0xBitcoin ($0XBTC) Review: A Data-Driven Look at Its Legitimacy and Risks

Project Overview

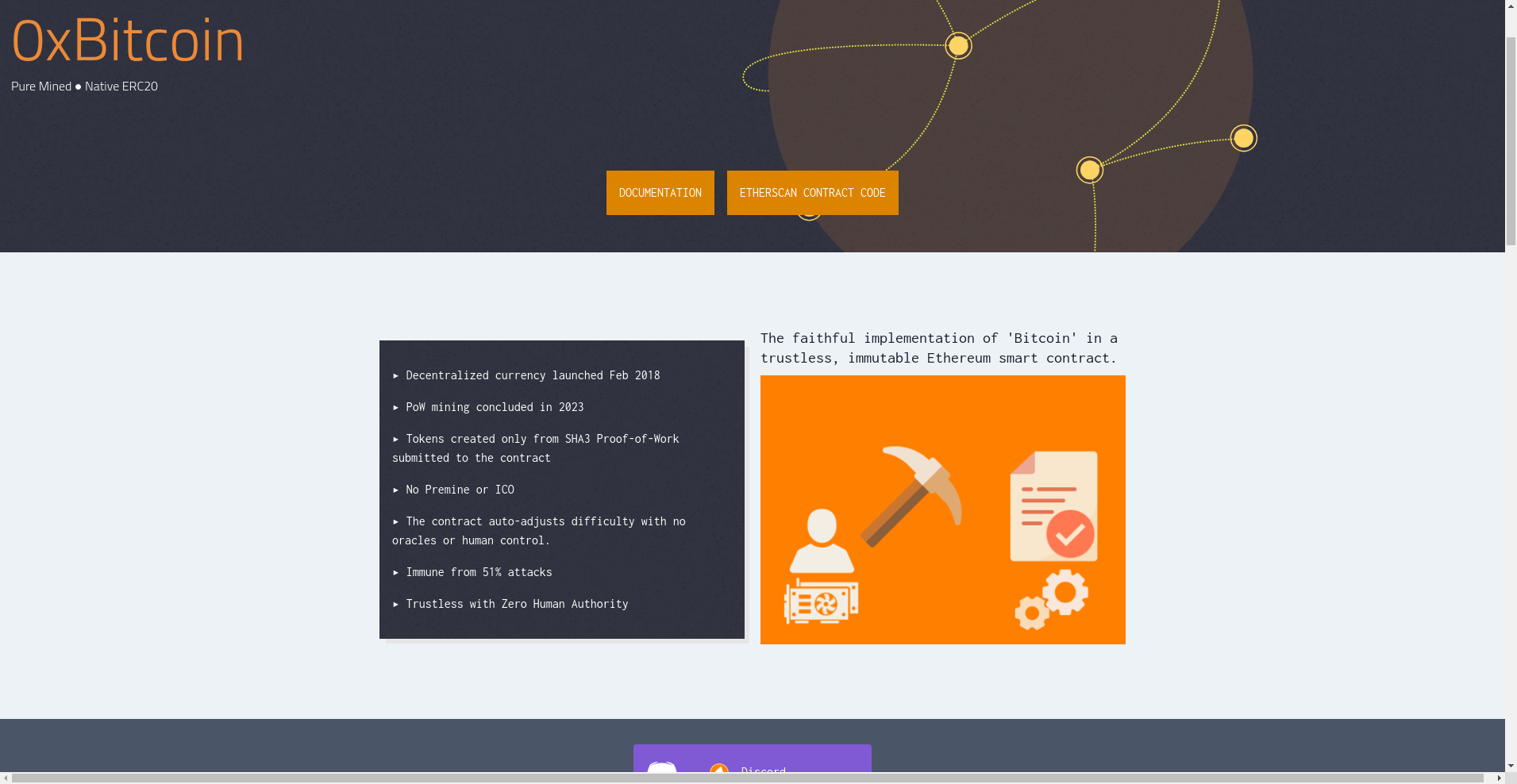

0xBitcoin (ticker: $0XBTC) represents an innovative experiment in mimicking Bitcoin's scarcity within the Ethereum environment. Its core proposition is to implement a trustless, immutable ERC20 token that leverages a self-adjusting Proof-of-Work (PoW) mechanism embedded directly into a smart contract. Launched in February 2018, the project emphasizes decentralization, security, and community participation, positioning itself as a native alternative to Bitcoin's model but with enhanced programmability and ecosystem integration.

