DefiOlio ($OLIO) Review: A Data-Driven Analysis of Its Legitimacy, Risks, and Long-term Potential

What Is DefiOlio: An Introduction

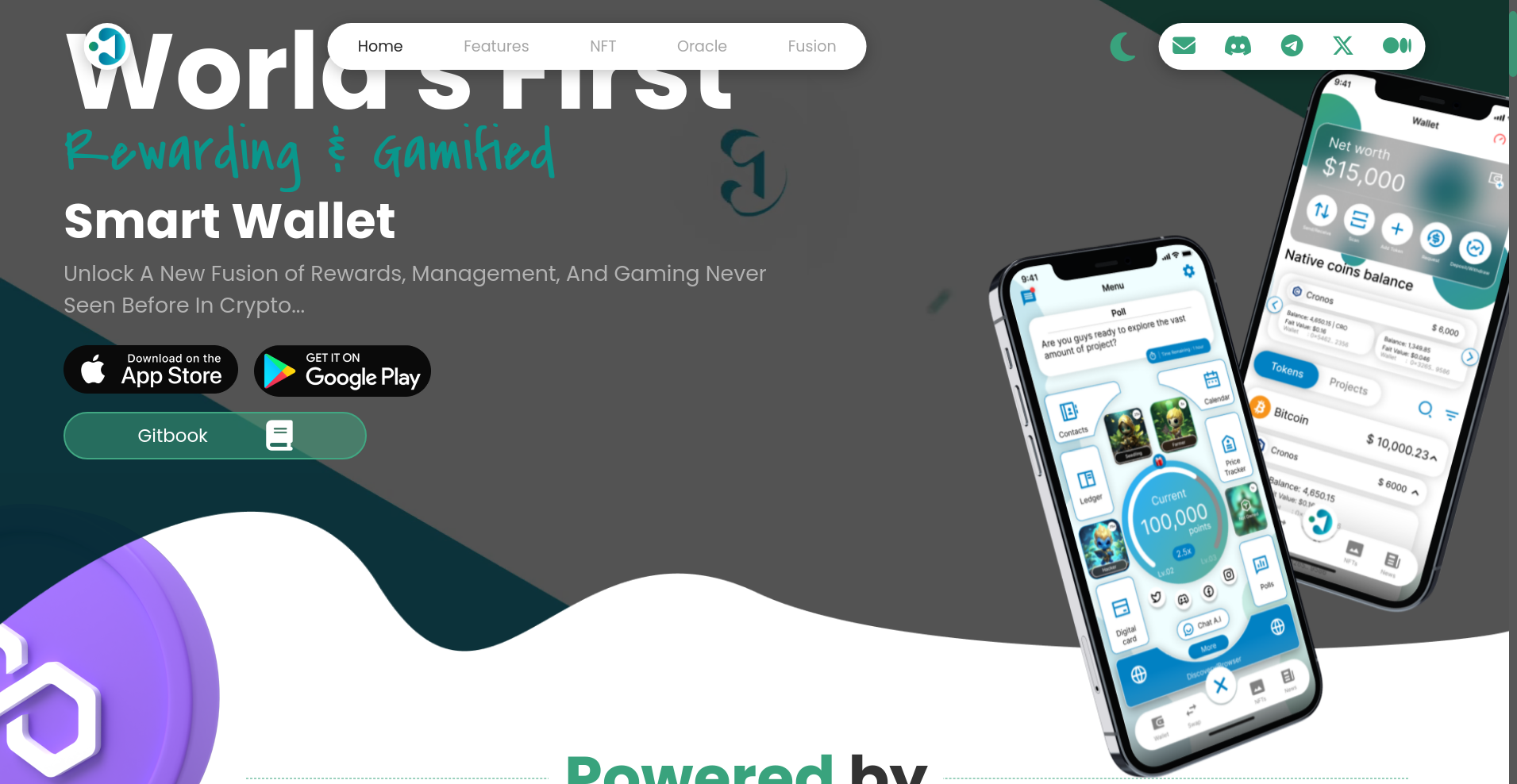

DefiOlio presents itself as the "World’s First Rewarding & Gamified Smart Wallet." Built as a mobile DeFi wallet, it aims to combine traditional wallet functionalities with innovative reward mechanisms, gamification features, and an NFT ecosystem. The project emphasizes turning routine wallet actions into earning opportunities through Use-To-Earn (U2E) and Play-To-Earn (P2E) models.

