Escrow Systems in Decentralized Marketplaces: Building Trust in DeFi

Trust is the backbone of any marketplace. In DeFi, escrow systems lock funds until obligations are met, reducing disputes and aligning incentives across open networks. This guide expands on the core idea, linking practical design choices to real-world outcomes.

What Escrow Is (and Isn't) in DeFi

Escrow in DeFi is a programmable custody layer that holds assets under predefined conditions. Unlike traditional escrow, on-chain rules automate enforcement, enabling trust without a central intermediary. This dynamic is reflected in industry coverage such as Cointelegraph, and in standard definitions of escrow on reputable finance sites like Investopedia. For deeper context on how organizational structure affects trust, see how anonymous teams influence trust in DeFi.

In practical terms, escrow acts as a neutral arbiter, curbing counterparty risk and ensuring that neither party can run away with value before completion. It is especially valuable in high-value or time-delayed exchanges—where a digital asset is delivered only after payment verification, or vice versa. The design choices behind a given escrow—such as who can modify the contract and how disputes are resolved—shape both security and speed of settlement.

Thoughtful consideration of governance, transparency, and audience expectations helps determine whether an escrow solution remains trustworthy as projects scale. The discussion aligns with: upgradeability risks and the principle that structure matters as much as the code.

To broaden practical insight, many developers and investors evaluate escrows alongside robust exit-plan thinking, avoiding common pitfalls that lead to value lockups or disputes. For context on broader market risk, see how reputation and disclosure influence trust in DeFi ecosystems, which underscores the importance of transparent governance.

How Escrow Works in Practice

In a DeFi escrow, funds are locked in a smart contract that acts as the neutral intermediary. The contract enforces rules autonomously, reducing the need for a single custodian. This design presupposes careful auditing, clear dispute channels, and well-defined triggers for release. Investors should examine how upgradeability choices affect security, since upgradeability risks can alter who controls the logic.

As a vendor or buyer, you’ll want to review potential failure modes—like disputes over timing, content delivery, or authentication. Some frameworks pair on-chain enforcement with off-chain arbitration to speed resolution while preserving transparency. For context on the importance of reliable dispute channels, see external analyses and case studies in the field.

Beyond technical design, trust signals—audits, clear documentation, and community governance—play a critical role in user adoption. Integrating these signals with the escrow design helps minimize misalignment between participants and the protocol.

