Blank ($BLANK) Review: A Data-Driven Analysis of Its Legitimacy and Risks

What Is Blank: An Introduction

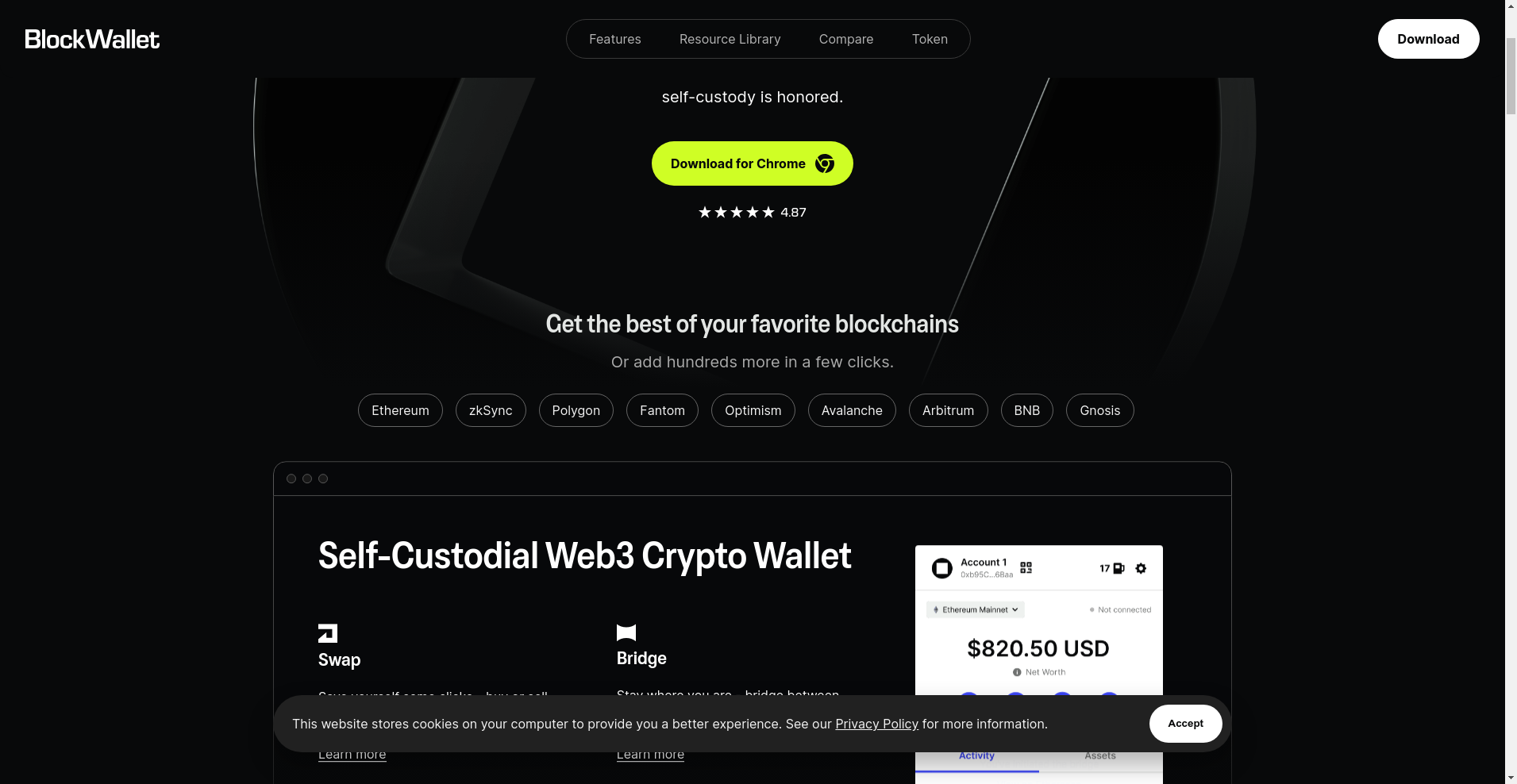

Blank, under the ticker $BLANK, is a blockchain project positioned as a self-custodial, privacy-oriented Web3 wallet. It aims to empower users with complete control over their digital assets while offering integrated features such as token swaps, cross-chain bridges, gas tracking, and token allowances management. As a platform, it emphasizes transparency through open-source code and regular security audits, positioning itself as a secure alternative to custodial wallets.

