Empowa Review, Risk Analysis, Scam Check & Latest Update: Is This Project Legit? A Deep Dive into Tokenomics, Ecosystem & Red Flags

Empowa is one of the more ambitious DeFi projects aiming to tackle Africa’s housing crisis through blockchain technology and real-world asset tokenization. As investors and enthusiasts seek transparency and legitimacy in the crypto space, it’s crucial to conduct a comprehensive analysis of Empowa’s offerings, team, tokenomics, and potential risks. In this in-depth review, we will dissect all available data, evaluate the project's credibility, highlight red flags, and provide valuable insights before you consider investing or participating.

Project Overview: What is Empowa?

Empowa (website: empowa.io) positions itself as a decentralized finance (DeFi) platform on Cardano dedicated to solving Africa’s affordable housing crisis. Operating since December 2020, its mission is to empower one million African families to own climate-smart homes by 2030. Leveraging blockchain, Empowa facilitates funding for rent-to-own (RTO) housing projects through tokenized assets and native tokens (EMP).

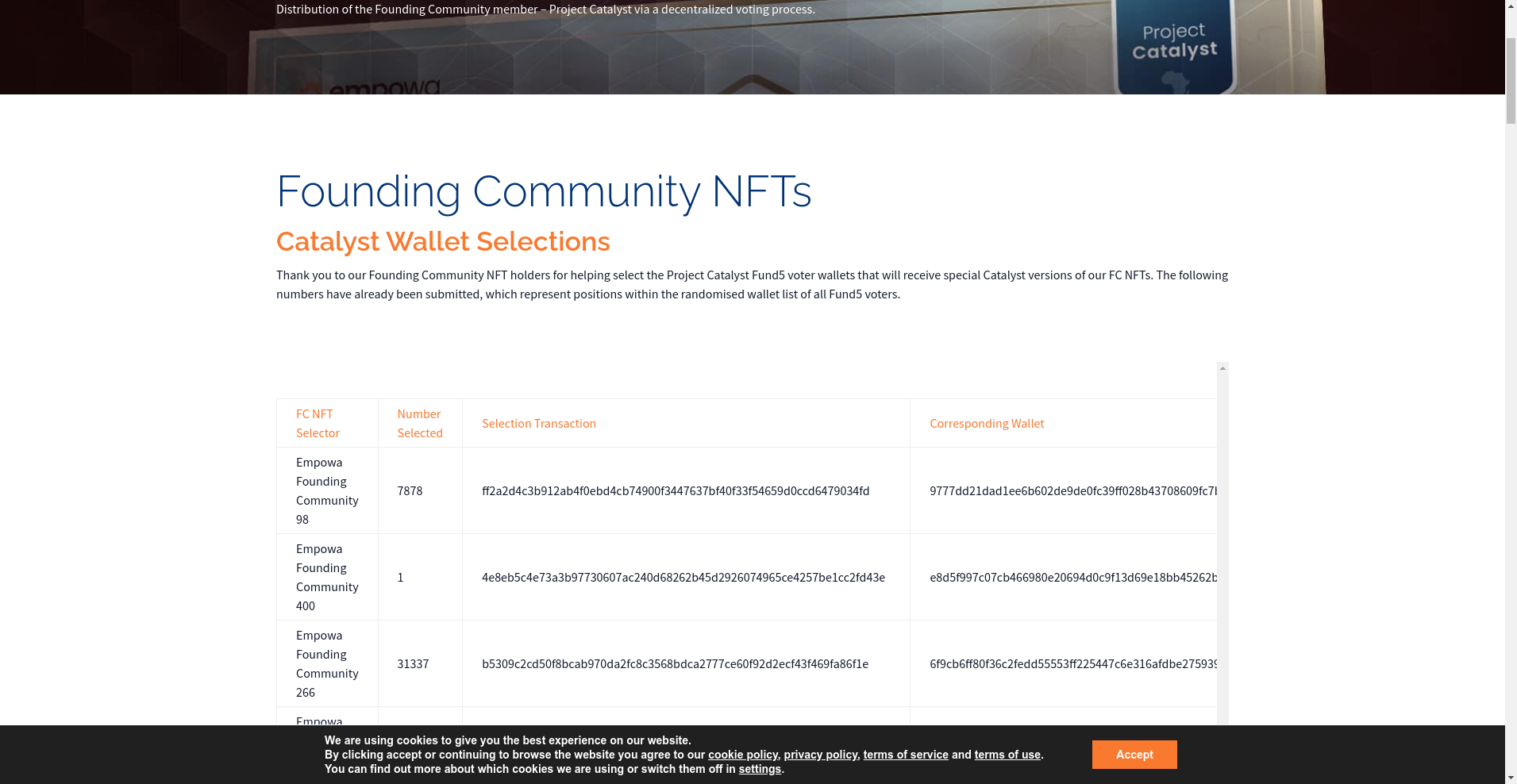

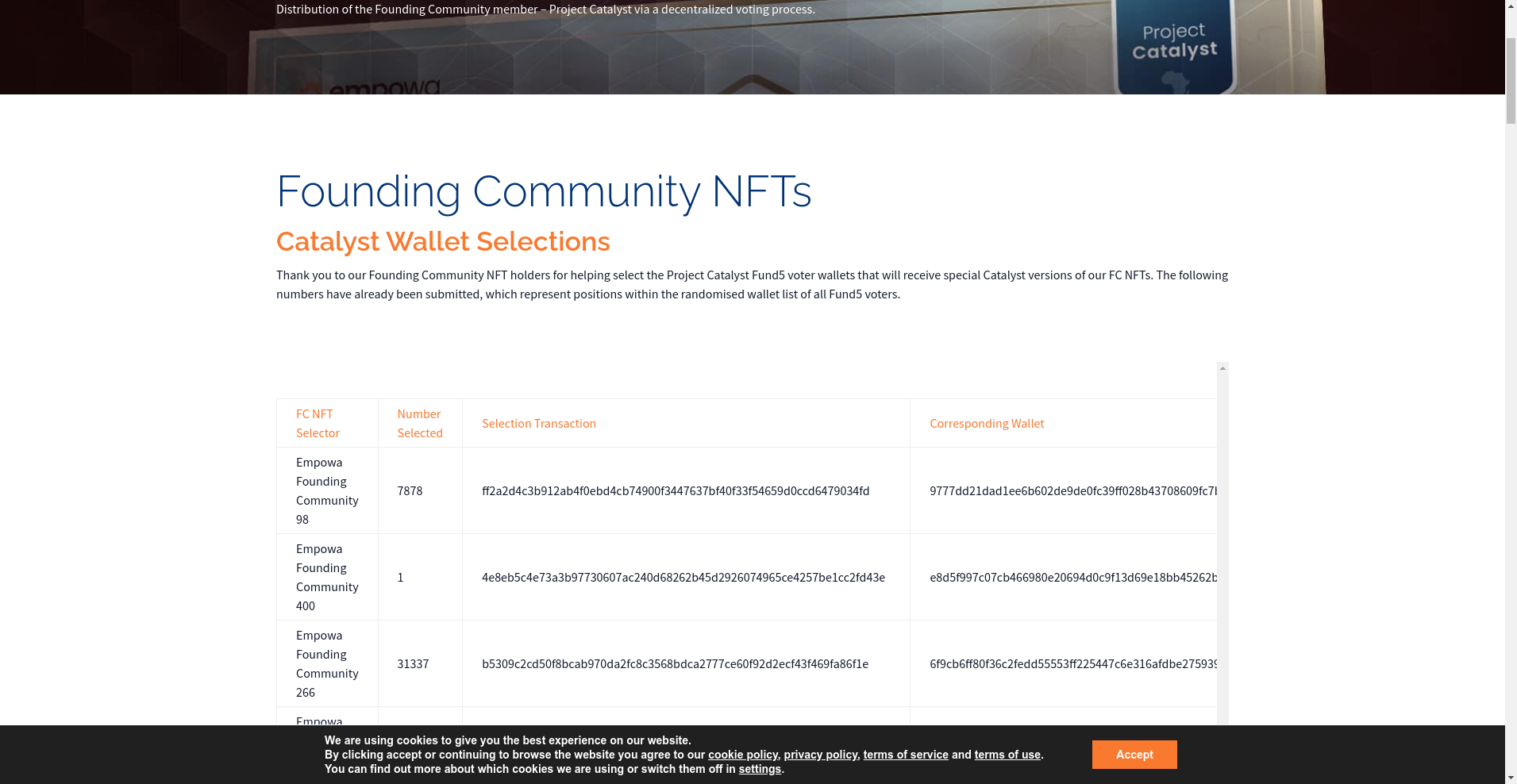

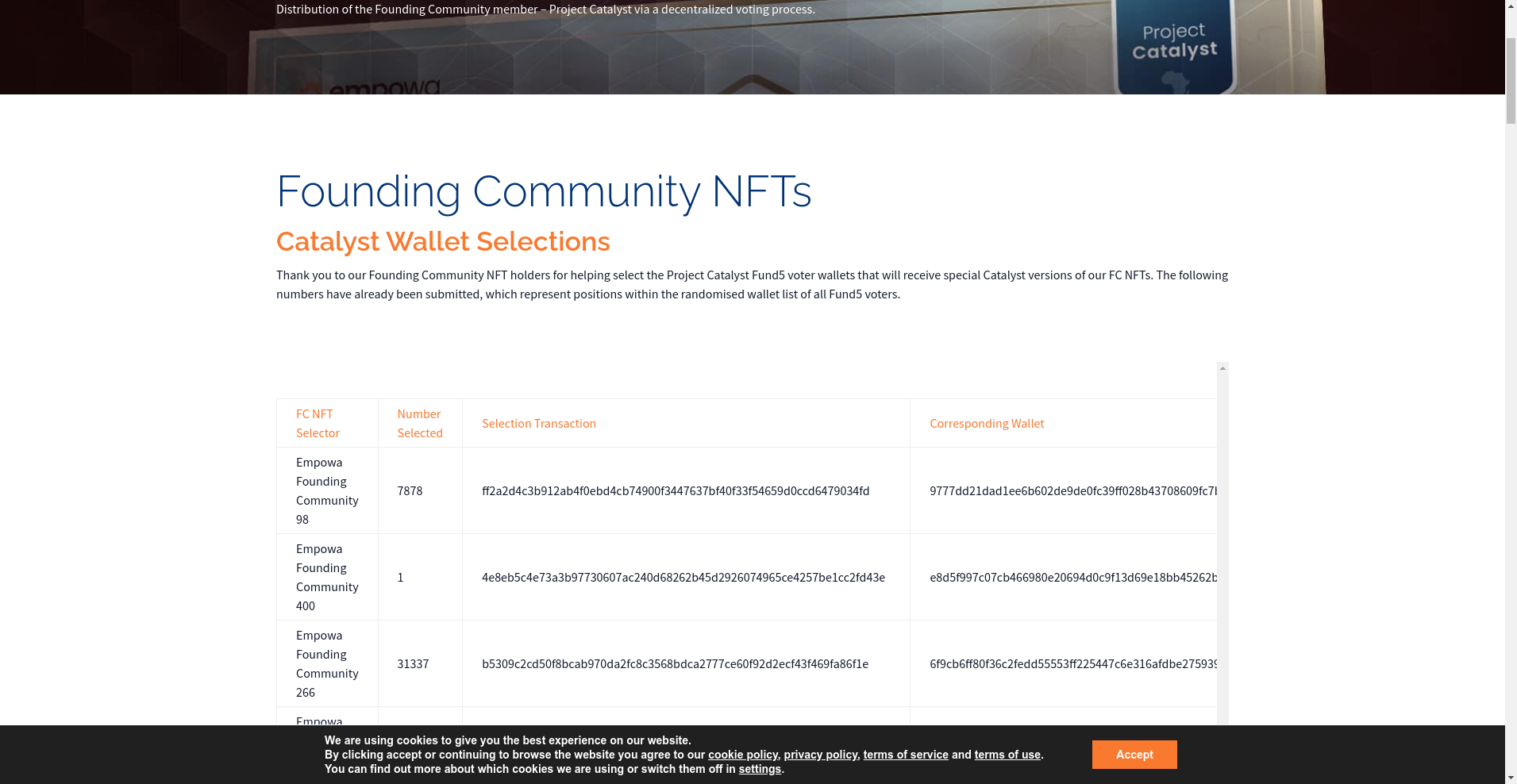

The core idea revolves around tokenizing real estate assets and over-collateralizing them with EMP tokens, creating a securitized ecosystem aligned with sustainable development goals. The project emphasizes social impact, transparency via blockchain, and community involvement through NFTs and staking mechanisms. The platform also integrates NFT sales—like Collateral NFTs and Founding Community NFTs—for fundraising and governance.

Team, Mission & Ecosystem: Transparency & Community Engagement

- Team & Leadership: The key figure highlighted is Andrew, Empowa’s Head of Quantitative Analytics & Risk, emphasizing their focus on data-driven strategies. There are no personal profiles or verified team members listed publicly, raising concerns about transparency.

- Mission & Goals: Address Africa’s housing shortage—50 million homes—described as a trillion-dollar opportunity—by providing innovative financing solutions rooted in blockchain.

