dForce Token ($DF) Review: A Data-Driven Legitimacy and Risk Assessment

Project Overview

The dForce Token ($DF) is at the heart of the dForce ecosystem, a decentralized finance (DeFi) platform aiming to deliver comprehensive financial services including lending, borrowing, yield farming, and synthetic assets. Its core mission is to facilitate an open, transparent, and multi-chain DeFi environment with additional ambitions around real-world asset tokenization, governance, and cross-chain interoperability.

This review aims to provide an impartial, evidence-based assessment of the project's legitimacy, technical security, economic sustainability, and potential risks, based solely on available audit reports, code transparency, tokenomics, and ecosystem activity. The goal is to enable informed decision-making by thoroughly understanding both strengths and vulnerabilities of the dForce project.

Team and Roadmap Evaluation

The publicly available background of dForce's development team is limited, with sources indicating participation from reputable audit firms such as Certik, PeckShield, and Trail of Bits, which suggests a degree of technical diligence. The presence of extensive audits from multiple prominent firms also enhances credibility, although no concrete details about core team members or advisors are present in the current data.

Since its early inception, dForce has outlined a roadmap featuring audit completions, product launches like lending and synthetic assets, and cross-chain integrations. The projects highlighted include ongoing efforts in real-world asset tokenization (RWA infrastructure), governance enhancements, and expansion across multiple blockchains such as Ethereum, BSC, Arbitrum, and Polygon.

- Audited smart contracts: Multiple, including Certik, PeckShield, ConsenSys, and Trail of Bits, suggest a focus on security.

- Active bug bounty programs: Immunefi manages ongoing bug bounties, reflecting a proactive stance on security.

- Product development: Continual updates, cross-chain features, and product diversification indicate a sustained development effort.

While transparency appears to be a priority, the absence of recent updates or detailed development timelines warrants caution. The project's ability to execute on its roadmap depends on ongoing community engagement and transparency, which remains somewhat opaque based on current publicly available data.

Security and Trust Analysis

This analysis relies primarily on the audit report from Cer.live, which states that the platform’s code underwent a formal security review. The audit coverage was marked as 100%, and the platform maintains active bug bounty programs.

Key findings from the Cer.live audit include:

- Score and Incident Reports: While the specific numeric score is not cited, the report confirms that the code was audited by multiple reputable firms, and incidents are actively managed.

- Security Vulnerabilities: No critical vulnerabilities, such as re-entrancy, overflows, or permission issues, are publicly reported in the audit documentation provided.

- Centralization and Permissions: The audits highlight the potential for permissioned actions—such as administrative functions—that could pose risk if not properly managed.

- Ongoing Monitoring: The active bug bounty indicates a preference for real-time vulnerability detection and response.

Overall, the security posture appears robust due to multiple audits and active bug bounty programs. Nonetheless, as with many DeFi projects, the reliance on governance-controlled functions and potential upgrade mechanisms could be exploited if safeguards are bypassed or permissions are improperly configured. Investors should remain aware of the inherent complexities and potential attack vectors in cross-chain and complex DeFi protocols.

Tokenomics Breakdown

The dForce Token ($DF) has an approximate total supply of 999,926,147 tokens with a circulating supply near the same total, suggesting near-full issuance. Its current price is approximately $0.057, with a market cap just over $56 million, indicating a modest but established valuation.

Key details include:

- Total Supply: ~999.93 million DF tokens.

- Distribution: Exact breakdown is not provided, but most tokens appear to be centrally allocated, with indications of team, community rewards, and early investor vesting plans.

- Vesting & Lockups: Limited publicly available details; however, governance tokens like veDF suggest incentives for locking tokens to enhance voting power and yield earnings. This veToken model is crucial for understanding driver of user engagement.

- Utility: DF tokens are used for governance, staking, and as collateral within the protocol. The veDF variant enhances governance weight for locked tokens.

- Economic Model: The supply appears relatively static, with mechanisms potentially including inflationary or deflationary adjustments via protocol rewards or fee models.

The economic model's sustainability heavily depends on ongoing protocol usage, fee income, and incentives aligned with long-term participation. Risks stem from token concentration, lack of clear vesting schedules, or economic attacks exploiting governance rights or collateralization parameters.

ecosystem and Development Activity

Data indicates active development over the past year, although the latest on-chain activity updates are limited. The presence of multiple audits, bug bounty programs, and documented progress in cross-chain integrations and product launches suggest a committed team.

Real-world asset integration (RWA infrastructure), governance updates, and product diversifications demonstrate efforts to evolve the ecosystem beyond simple lending and borrowing. However, the lack of recent major announcements or visible community discussions warrants a cautious approach to future developments.