This review provides an impartial, evidence-based analysis of 0xBitcoin's strengths and potential vulnerabilities, focusing on its technological foundation, security posture, economic model, and community development. The goal is to evaluate whether its claims of legitimacy hold under scrutiny and what risks prospective holders should be aware of.

Team and Roadmap Evaluation

The team behind 0xBitcoin remains largely anonymous, which is common in many open-source crypto projects but can raise concerns regarding accountability and long-term vision. Their primary communication channels include a dedicated community on Discord, Reddit, and Medium, with active engagement through documentation and tutorials. For insights into navigating such teams, consider a deep dive into evaluating anonymous crypto project transparency.

Key milestones outlined in the roadmap encompass:

- 2018: Initial launch and community building.

- 2023: Completion of SHA3 Proof-of-Work mining, transitioning the project from active mining to a static supply model.

- Post-2023: Focus on ecosystem development, decentralized applications, and community governance contributions.

While these milestones suggest a clear technical trajectory, the absence of a dedicated, known core development team and the reliance on community-led efforts imply that long-term execution depends heavily on volunteer contributions and open-source collaboration. Their ability to deliver future upgrades or governance features remains uncertain but appears aligned with their open, community-driven philosophy.

Assessing Security and Trustworthiness

## Based on the Cer.live audit report, the security assessment of 0xBitcoin indicates a baseline level of confidence but also highlights specific vulnerabilities. The project’s platform is marked as have been audited by Callisto Network, with public audit documentation accessible via GitHub.

Key findings from the audit include:

- Score and Rating: The smart contract received an overall rating of 5.5 out of 10, suggesting moderate security robustness.

- Vulnerabilities: The report identified potential issues related to reentrancy, lack of upgradeability safeguards, and some code complexity that could potentially be exploited if not mitigated carefully. Understanding specifics can be aided by exploring common ERC-20 token security vulnerabilities.

- Centralization & Control: The smart contract code appears to operate without upgraded mechanisms or multisig safeguards, increasing reliance on code immutability and developer vigilance.

- Insurance and Bug Bounties: Currently, no bug bounty program is active, which could slow response to discovered vulnerabilities.

While the platform maintains a basic level of security verification, the moderate audit score underscores the importance of cautious risk assessment. The absence of ongoing bug bounty initiatives and the complexity of the embedded proof-of-work mechanism imply that vulnerabilities, if exploited, could affect project stability or token holders’ assets. Investors should note that while the smart contract is publicly accessible for review, its code complexity and identified issues could serve as attack vectors.

A Breakdown of 0xBitcoin Tokenomics

The economic structure of 0xBitcoin revolves around a fixed maximum supply approximating 21 million tokens, mimicking Bitcoin’s supply cap. Unlike traditional Proof-of-Work cryptocurrencies, all token issuance occurs through mining submissions to a smart contract that adjusts difficulty automatically. This design aims to replicate Bitcoin's scarcity and mining incentives within Ethereum’s programmable framework. This innovative approach of using smart contract embedded proof-of-work offers a unique perspective in blockchain design.

Key tokenomics details include:

- Total Supply: Approximately 20.99 million 0xBTC, with current circulation at ~10.84 million, indicating half of the maximum target has been mined.

- Inflation/Deflation: The halving schedule is embedded within the smart contract, with initial rewards at 50 tokens per block, halving when the supply approaches certain thresholds, similar to Bitcoin.

- Distribution:

- Mining Rewards: All tokens are mined through SHA3 PoW submissions.

- Premines/VCs: None reported; the project emphasizes a fair launch with no premine or ICO.