- Ecosystem Components: Includes the EMP token, NFT sales (NFT Marketplace), Empowa Pay, and community initiatives like Founding Community NFTs and Impact Cards.

Legal & Policy Review: Terms, Privacy & Security

Empowa’s official site contains several legal notices:

While these pages are standard, the absence of KYC/AML procedures or clear legal entity details raises questions about long-term compliance. The Security Score on Cyberscope (94.98%) is high, but technical vulnerabilities or operational opacity remain concerns.

Tokenomics & Airdrop: What You Need to Know

EMP is a native, fungible token on Cardano with a total fixed supply of 200 million, over-collateralizing real estate loans. Key token distribution:

- 60% to Housing Projects (via collateralization)

- 10% Public Sale

- 10% Innovation Fund

- 10% Team (unclear vesting)

- 5% Operating Fund

- 3% Private Sale

- 2% ISPO (Initial Stake Pool Offering)

The token was audited by Cyberscope, which confirms its on-chain minting policies and a fixed supply locked at 200 million. The token’s minting was completed approximately in early 2025; further details in the audit suggest a time-locked minting policy, reducing the risk of inflation or arbitrary minting.

Recent Updates & Activity: Is Empowa Active?

The project’s official Twitter (@empowa_io, 14,654 followers) remains active, sharing updates about NFT sales, partnerships, and ecosystem progress. The Cyberscope audit shows a community score of 54, with stability and decentralization scores near the top (around 80-90th percentile), indicating a modest community size but relatively decentralized governance.

Latest update indicates ongoing NFT sales, collateralization milestones, and partnerships like Genius Yield. Regular blog posts, social media activity, and the release of a Blackpaper in May 2025 suggest continuous development. However, a community discord with 1,433 members is relatively small for a project of this scope, hinting at limited community engagement.

Embtc Ecosystem & Tools: How Do They Work?

- Empowa Token ($EMP): Used for collateral, staking, and governance participation. Its value is driven by demand for real estate collateral and staking rewards.

- NFTs: Founding NFTs, Collateral NFTs, and Impact Cards facilitate community involvement and project funding.

