ThermAI Review 2025: Scam Check, Risk Analysis, & Latest Update | Is THRM Token Legit Before You Invest? | Airdrop & Tokenomics Insights

In the rapidly evolving landscape of crypto projects blending sustainability and blockchain technology, ThermAI emerges as a seemingly innovative initiative promising to turn wasted computing heat into usable energy. But is this project truly a breakthrough or just another high-risk scam? In this comprehensive review, we dive deep into the core aspects of ThermAI, scrutinize its tokenomics, assess the risks, and provide the essential insights every potential investor must know before considering involvement.

Project Overview: What Is ThermAI?

ThermAI positions itself as a decentralized compute infrastructure project (DePIN) with an ambitious mission: harness waste heat generated by crypto mining and decentralized computing to heat homes and support clean energy practices. Officially hosted at thermai.uk, the project claims to combine blockchain rewards with sustainability by installing "ThermAI Nodes" in households, which mine cryptocurrency, power AI workloads, and offset heating costs using excess solar or off-peak energy.

At its core, ThermAI operates on the Polygon network, utilizing the utility token $THRM. The project's whitepapers detail a vision of reducing carbon emissions, tackling fuel poverty, and decentralizing computational resources. Such a trending melding of green energy solutions and blockchain tech naturally raises curiosity—and suspicion—regarding its true feasibility and legitimacy.

Key Features & Ecosystem Overview

- Decentralized Nodes: Hardware that repurposes heat for residential heating while mining cryptocurrencies.

- $THRM Token: Utility token powering staking, rewards, liquidity, and ecosystem growth.

- Token Utility: Supports hardware development, staking pools (up to 15% APY), liquidity mining, and partner incentives such as Flux, Dynex, and Raven.

- Partnerships & Community: Highlighted collaborations with Flux Technologies and an active Discord community with over 720 members.

- Real-World Impact: Addresses fuel poverty and promotes renewable energy with a focus on decentralizing computing power.