- Vesting & Allocations: No dedicated vesting schedules are publicly detailed, as tokens are created purely through mining.

- Utility: The token functions as a decentralized currency, with community and developer ecosystems leveraging it for various use cases, including DeFi integrations.

The economic model’s sustainability hinges on continuous mining participation, with halving events designed to synchronize supply issuance with decreasing block rewards. However, the marginal costs of mining and the total supply cap could pose risks of centralization if mining power consolidates or if SHA-3 PoW mining efficiency diminishes against SHA-256.

Assessing 0xBitcoin’s Development and Ecosystem Activity

According to available data, 0xBitcoin exhibits consistent development activity, evidenced by its active GitHub repositories, comprehensive documentation, and ongoing community engagement via social channels. The project’s focus on open-source and community contributions is apparent through platforms like the “awesome-0xBTC” repo, which curates developer tools, tutorials, and projects built around 0xBTC.

Real-world usage appears modest but steady, with some liquidity on decentralized exchanges like Uniswap and visible trading volume (~$205.73). The project emphasizes decentralization and community-driven innovation, with active discussions and meme culture fueling adoption. While these are positive signs of organic growth, large-scale adoption or integrations into critical financial protocols are still pending, representing a relatively nascent ecosystem.

It is important to distinguish actual development progress from marketing hype. The presence of detailed documentation, active repositories, and transparent smart contract code suggests a genuine technical trajectory rather than superficial claims.

The Fine Print: Analyzing 0xBitcoin's Terms

From available resources, 0xBitcoin’s legal framework is minimal, aligning with its open-source ethos and public domain licensing. The code and documentation being CC0 reduces legal restrictions but also means there are no explicit investor protections or formal governance structures. There are no clear clauses concerning dispute resolution, rights to modify protocols, or exit strategies, which are common sources of risk in centralized or semi-centralized projects.

No significant legal clauses or restrictions stand out. However, the absence of formal legal safeguards underscores the importance of understanding the technological and security risks before engaging with this asset. The need for robust legal documentation in crypto is clearly highlighted by projects like this.

Final Analysis: The Investment Case for 0xBitcoin

0xBitcoin presents a compelling technological innovation — a Bitcoin-like asset operating fully within Ethereum via a trustless, smart contract-based proof-of-work. Its emphasis on decentralization, open-source development, and community involvement underscores its commitment to the ethos of censorship resistance and transparency. Nonetheless, several risks temper its long-term promise.

Security-wise, the project has received a moderate audit score, with known vulnerabilities that could be exploited if not vigilantly managed. The anonymous team, limited governance mechanisms, and nascent ecosystem further suggest higher risk for investors seeking stability or liquidity in the short term. The tokenomics model relies heavily on ongoing mining activity, which could decline if technical incentives diminish or if mining centralization occurs.

In conclusion, 0xBitcoin embodies innovative blockchain principles but requires cautious engagement. It may appeal to enthusiasts and developers interested in trustless, tokenized Bitcoin replication on Ethereum but is unlikely to compete with mature, audited assets in terms of security or market liquidity. As always, potential holders should conduct extensive due diligence and consider their risk appetite before allocating capital to such experimental projects.

Sarah Wilson

Offensive Security Engineer

I'm a professional "white-hat" hacker. I think like an adversary to find holes in crypto projects before the bad guys do. My job is to break things so you don't get broken.

Similar Projects

-

Streamflow Finance

Streamflow Finance Review: Scam or Legit Crypto? Full Legitimacy Check

-

TAIGER COIN

TAIGER COIN ($TAIGER) Review: Risks, Security & Project Exit

-

AIO Ecosystem

Crypto Project Review: Is AIO Ecosystem a Scam or Legit Investment? Scam Checker & Analysis

-

PAXE Protocol

Comprehensive Review of PAXE Protocol: Is This Crypto Project a Scam? | Crypto Scam Checker & Review

-

Zenko Protocol

Zenko Protocol Review: Is This Crypto Project a Scam or Legit?