Meme Token Tokenomics: Signal-Driven Economics in Meme Assets

In the fast-moving meme-token space, tokenomics form the backbone of whether hype translates into lasting value. This guide distills the essential mechanics and adds a sharp, signal-first lens for evaluating potential tokens.

- Introduction

- Fundamentals of Supply

- Burn Mechanisms

- Taxes & Redistribution

- Staking & Rewards

- Sustainability & Risk

- Best Practices

- FAQ

Introduction: Signal vs Noise in Meme Tokenomics

The game is loud, but the signal still matters. I track wallet clusters and pre-pump accumulations to separate actionable patterns from market noise. As you assess a meme token, remember that tokenomics are a proxy for long-term viability, not a last-minute hype sprint. For a governance perspective, see our DAO governance in blockchain gaming analysis.

Fundamentals of Supply

Supply underpins scarcity and demand. Most meme tokens feature a fixed or elastic supply, often with max supplies in the trillions and mechanisms to reduce circulating tokens over time. Initial distribution typically allocates tokens to developers, community rewards, marketing, and liquidity pools. Tracking how tokens are distributed—and whether large holders loom—helps gauge the risk of manipulation or pump schemes. For deeper context on token supply dynamics, see our piece on token liquidity and market cap benchmarks.

Burn Mechanisms and Scarcity Creation

Token burns permanently remove supply, often triggered by transactions or governance votes. Regular burns can align incentives toward long-term holding, but the impact hinges on scale and cadence. If burns are cosmetic or poorly synchronized with demand, they may be marketing fluff. A thoughtful burn program should be transparent, measurable, and tied to real liquidity or utility growth.

Transaction Taxes and Redistribution

Many meme tokens deploy transaction taxes on buys, sells, or transfers to fund liquidity, rewards, or development. In practice:

- Liquidity Fees help sustain trading depth.

- Rewards distribute tokens to holders, incentivizing retention.

- Development Funds ensure ongoing updates and improvements.

Taxes can boost holder commitment but may deter traders if set too high. For broader tokenomics principles, see CoinDesk and for technical standards, ERC-20.

Staking and Reward Systems

Staking locks up tokens to earn rewards, which can stabilize price and reward long-term holders. Reward structures vary: dividend-like payouts, participation incentives, and governance rights that let stakers influence future directions. A well-designed system aligns community interests with tokenomics and discourages short-term dumping. As you compare protocols, consider how rewards are funded and whether there is a clear, auditable mechanism behind distributions.

Analyzing Sustainability in Meme Coin Models

Beyond hype, sustainable meme tokens emphasize transparent tokenomics, honest burn mechanics, and community-driven growth. Tools from CoinGecko and CoinMarketCap can help track supply, burns, and liquidity to provide investor transparency. For broader context on token design best practices, consider how gas costs and on-chain efficiency affect real-world usability. A practical check when evaluating a project is whether the token aligns with ERC-20 standards and industry best practices highlighted on Ethereum.org.

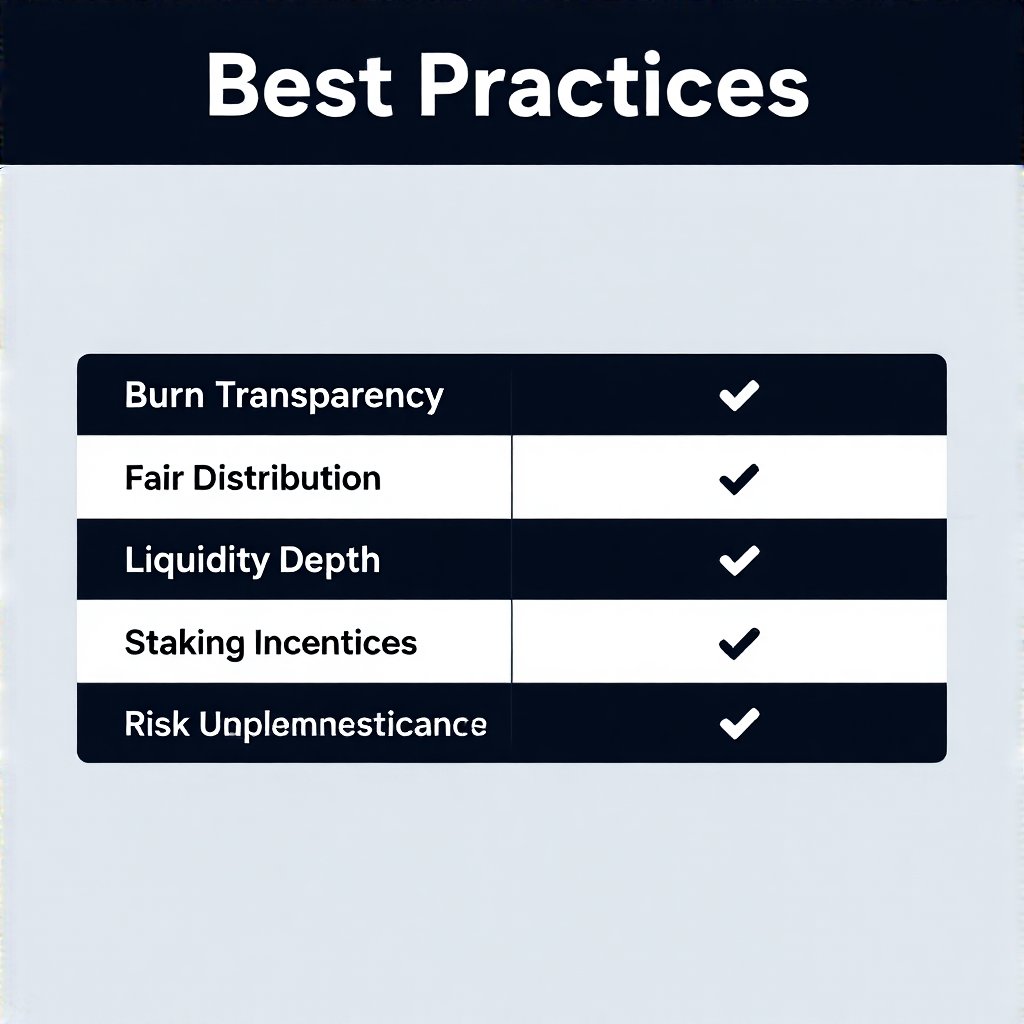

Best Practices

To separate signal from hype, apply these guardrails in practice. The table below contrasts common approaches and their trade-offs. This section synthesizes what you should look for when evaluating meme-token economics.

| Aspect | Good Practice | Risky Practice |

|---|---|---|

| Burn cadence | Transparent, forecastable burns with measurable impact | Opaque, irregular burns |

| Liquidity | Sufficient depth and lock-up mechanisms | Thin liquidity with high slippage |

| Distribution | Fair, verifiable allocations | Whale-heavy owners |

| Rewards | Clear funding and auditability | Unbounded token issuance |

For governance and strategic insights, some readers also explore DAO governance in exchange platforms and exit-scam patterns.

FAQ

Q: Can a meme token be sustainable without real utility?

A: Yes, if tokenomics, governance, and community incentives create enduring demand beyond hype.

Q: How important is price history in evaluating tokenomics?

A: Price is a reaction; tokenomics determine the long-term structural viability. Look for transparent reserves, burn cadence, and liquidity depth.

Q: Should I rely on external audits?

A: Yes. Independent audits reduce risk visibility gaps and improve trust in the token’s economics and security.