Solana Token Control: Developer Influence & Risks

A token is more than code: it sits at the intersection of governance, cryptography, and human intent. In Solana, ownership and control can hinge on who holds keys, who can mint or freeze, and how program logic ties to real-world actors. This article examines how linked addresses shape security, decentralization, and the potential for developer-driven actions. By analyzing data flows and governance signals, you’ll learn how to spot risk and what practices can improve transparency.

- Understanding developer control in Solana token contracts

- Linked addresses and the control graph

- Transparency, decentralization, and investor risk

- Mitigation: best practices for developers and investors

Understanding developer control in Solana token contracts

Developer authority often comes from minting, freeze, and upgrade permissions within the token program. In Solana, these controls are implemented in the SPL Token model and related programs. For readers seeking context, the official SPL Token program documentation explains how authorities are assigned and managed. See also the broader Solana documentation for governance implications.

Not all control is obvious at launch. A project may publicly present decentralization while retaining hidden privileges in the deployed program. For a deeper technical lens on risk, see our discussion of smart-contract vulnerabilities, which highlights how hidden controls can be exploited.

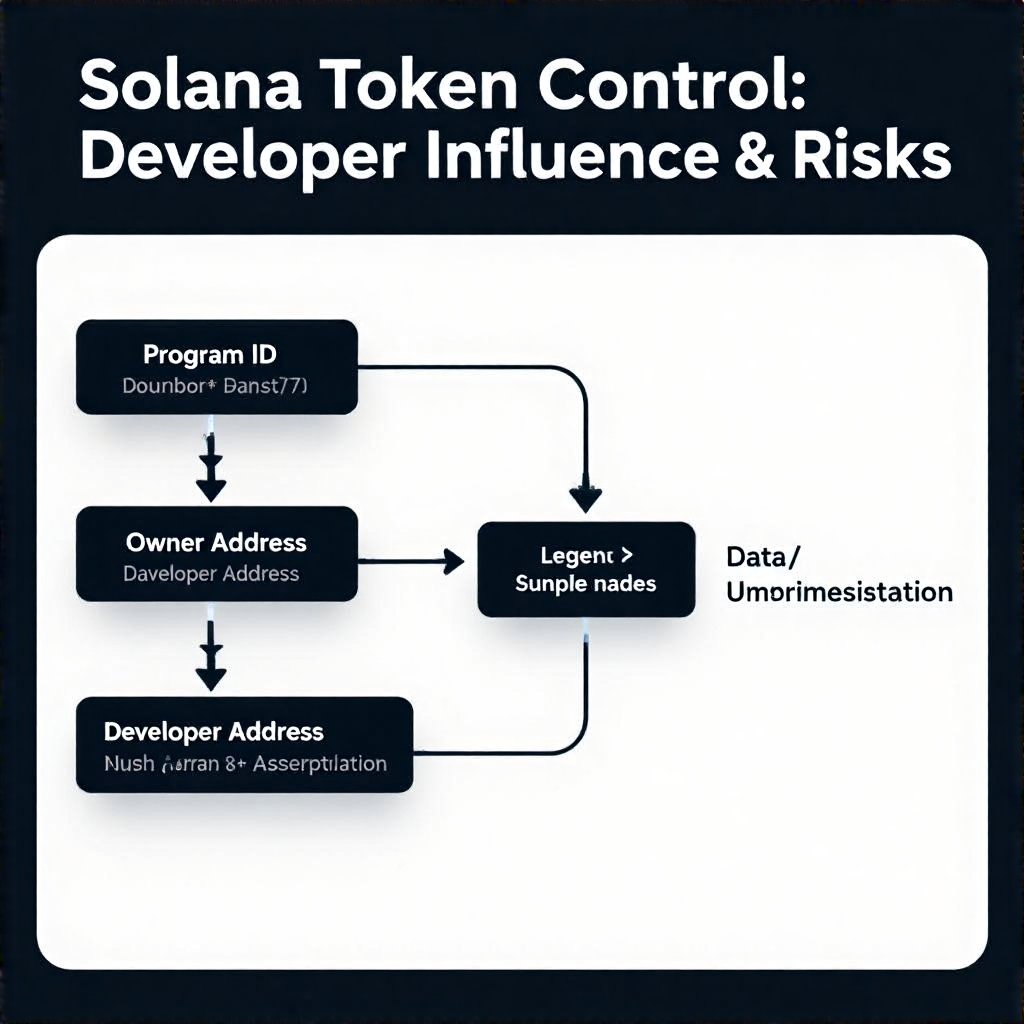

Linked addresses and the control graph

Ownership can involve linked addresses—owner wallets, developer accounts, and mint authorities—creating a control graph. The strength of decentralization depends on how many independent actors can authorize changes. In practice, a single point of failure in these links can expose funds or alter tokenomics. For readers exploring launch readiness, consult our Solana launch checklist for governance considerations.

Understanding the graph helps investors assess risk. A transparent token should publish key roles and their access rights, reducing the chance of covert actions. For background on broader risk patterns, access Solana’s programming model overview to see how programs orchestrate control flows.

Transparency, decentralization, and investor risk

Transparency is a guardrail against hidden control. When developers retain privileged keys or backdoors, centralization can creep in despite a project’s public messaging. Investors should look for clear disclosures about who can upgrade or pause a token, and how those controls are rotated or removed over time. For a broader risk lens, our internal analyses link to Defi platform risk assessment and related governance checks.

External signals matter too. Trust grows when teams publish audits and governance logs, and when there is a commitment to community oversight. See the Cyberscope audit framework for how to interpret security scores and remediation steps. Cyberscope audit reports offer a useful benchmark.

Mitigation: best practices for developers and investors

Developers should adopt minimal-privilege patterns, remove backdoors, and implement verifiable governance that limits centralized power. Investors can mitigate risk by demanding token mint authority rotation, public key disclosures, and independent audits. In practice, combine on-chain signals with off-chain governance metrics to form a holistic risk picture.