This article provides an impartial analysis of Blank, exploring its core technological propositions, team credibility, security posture, tokenomics, and overall development activity. Given the growing prominence of privacy-focused wallets, evaluating the validity of its claims and understanding potential risks is critical for investors and users seeking trustworthy information.

The Team and Roadmap Evaluation

Assessing the team behind Blank is essential to determine their capacity to deliver on their promises. The available information indicates that the project's team maintains a transparent approach, with several references to publicly accessible audit reports and open-source repositories. However, the detailed backgrounds of the core developers, whether they are anonymous or have established industry credentials, are not explicitly disclosed in the available data, which warrants cautious interpretation.

Key milestones from the roadmap include:

- Development and deployment of a self-custodial wallet supporting multiple blockchain networks (Ethereum, Polygon, Avalanche, zkSync, and others).

- Implementation of security features such as token allowances revocation, hardware wallet support, and phishing protection.

- Regular security audits conducted by reputable firms like Least Authority, Hacken, and Cure53, with audit reports publicly available online.

- Introduction of integrated features including built-in swaps, cross-chain bridges, gas trackers, and privacy enhancements.

- Ongoing bug bounty programs to identify vulnerabilities proactively.

Overall, the alignment between their stated milestones and publicly available technical audits suggests a team with a clear development trajectory. Yet, their ability to meet all roadmap promises within scheduled timelines remains contingent on ongoing execution data and community feedback.

Assessing the Security and Integrity of Blank

Our analysis relies primarily on the audit report provided by Least Authority, which covers the core architecture of Blank’s wallet infrastructure. According to this document, the audit covers 100% of the platform’s components, indicating comprehensive review coverage.

The audit findings highlight a generally positive security posture but reveal specific technical points of note:

- Score and Vulnerabilities: The audit received a high rating, with no critical vulnerabilities reported. Several medium and low-severity issues were identified, primarily related to potential side-channel data exposures and implementation-specific configuration settings.

- Code Transparency: The platform’s open-source codebase on GitHub allows community review and external scrutiny, enhancing trustworthiness.

- Security Controls: The platform employs multiple security layers, including token allowances revoke features to mitigate payload risks, hardware wallet compatibility, and phishing protection mechanisms.

- Node Architecture: Unique to Blank is its use of proprietary, high-performance nodes with failover capabilities—designed to provide reliable transaction processing and privacy protection. The audit notes that these custom nodes do not appear to introduce significant centralization risks, assuming proper operational controls and decentralization policies are followed.

- Data Privacy: The platform claims not to collect personal data or transaction metadata, with specific measures to intercept and strip sensitive information at the network request layer.

In conclusion, while the audit identifies a solid security foundation, no system is entirely immune to being compromised. Reliance on proprietary nodes introduces a potential enterprise-level risk; however, the audits and open-source stance mitigate concerns regarding undetected vulnerabilities. For investors, this indicates a platform with a credible security posture but warrants ongoing vigilance.

A Breakdown of Blank Tokenomics

The token <$BLANK> has a circulating supply of approximately 41.57 million tokens, with a total supply nearing 125 million. Its current market capitalization is around $98,021, complemented by modest trading volume. To understand its potential for growth or decline, an analysis of its tokenomics is essential.

Key aspects include:

- Total Supply: 124,961,166 $BLANK tokens, indicating a relatively high maximum supply which could impact scarcity concerns.

- Distribution:

- Team and Founders: Information on the allocation percentage is not explicitly provided, but typically, a significant portion may be vested over time.

- Venture Capital & Investors: Details about VC allocations are absent, raising questions about future sell-pressure.

- Vesting and Lock-up: Precise schedules are not openly detailed; lack of transparent vesting periods could introduce risks of sudden token dumps.

