer science. I audit smart contracts to find the critical gap between a project's legal promises and its code's reality.