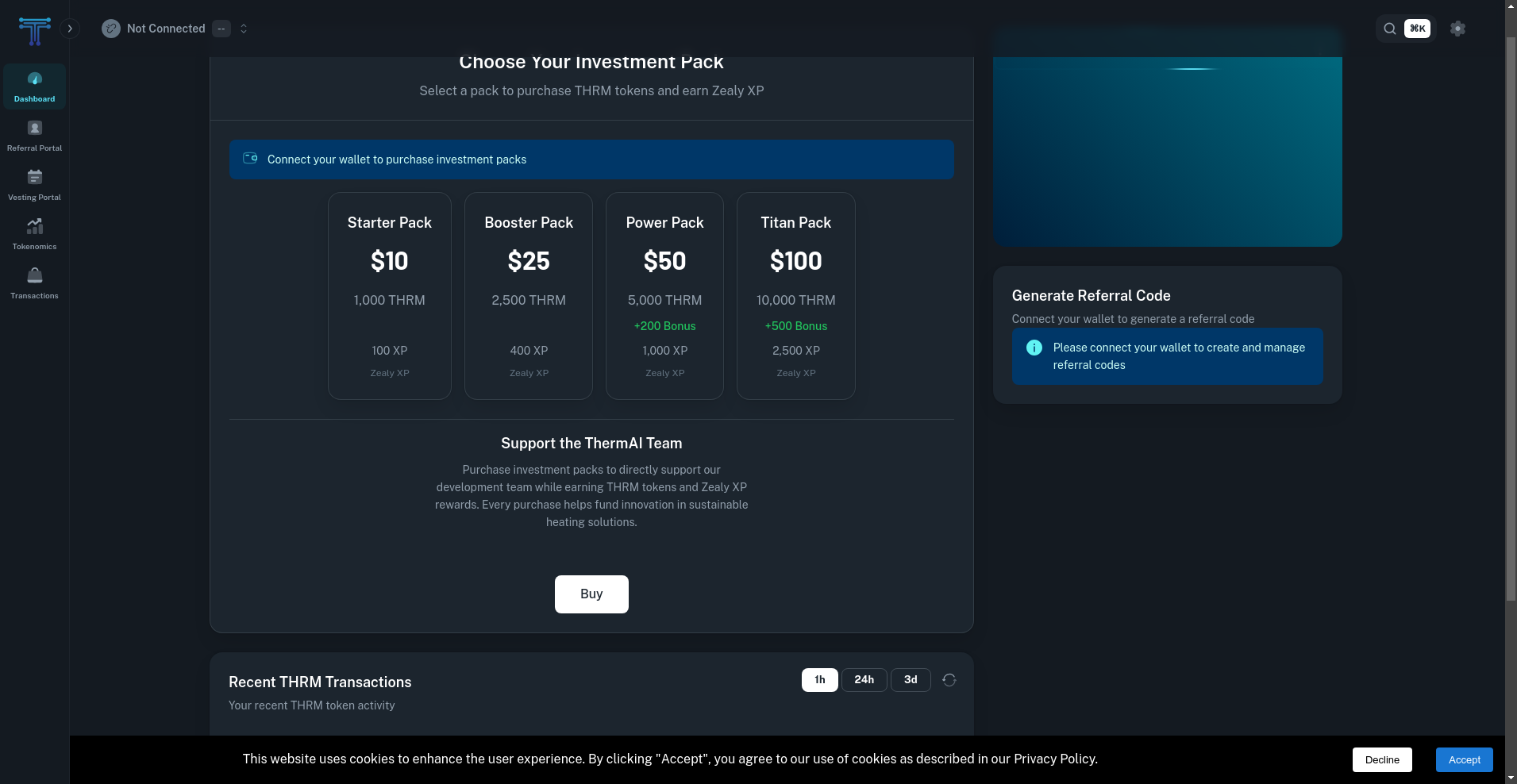

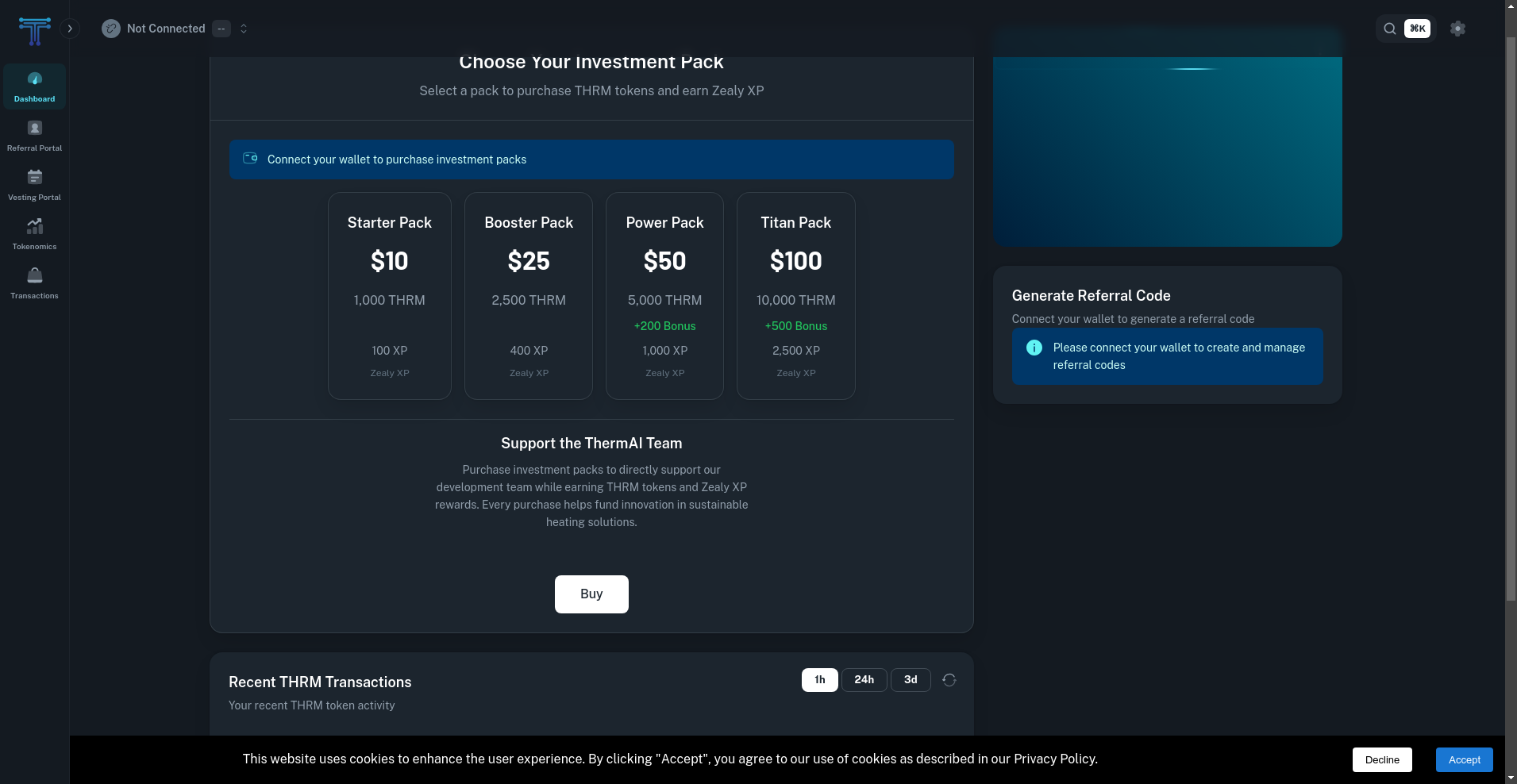

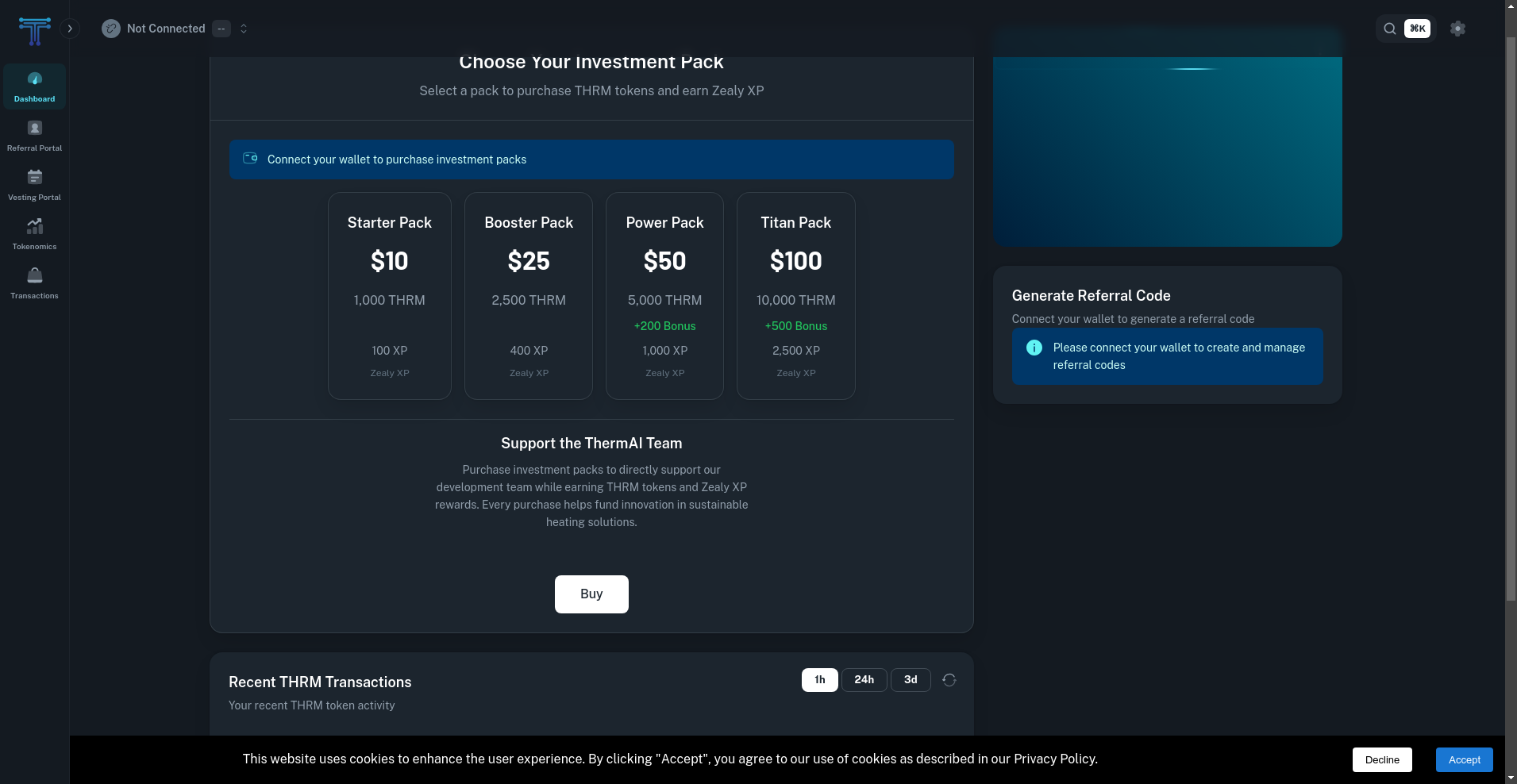

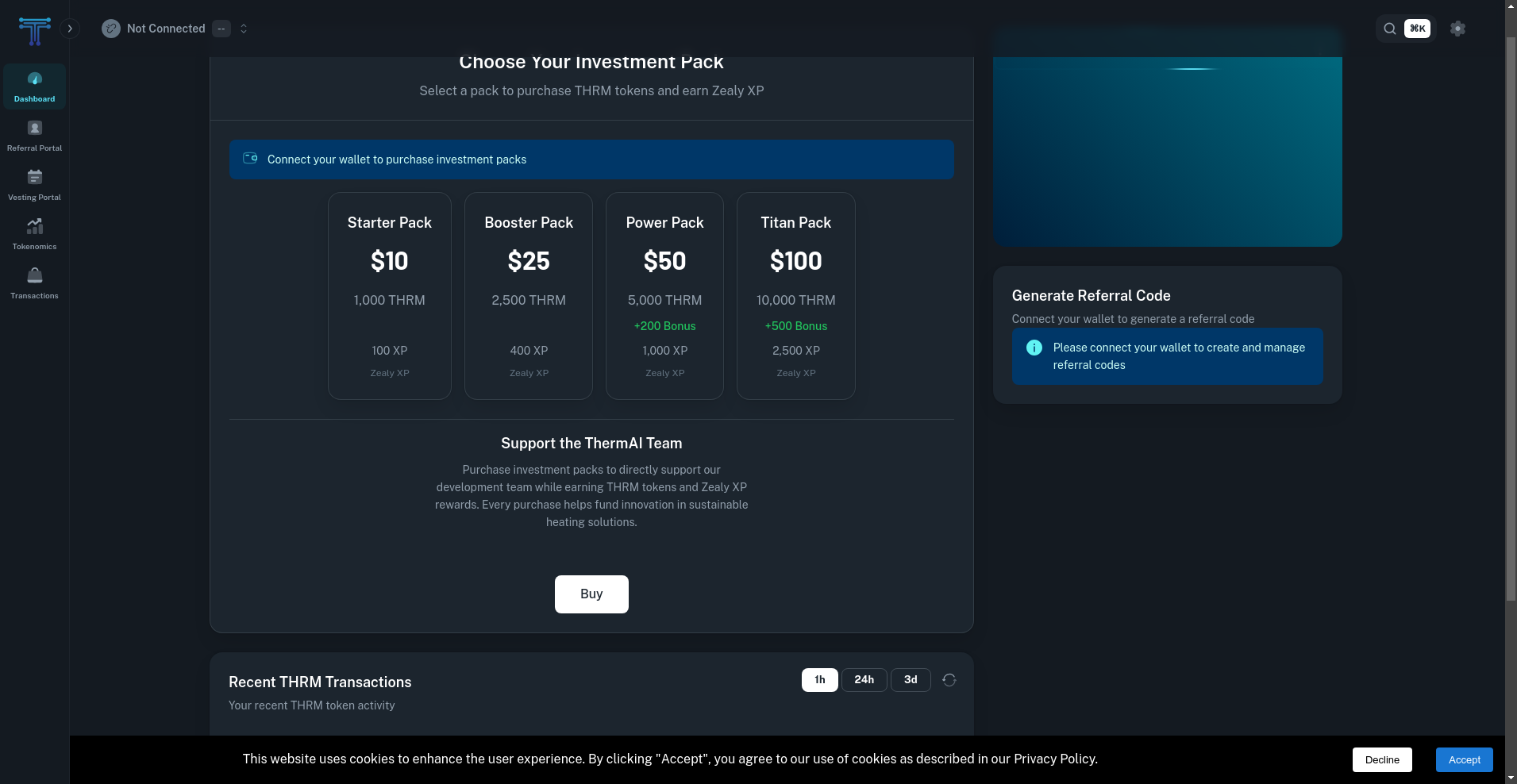

Visual Overview:

Tokenomics & Airdrop Details

ThermAI's tokenomics reveal a fixed supply of 1 billion $THRM tokens. Their distribution includes:

- 10% Private Sale

- 15% Public Sale (via DxSale IDO)

- 15% Staking Rewards (over 5 years)

- 10% Liquidity Pool

- 10% Liquidity Mining

- 5% Partner Mining Rewards

- 5% Marketing & Community

- 10% Team & Advisors

- 10% Reserve & Treasury

The project explicitly emphasizes no additional tokens will be minted, supporting long-term scarcity. As of now, no official airdrop announcements have been made—investors should be cautious about claiming any form of free tokens unverified by official sources.