Leveraging multi-chain technology, DefiOlio intends to offer seamless cross-chain swaps, NFT minting and fusion, as well as on-chain revenue sharing via its proprietary DefiOraProfit Oracle. While marketing materials promote a future-rich ecosystem filled with NFTs, rewards, and on-chain rewards, an impartial analysis requires scrutinizing the project's fundamentals, security posture, and economic sustainability.

The Team and Vision Behind DefiOlio

The publicly available information about DefiOlio’s team remains limited. The project’s main site, social channels, and audit reports do not explicitly list individual team members or founders, which raises questions about transparency and governance. This lack of visible leadership can be characteristic of newer or less-established projects, requiring caution as it impairs verification of track record or prior experience. You can learn more about recognizing anonymous teams in crypto to better assess such situations.

Nevertheless, the project has outlined a clear roadmap including NFT minting phases, feature rollouts like cross-chain swaps, rewards systems, and governance enhancements. These milestones, while promising, are primarily presented as future targets, without details on timelines or development benchmarks, which complicates assessing their achievability.

- Core features like NFT fusion, passive income via swap-fee sharing, and reward schemes depend heavily on successful technical implementation.

- Partnerships, if any, are not explicitly detailed; future collaborations could influence credibility.

- The community metrics suggest growing interest—Twitter followers number around 4,255—but community size alone does not attest to project robustness.

Overall, while the roadmap suggests ambitious growth, the absence of transparent leadership or verified development history necessitates cautious optimism regarding the team’s ability to deliver on their promises.

Assessing the Security and Integrity of DefiOlio

Based solely on the Cyberscope audit report, the security evaluation of DefiOlio reveals a generally positive posture with some caveats. The audit focused on a specific smart contract on the BSC testnet, with results indicating a high level of security but also highlighting critical vulnerabilities. Understanding how to interpret these reports is crucial.

The key findings include:

- Security Score: 95.65 percentile, indicating strong overall security practices.

- High Criticality Issues: One major vulnerability was identified, though specific details are limited in the provided data. Critical issues in smart contract audits typically pertain to re-entrancy, access control, or code exploits, which could impact user funds if not rectified.

- Decentralization and Community Score: Decentralization is rated at approximately 66%, while community engagement sits at 47%. A moderate decentralization score suggests that control may be clustered or centralized, posing potential governance risks.

- Audit Scope Limitations: The audit appears to cover a specific contract in a testing environment, indicating that comprehensive security validation in the mainnet and across all modules remains pending or undisclosed.

While the high security score is encouraging, the presence of a critical vulnerability in the audit is a red flag. Without full transparency on the nature of this vulnerability or independent third-party audits of all core smart contracts, investors must remain cautious about smart contract risk and potential exploits that could compromise user assets.

A Breakdown of DefiOlio Tokenomics

DefiOlio’s economic model revolves around the OLIO token, mainly driven by its NFT ecosystem, rewards, and revenue sharing mechanisms. Notably, explicit details regarding total token supply, distribution, and inflation/deflation trends are limited. The primary token utility is embedded in staking, NFTs, and platform rewards.

- Total Supply: Not explicitly disclosed; the emphasis is placed on NFT-related royalties and reward distributions.

- Token Utility: Participating in staking unlocks platform benefits such as reduced fees, early access, and bonus rewards. NFT ownership grants royalties (2.5%) and access to exclusive features.

- Distribution: There is no detailed breakdown of initial allocation (e.g., team, early investors, community rewards). The absence of a clear vesting schedule or allocation plan raises concerns about centralization of token control. Learning about centralization risks is key here.

- Rewards and Incentives: The ecosystem incentivizes activity through reward points, NFT bonuses, and potentially passive income from swap fees.

