Understanding MEV Mitigation Strategies in DeFi

In the high-stakes arena of DeFi trading, MEV is a latent tripwire. It’s the profit miners or validators can capture by reordering, inserting, or censoring transactions within a block. This adversary can front-run or sandwich trades, distorting fair price discovery. Recognizing this threat is the first step in turning the tables with hardened defenses.

- The MEV Threat

- How MEV Affects Traders

- Private Routing and Confidential Transactions

- Fair Ordering Protocols

- Protocol-Level Improvements

- Advanced Countermeasures

- Time-Weighted Average Pricing (TWAP)

- MEV-Resistant Routing

- Case Study: Axiom’s Approach

- Best Practices & Real-World Examples

- FAQ

- Conclusion

The MEV Threat

MEV is a surface-level risk that hides in block construction logic. It grows where miners or validators can reorder, insert, or censor transactions. As attackers trace the transaction flow, they discover exploitable windows that let them extract value without user consent. This is not just about profits; it reshapes incentives and can undermine trust in automated markets.

From a hunter’s perspective, each block is a battlefield. The attack surface expands across mempools, relay networks, and cross-chain bridges. To stay ahead, defenders must map these surfaces and anticipate where a vulnerability could be triggered, even if the user never signs a malicious action themselves.

How MEV Affects Traders

MEV isn't only about lost earnings; it corrodes confidence in on-chain trades. A pending transaction might become a target, enabling front-running and sandwiching that skew outcomes. As CoinDesk notes, these tactics inject volatility and create unfair advantages that threaten DeFi’s decentralization ethos. This isn’t speculation—it's a reproducible pattern that good defenses must neutralize. CoinDesk also highlights how persistent MEV activity can erode trust if left unchecked.

Traders increasingly demand predictable execution, clear costs, and transparent risk models. That demand pushes protocols toward private ordering layers and standardized front-end interfaces that reveal little about intent until after execution. For readers seeking deeper proof, see how different ecosystems approach this problem and what works in practice.

On the liquidity side, MEV-driven strategies can skew fees and slippage. Understanding when and where MEV is likely to spike helps traders time their activity and choose venues with lower exposure. For context on cross-chain effects, you can explore related analyses in the industry literature and case studies.