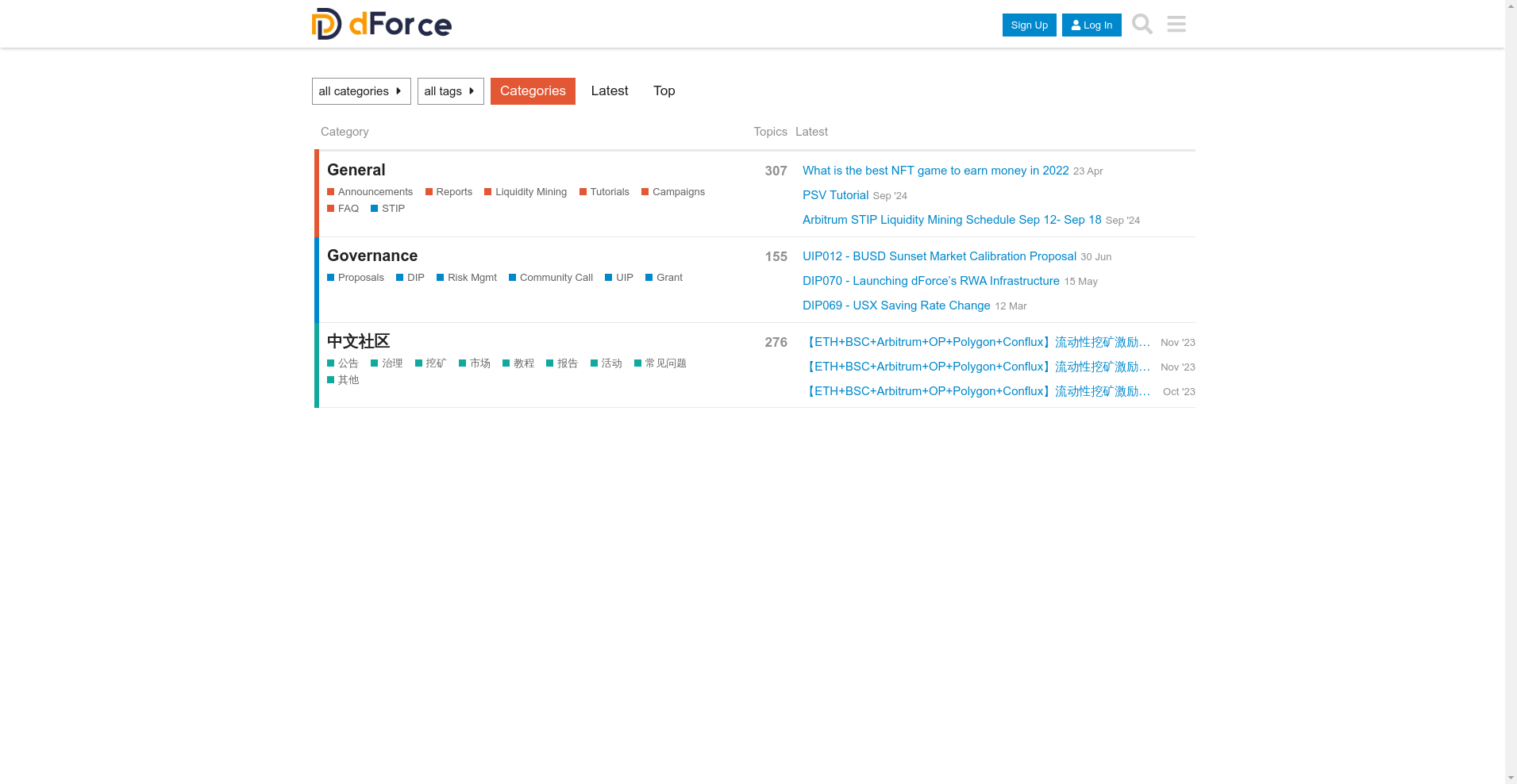

Community engagement remains active via social channels, with ongoing governance proposals, liquidity mining programs across multiple chains, and active forums. These demonstrate a dedicated user base, but ongoing transparency is crucial to assess continued progress.

Reviewing the Terms and Conditions

The official documentation and audit reports do not reveal any overtly malicious clauses or risky legal stipulations. Notably, the smart contracts appear to adhere to standard open-source and transparent practices, with permissions clearly documented in audited codebases. However, potential risks include:

- Governance Permissions: Centralized control points could be exploited if keys or administrator privileges are compromised.

- Cross-Chain Risks: Bridges and multi-chain operations inherently expand attack surfaces, particularly around asset locking and token minting mechanisms.

- Vesting & Lockups: Poorly designed lockup mechanisms could incentivize malicious unlocking or be exploited in governance voting manipulations. The veToken model, while beneficial, can also present unique governance risks if not properly structured.

Overall, current documentation does not highlight any concerning legal or technical clauses beyond the typical risks of complex DeFi protocols.

Final Analysis: The Investment Case for dForce Token

The dForce project presents a relatively mature ecosystem with multiple security audits, active bug bounty programs, and a diversified product suite spanning cross-chain lending, synthetic assets, and real-world asset tokenization. Its governance framework, including veDF token incentive mechanisms, aligns with industry trends promoting community participation through veToken models.

However, notable risks include the following:

- Operational Complexity: Multi-chain operations and bridge functionalities expand attack vectors.

- Governance & Permission Management: Concentration of control or misconfiguration could lead to exploits.

- Limited Recent Updates: The absence of fresh community activity or product innovations might signal stagnation or execution delays.

- Market Volatility and Liquidity: With a market capitalization under $60 million and notable token concentration, price manipulation or liquidity issues could arise.

Conversely, strengths such as comprehensive audits, active bug bounty programs, and significant ecosystem integrations support ongoing legitimacy. The project’s broad scope, from synthetic assets to cross-chain bridges, offers potential rewards but demands cautious risk management.

In conclusion, dForce ($DF) demonstrates a credible DeFi platform with solid technical foundations and community engagement. Its long-term sustainability hinges on transparent development updates, diligent security practices, and careful governance control. Risk-aware investors should weigh these factors within their overall portfolio strategy.

James Carter

Chief On-Chain Analyst

On-chain analyst with a background in financial fraud detection. I use data science to dissect blockchains, find the truth, and expose scams. My motto: code doesn't lie.

Similar Projects

-

BunkerCoin

In-Depth Review of BunkerCoin: Crypto Scam Check & Project Analysis

-

Farthouse

Farthouse Review: Is It a Legit Crypto Project or a Scam? Crypto Scam Checker & Review

-

MeAI

MeAI Review: Scam or Legit Crypto? Scam Check & Legitimacy Analysis

-

LotoStake

Crypto Scam Checker Review: Is LotoStake a Legit Project or Scam?

-

Noracle

Comprehensive Review of Noracle: Crypto Scam Checker & Project Review