Recent Developments & Roadmap

According to their roadmap, the project is in its early stages, with key milestones including:

- Q1 2025: Whitepapers release, dApp launch, seed funding.

- Q2 2025: Contract audits, private sale, prototype finalization, public IDO.

- Q3 2025: Beta testing of Nodes, staking/liquidity rewards, partnerships expansion.

- Q4 2025 and beyond: Node deployment in social housing, AI hot water development, and large-scale community projects.

While ambitious, these milestones are typical for projects just beginning their journey. Notably, there’s no guarantee these timelines will be met, especially considering the technical complexity and unproven nature of integrating heat recycling with blockchain tech.

Transparency & Community Engagement

The project maintains active official channels, including:

- Website: thermai.uk

- Twitter: @thermaiofficial

- Discord: Join Discord

With a community of over 720 members, it’s clear there's interest—but numbers alone do not guarantee project legitimacy or success. The community score on Cyberscope is about 52/100, indicating average transparency but room for skepticism.

Visual Content:

Developer & Technical Documentation

ThermAI provides several whitepapers and technical documents available at:

However, independent technical audits performed by Cyberscope have identified "high criticality" issues related to smart contracts’ security and deployment, raising red flags for potential vulnerabilities.

Image Content:

Investment Risks & Red Flags

Despite appealing claims, several risks should be carefully considered before investing or endorsing ThermAI:

- Unproven Technology: The core premise—turning waste heat directly into usable home heating—lacks real-world operational proof and remains experimental.

- Developmental Uncertainties: The roadmap is lengthy, ambitious, but unverified; delays and technical failures are likely.

- Audit Warnings: Cyberscope’s audit reports highlight high-criticality issues in the smart contract code, indicating critical vulnerabilities that could lead to hacks or fund losses.

- Community Scores & Transparency: Moderate community score (~52%) suggests limited transparency or unresolved concerns from independent auditors.

- Bedrock of Trust: The project relies heavily on technological claims and partnerships that are not yet operational—be wary of overhyped narratives.

- Token Utility & Market Liquidity: Without existing exchange listings or liquidity, the token remains speculative. Price is currently zero, with no active trading volume.

- Legal & Regulatory Risks: As a green tech hybrid project, regulators might scrutinize claims about sustainability and the energy impacts of crypto mining.

Is ThermAI Legit? Final Verdict

Based on available information, while the project’s vision is intriguing and aligned with global sustainability goals, there are systemic red flags associated with its current stage of development. The high criticality in code audits, lack of proven technology, untested real-world application, and moderate transparency should be significant warning signs for investors.

Conclusion: Do not consider ThermAI a guaranteed opportunity. Approach with extreme caution, verify all claims independently, and never invest more than you can afford to lose. Its innovative approach could be promising in the future—if it overcomes technical, security, and operational hurdles—and not a moment before.

Final Thoughts & Recommendations

- Follow official channels for major updates, but remain skeptical of hype.

- Wait for transparent, third-party audits and real-world pilot deployments.

- Never send funds or personal data before thorough due diligence.

- Monitor regulatory developments concerning sustainability claims in blockchain projects.

In summary, ThermAI embodies a politically and technologically ambitious vision—yet it currently bears significant risks that overshadow its promises. For now, it is best classified as high-risk speculation rather than a safe or legitimate investment opportunity.

Daniel Clark

On-Chain Quantitative Analyst

I build algorithmic tools to scan blockchains for signals of manipulation, like whale movements and liquidity drains. I find the patterns in the noise before they hit the charts.

Similar Projects

-

Unicoin

Unicoin Review: Cryptocurrency Scam Checker & Project Analysis

-

Sportcoin Network

Sportcoin Network ($SPORT) Review: Tech, Risks & Community Insights

-

Genesis

Genesis ($GEN) Review: Assessing Its Legitimacy and Risks

-

MitaoCat

Comprehensive Review of MitaoCat Crypto Project | Scam Checker and Risk Assessment

-

Avalaunch

Review of Avalaunch: Crypto Project Scam Checker & Risk Analysis