Private Routing and Confidential Transactions

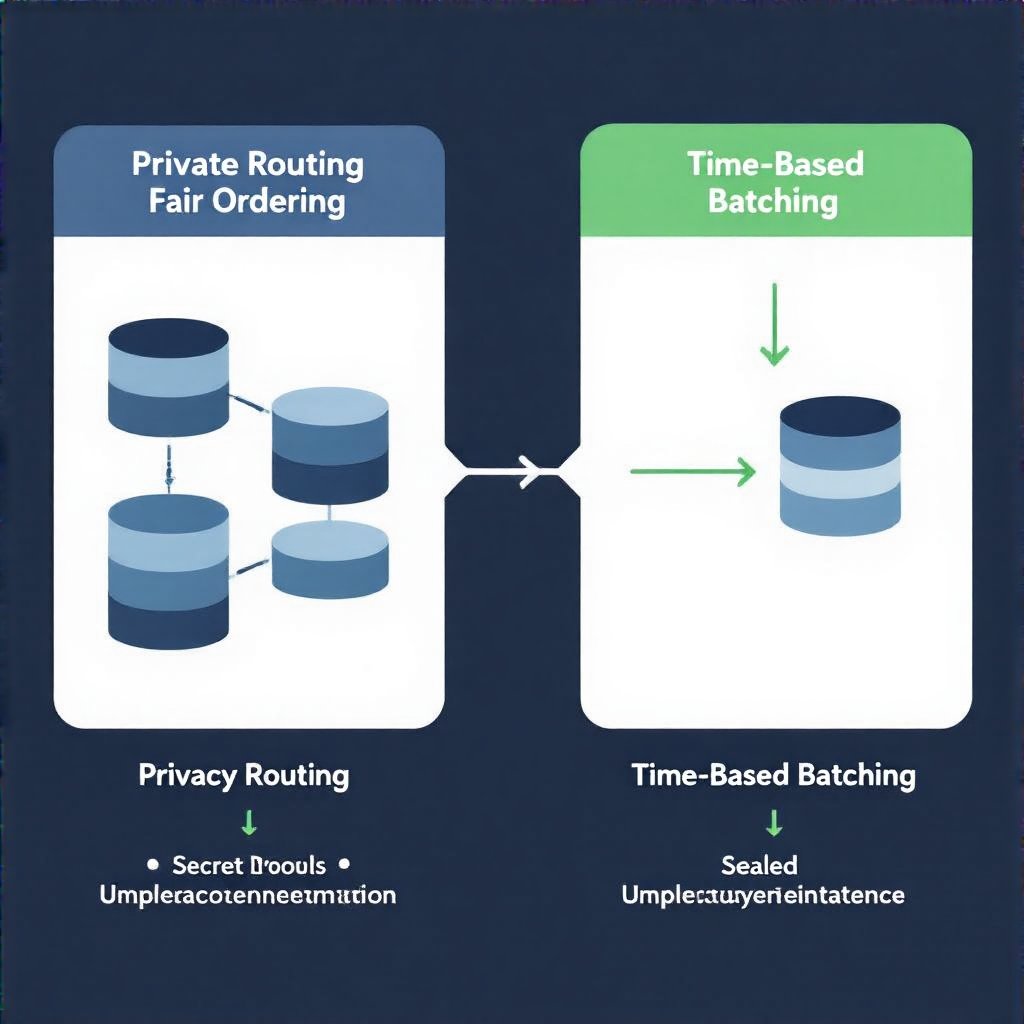

One proven method is routing trades through privacy-preserving techniques. Using specialized relayers or secret transaction pools, traders obscure their intent from miners. Systems like Flashbots' MEV-Boost enable a sealed-bid auction layer where transactions are batched privately before inclusion, reducing the risk of front-run attacks. This approach also benefits users who value consistent execution rather than opportunistic distortions.

Real-world deployments show that privacy layers can significantly shrink the window of exploitable visibility. The practical takeaway is: isolate your sensitive order flow behind cryptographic commitments and trusted relay infrastructure to minimize predictable signals that attackers can exploit. Arbitrum is actively exploring proposer/bicker models and time-based batching to limit selective ordering.

For readers curious about substrate alignment, consider how tokenomics models influence MEV dynamics across ecosystems. Solana tokenomics can shape incentives that either amplify or dampen MEV opportunities, depending on governance and liquidity design.

Fair Ordering Protocols

Fair ordering aims to neutralize MEV benefits by constraining how and when transactions are selected for inclusion. Projects are experimenting with time-based batchings, verifiable randomness, and commissions that incentivize unbiased sequencing. Implementations like Ethereum’s upgrades introduce native anti-MEV features, including cryptographic commitments and randomized ordering in certain contexts. This multi-pronged approach reduces the leverage of miners over transaction order.

From a defensive lens, the message is clear: the safest path blends privacy, fair ordering, and protocol-level safeguards to align incentives with user protection. The end goal is a chain where order is driven by code, not opportunistic whim.

Protocol-Level Improvements

Beyond surface controls, protocol designers embed anti-MEV capabilities into the core. These include randomized ordering within constrained windows, commit-reveal schemes for sensitive actions, and cryptographic puzzles that complicate preemption. In practice, this means fewer exploitable signals and a reduced ability for an attacker to front-run effectively.

From a governance perspective, protocol upgrades should be scrutinized through an adversarial lens—testing how new rules affect attacker profit without harming legitimate users. For further depth on upgrade risks, see the discussion on upgradeability risks and how to mitigate them. External references at Ethereum.org provide authoritative context on these upgrades.

Advanced Strategies to Counteract MEV

Teams increasingly combine multiple layers of defense. Time-Weighted Average Pricing (TWAP) splits large orders over time to dilute MEV exposure and reduce predictability. This technique is already widely used in traditional markets and is gaining traction in on-chain venues. TWAP helps avoid single-block sweeps by attackers and preserves price integrity over longer horizons.

Other defenses include dedicated MEV-resistant routes that distribute order flow across aggregators, making it harder for any actor to identify critical transactions. For example, Axiom’s routing model demonstrates how multi-path delivery and encryption can minimize front-running opportunities.

Time-Weighted Average Pricing (TWAP)

TWAP fragments large orders into a sequence of smaller trades executed over a period. The result is a flatter price impact curve, complicating front-running attempts and reducing the incentive for predatory bots to chase chunks of liquidity. Implementing TWAP requires proper monitoring to ensure execution quality and slippage control across markets.

Using Dedicated MEV-Resistant Routes

MEV-resistant routing protocols aim to decouple order flow from immediate block inclusion, often by aggregating across multiple venues and obfuscating the exact intent until after execution. These designs are still evolving, but early implementations show meaningful reductions in front-running risk and improved execution fairness.

Case Study: Axiom’s Approach

Axiom showcases practical MEV defense through multi-path routing, transaction encryption, and post-batch settlement. By splitting orders, concealing details, and batching behind confidentiality layers, they reduce opportunities for front-running and improve user trust. This case demonstrates a mature, protocol-level mindset toward MEV resilience.

Best Practices & Real-World Examples

| Practice | Rationale | Real-World Example |

|---|---|---|

| Adopt private relayers | Minimizes visibility of intent | Private transaction pools in MEV-Boost-like ecosystems |

| Use TWAP for large orders | Reduces block-hose manipulation window | Institutional DeFi desks implementing time-sliced executions |

| Prefer fair ordering protocols | Limits miner-induced sequencing | Proposer/bicker and time-batching studies in major L2s |

FAQ

Q: What is MEV, exactly? A: MEV is the extra value miners or validators can extract by manipulating transaction order within a block. Q: Can MEV be eliminated? A: Not entirely, but it can be mitigated through privacy, fair ordering, and protocol-level protections. Q: Do MEV defenses hurt liquidity? A: Properly designed defenses aim to preserve liquidity while reducing exploit windows.

Conclusion

The MEV landscape is evolving, and so should your defenses. By tracing attack surfaces, deploying privacy-preserving routing, and embracing protocol-level safeguards, you can align miner incentives with user protection. The attacker’s tripwires become less reliable, and DeFi can move toward fairer, more transparent execution.