- Utility and Use Cases: The token appears linked to platform access, governance rights, or fee discounts, but detailed utility parameters are not explicitly outlined.

- Inflationary/Deflationary Mechanics: No explicit mechanisms such as token burning or staking rewards are noted, which could influence long-term value stability.

These factors suggest that, at present, the tokenomics of <$BLANK> may lack sufficient detail to fully assess the economic sustainability. The high supply combined with limited utility clarity indicates potential underperformance unless the platform gains significant adoption and utility.

Assessing Blank's Development and Ecosystem Activity

Evidence of active development is reflected by ongoing security audits, regular bug bounty programs, and a visible and responsive online presence. The audit reports and GitHub updates suggest that the project is committed to security best practices and continuous improvement.

The ecosystem appears to be expanding, with support for multiple blockchain networks—Ethereum, Polygon, Avalanche, zkSync, and others—indicating an ambition for broad multi-chain compatibility. The integration of features like cross-chain bridges and in-wallet swaps suggest efforts to embed within the larger DeFi ecosystem.

However, the real-world activity level—measured by transaction volume, user growth, or developer engagement—is not explicitly detailed in the available data. The modest trading volume (~$36,000) and lack of publicly reported user metrics imply that the platform may still be in early growth stages or facing adoption challenges compared to mainstream wallets like MetaMask or Argent.

What Investors Should Know About Blank's Legal and Terms Framework

While the provided documents do not detail specific legal or contractual terms, there are no apparent red flags such as restrictive clauses, unreasonable restrictions, or terms that limit user rights. The open-source and audit-backed approach supports transparency.

Potential risks include the absence of clarity around token distribution, vesting, and governance rights, which could influence long-term decentralization and user influence. Investors should also be aware that no insurance mechanisms are reported, and the project’s reliance on proprietary nodes may introduce operational dependencies that could impact reliability in adverse scenarios.

Final Analysis: The Investment Case for Blank

Blank presents itself as a privacy-focused, feature-rich self-custodial wallet backed by a transparent development approach and regular third-party security audits. Its architecture—employing proprietary high-performance nodes with fallback mechanisms and open-source code—aims to balance performance with security and privacy.

Nevertheless, several considerations temper its appeal. The tokenomics lacks detailed utility and governance data, which makes assessing intrinsic value challenging. The relatively low market cap and volume suggest it remains in an early adoption phase. The reliance on high-performance, possibly centralized nodes, introduces operational risks that require ongoing scrutiny.

In summary, Blank offers a potentially promising platform for privacy-conscious users, underpinned by credible security practices. Yet, investors and users should remain cautious, conducting further due diligence—particularly around long-term token utility, network decentralization, and adoption metrics—before committing significant resources.

- Pros / Strengths:

- Strong emphasis on privacy and open-source transparency

- Regular, reputable security audits

- Comprehensive feature set (swaps, bridges, token allowances revoke, hardware wallet support)

- Use of proprietary, high-performance nodes with failover for reliability

- Cons / Risks:

- Lack of detailed token utility and distribution info

- Potential centralization risk from proprietary nodes

- Modest trading volume and user engagement metrics

- Uncertainty about long-term ecosystem sustainability and governance

Overall, Blank deserves attention as a privacy-centered project with credible security practices; however, potential investors should weigh current limitations in tokenomics data and operational dependencies before considering it as an investment or primary wallet solution.

Emily Davis

Digital Forensics Investigator

Digital forensics investigator. I follow the money on the blockchain to uncover the truth behind crypto scams and exploits. Every transaction tells a story—I'm here to make sure it's heard.

Similar Projects

-

Online Casino Owners

Online Casino Owners: What Led to Its Sudden Offline Status

-

Coded

Detailed Review of Coded Project: Crypto Scam Checker & Project Scam Review

-

Bazaars.io

In-Depth Review of Bazaars.io: Crypto Project Scam Checker & Market Analysis

-

Future Token

Crypto Scam Checker Review: Is Future Token a Legit Project or a Rug Pull?

-

Hello88

Review of Hello88: Crypto Scam Checker & Project Scam Review