Given the limited data, the tokenomics appears heavily ecosystem-driven, with its sustainability relying on continuous platform engagement, revenue generation, and effective distribution. The lack of transparency regarding supply caps or inflation mechanisms limits definitive conclusions on long-term token economic sustainability.

Assessing DefiOlio's Development and Ecosystem Activity

The project’s development activity, based on publicly available information, appears primarily marketing-driven with a focus on deploying aesthetic features, NFT mechanics, and user interface elements. The roadmap includes multiple phases for NFT minting, features like fusion, upgrade, and rewards, indicating ongoing ecosystem expansion. The introduction of an on-chain oracle designed to showcase earnings potential is a notable feature.

Recent activity shows the launch of Phase Two minting, with a cap of 500 NFTs, and the deployment of an on-chain oracle (DefiOraProfit) designed to showcase earnings potential. However, concrete functional updates or technical demonstrations seem limited, and critical metrics such as actual transaction volume, active user count, and platform usage are not publicly reported.

While some marketing claims and feature demos are promising, the absence of independent usage data or third-party validation makes it difficult to gauge actual user traction or real-world adoption. The project appears to be in the growth and testing phases, but without transparent development metrics, evaluating its ecosystem strength remains speculative.

Analyzing the Terms and Conditions

Based on the available documentation and website content, there are no immediately apparent clauses in the T&Cs that pose significant legal or operational risks. The site primarily emphasizes branding, NFT minting, and rewards, with standard copyright and user rights language.

Potential areas for concern include:

- Unclear language regarding user funds, especially around the prepaid card and cross-chain swaps.

- Absent or vague terms about platform governance, dispute resolution, or liability waivers related to NFT assets or rewards.

- No explicit disclosures about data privacy, especially concerning community feedback or user activity tracking.

Overall, the legal framework appears standard but warrants further review if the platform scales, especially concerning asset custody and revenue sharing rights.

Final Analysis: The Investment Case for DefiOlio

DefiOlio positions itself as an innovative fusion of a mobile DeFi wallet, NFT-based incentives, and gamified earning mechanics. Its core appeal lies in integrating wallet functionality with engaging rewards, on-chain revenue sharing, and an evolving NFT ecosystem. The project demonstrates promising technical features such as cross-chain swaps, NFT fusion, and reward points, alongside a potentially lucrative swap-fee sharing Oracle.

However, several red flags temper immediate enthusiasm. The lack of transparent leadership, limited detailed tokenomics, and incomplete security disclosures introduce significant risks. Its dashboard-reported earnings ($13 daily, $388 monthly) are interesting but unverified and should be viewed cautiously. The security audit indicates a generally strong posture but highlights vulnerabilities that must be addressed before high trust can be placed in the platform's smart contracts. Understanding risk mitigation strategies is always advisable in the crypto space.

Pros / Strengths

- Innovative combination of U2E and P2E mechanics within a mobile DeFi wallet.

- Tokenized rewards and high NFT royalty rates (2.5%) promoting passive income and user engagement.

- Cross-chain swap capabilities promote usability across multiple blockchain networks.

- On-chain Oracle sharing swap fees as passive revenue.

- Active roadmap with phased NFT minting, fusion, upgrade, and new character introduction.

Cons / Risks

- Limited transparency on team members, governance, and token distribution.

- Security audit reports indicate a critical vulnerability that needs mitigation.

- Revenue figures are self-reported; external validation is absent.

- Uncertain long-term sustainability of tokenomics and economic incentives.

- Potential centralization of control due to limited governance details.

In conclusion, while DefiOlio offers a compelling, multi-faceted ecosystem that blends rewards, NFTs, and DeFi functionality, investors and users must be cautious and conduct thorough due diligence. Its future success hinges on transparent development, rigorous security audits, and verifiable economic sustainability. The project’s ambitious vision warrants attention but should be approached with an appropriate level of skepticism until further validation is available.

James Carter

Chief On-Chain Analyst

On-chain analyst with a background in financial fraud detection. I use data science to dissect blockchains, find the truth, and expose scams. My motto: code doesn't lie.