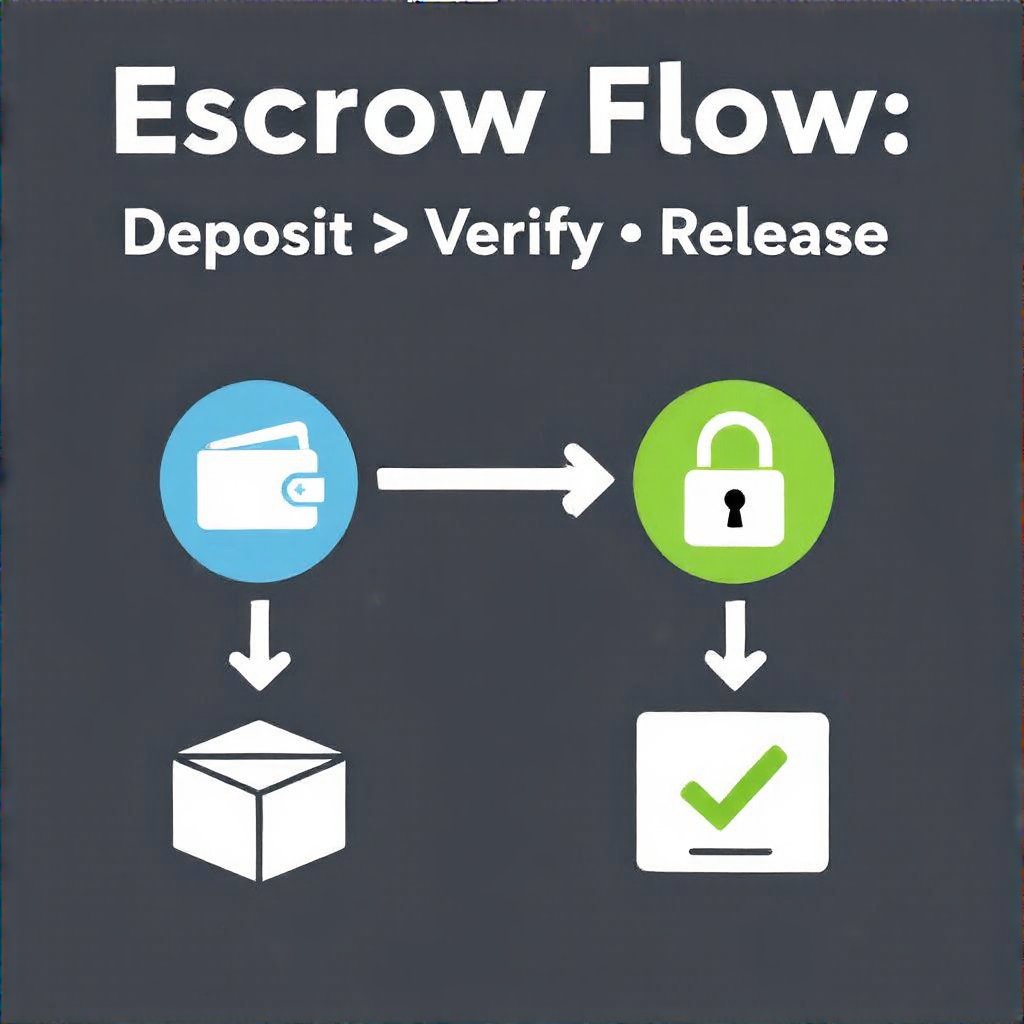

Escrow Flow: Step-by-Step

- The buyer deposits funds or assets into the escrow contract.

- The seller delivers the product or grants access to the digital item.

- The buyer confirms receipt or initiates a dispute if requirements aren’t met.

- The contract releases funds to the seller or routes assets to resolution through on-chain arbitration.

Disputes are resolved by on-chain mechanisms or trusted arbiters, ensuring neither side is left exposed. This flow reduces counterparty risk and supports faster, cheaper settlement than traditional intermediaries.

Pros, Cons, and Practical Trade-offs

Pros: trust-building, automated enforcement, lower overhead, and transparent audit trails on the blockchain.

Cons: introduction of contract complexity, potential gas costs, and the need for ongoing governance to handle upgrades. Centralization risk remains if control concentrates in a single actor or entity.

Risks and Limitations

Escrow systems improve safety but face vulnerabilities: bugs or exploits in smart contracts, oracle failures, and regulatory ambiguity across jurisdictions. Regular audits, formal verifications, and diversified dispute channels help mitigate these issues. The balance between on-chain rules and off-chain arbitration remains an active area of vetting in the space, with ongoing research and case studies informing best practices.

As the ecosystem evolves, cross-border and cross-chain considerations grow in importance, particularly for marketplaces handling diverse asset types. On-chain actions must be integrated with clear user expectations and well-documented governance to sustain long-term reliability.

The Future of Escrow in Web3

Escrow is likely to become more integrated with multi‑layer dispute resolution, stronger governance, and cross-chain compatibility. Projects experiment with hybrid models that combine off-chain arbitration and on-chain enforcement to improve speed and fairness. For broader context on the evolving market, see resources on smart contracts and ongoing research about secure design patterns in Web3.

Frequently Asked Questions

- What is the primary benefit of escrow in DeFi?

- Escrow reduces counterparty risk by holding assets until obligations are satisfied.

- Can escrow be hacked?

- Yes, through contract bugs or misconfiguration; rigorous audits and formal verification help mitigate this.

- Are escrow services legally enforceable?

- Enforcement varies by jurisdiction; consider integrating off-chain arbitration when appropriate.

In trustless markets, escrow is the backbone of safe, scalable commerce, helping DeFi reach mainstream adoption while preserving decentralization.