- Empowa Vault: Allows users to lock EMP tokens and earn yield—initial APYs are 4-4.75% for 3-6 months, boosted by NFT holdings.

- Empowa Blackpaper & Tokenomics: Detail mathematical frameworks, risk models, and supply-demand logic underpinning the ecosystem’s valuation.

- Token Marketplace & Liquidity: EMP tokens are traded on Cardano DEXs like MuesliSwap, Minswap, SundaeSwap, & Wingriders, providing liquidity and price discovery.

Risks & Red Flags: What Are the Potential Pitfalls?

1. Transparency & Team Verification

Absence of verified team members, legal entity disclosures, or independent audits beyond Cyberscope raises transparency doubts. Skeptics often view projects without clear leadership as risky.

2. Smart Contract & Security

The Cyberscope audit confirms the minting policy but does not necessarily cover comprehensive security audits. Potential vulnerabilities in escrow, NFT marketplaces, or loan protocols could be exploited.

3. Regulatory Uncertainty

Although the project operates on Cardano, legal frameworks in many African countries remain unclear regarding real estate-backed tokens. Cross-border asset tokenization can face legal hurdles or bans.

4. Tokenomics & Usage

While fixed supply reduces inflation risk, the valuation heavily depends on developer adoption, real estate activities, and market demand for EMP. Limited liquidity or large whales hoarding tokens could cause price manipulation.

5. Community & Adoption

Community engagement appears modest, with smaller social channels and limited discord activity. Adoption on the ground in Africa remains unverified—interactions are mostly virtual.

CyberScope Audit: What Does it Say?

The Cyberscope audit confirms the minting policy and the fixed total supply of EMP tokens. The ecosystem shows decentralization scores near the 90th percentile, with a community score around 54. High security score (94.98%) suggests good technical hygiene. However, the audit does not directly verify smart contract implementation or operational security beyond token minting rules.

Investment Risks Summary: Should You Trust Empowa?

- Legitimacy & Transparency: Limited team or legal disclosures pose a red flag. While the project is on Cardano and audited via Cyberscope, absence of verified individuals or KYC checks could lead to scams or rug pulls.

- Operational & Adoption Risks: Real-world projects depend heavily on local partnerships, legal compliance, and economic conditions. If on-the-ground implementation falters, the token’s value may diminish.

- Market & Liquidity Risks: Small community size and niche ecosystem could limit liquidity, making exit difficult especially for large holders.

- Technology & Security: The audit confirms minting policies but not comprehensive smart contract security. Future protocol bugs could harm user funds.

Conclusion & Final Insights

Empowa presents an innovative approach to Africa’s housing crisis, blending real estate, DeFi, and NFTs within Cardano’s ecosystem. Its fixed token supply, transparent minting policy, and ongoing ecosystem development support its credibility on paper. However, notable red flags such as limited team disclosures, small community size, and regulatory uncertainty call for caution.

Potential investors should perform due diligence, seek more verified info on the team and legal footing, and consider the project’s long-term operational risks before committing significant funds.

In sum, Empowa is a promising but complex project—good for impact investors with high risk appetite who are willing to monitor development closely. Always exercise caution and diversify your portfolio when engaging with nascent crypto projects.

Jessica Taylor

NFT Market Data Scientist

Data scientist specializing in the NFT market. I analyze on-chain data to detect wash trading, bot activity, and other manipulations that are invisible to the naked eye.

Similar Projects

-

FlipFox

FlipFox Review: Scam or Legit Crypto? Scam Check & Analysis

-

Academic Labs

Academic Labs ($AAX) Review: A Deep Dive into Its Tech & Risks

-

MultCred

Comprehensive Review of MultCred: Crypto Project Scam Checker & Risk Analysis 2025

-

Avalon Games

Avalon Games Review: Crypto Scam Checker and Project Scam Review

-

Cashaa

In-Depth Review of Cashaa: Crypto Project Scam Checker & Risk Analysis