Interpreting Cer.live Security Scores in Blockchain

Cer.live scores summarize a project's security posture by aggregating on-chain signals and audit signals. This guide shows how to read them, their limits, and how to combine them with audits for risk assessment.

- What Cer.live Scores Reveal

- How Cer.live Calculates Scores

- Practical Investor Takeaways

- Integrating Cer.live with a Broader Security Review

What Cer.live Scores Reveal

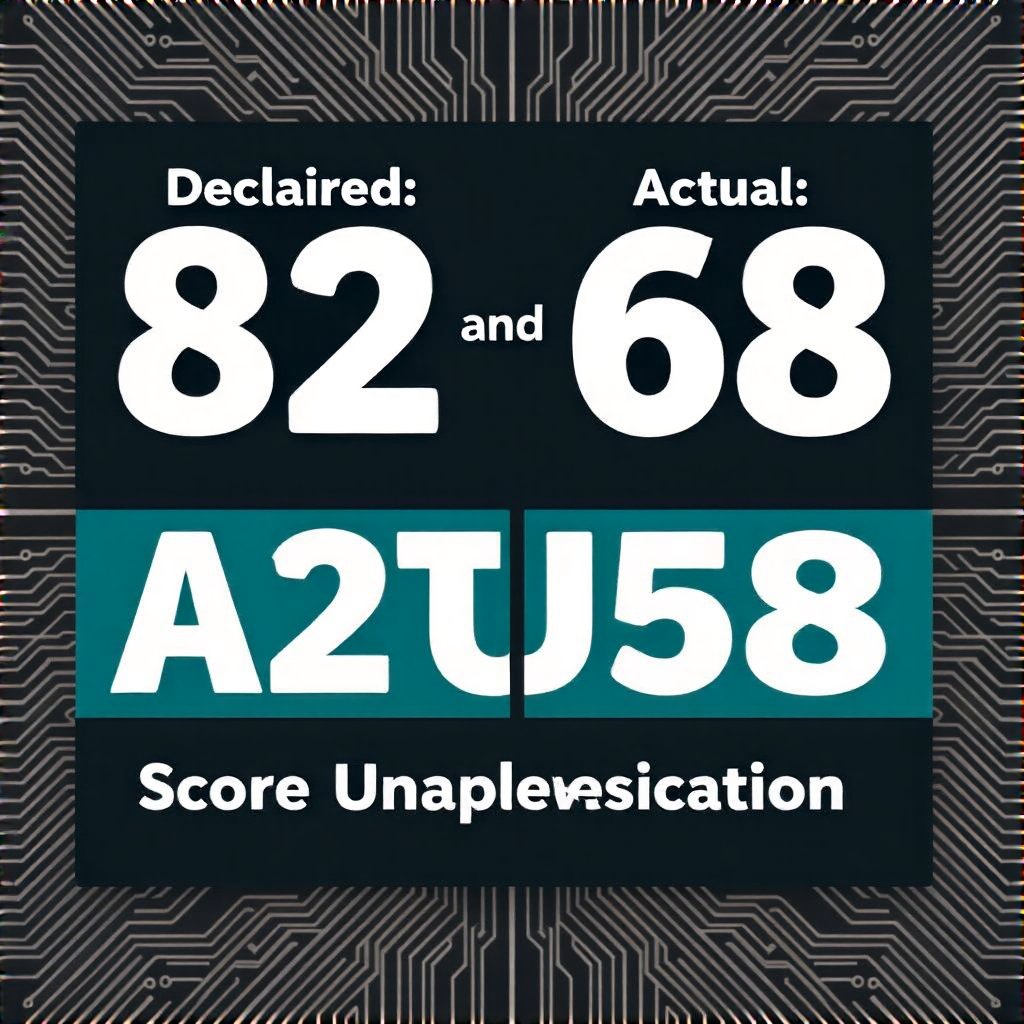

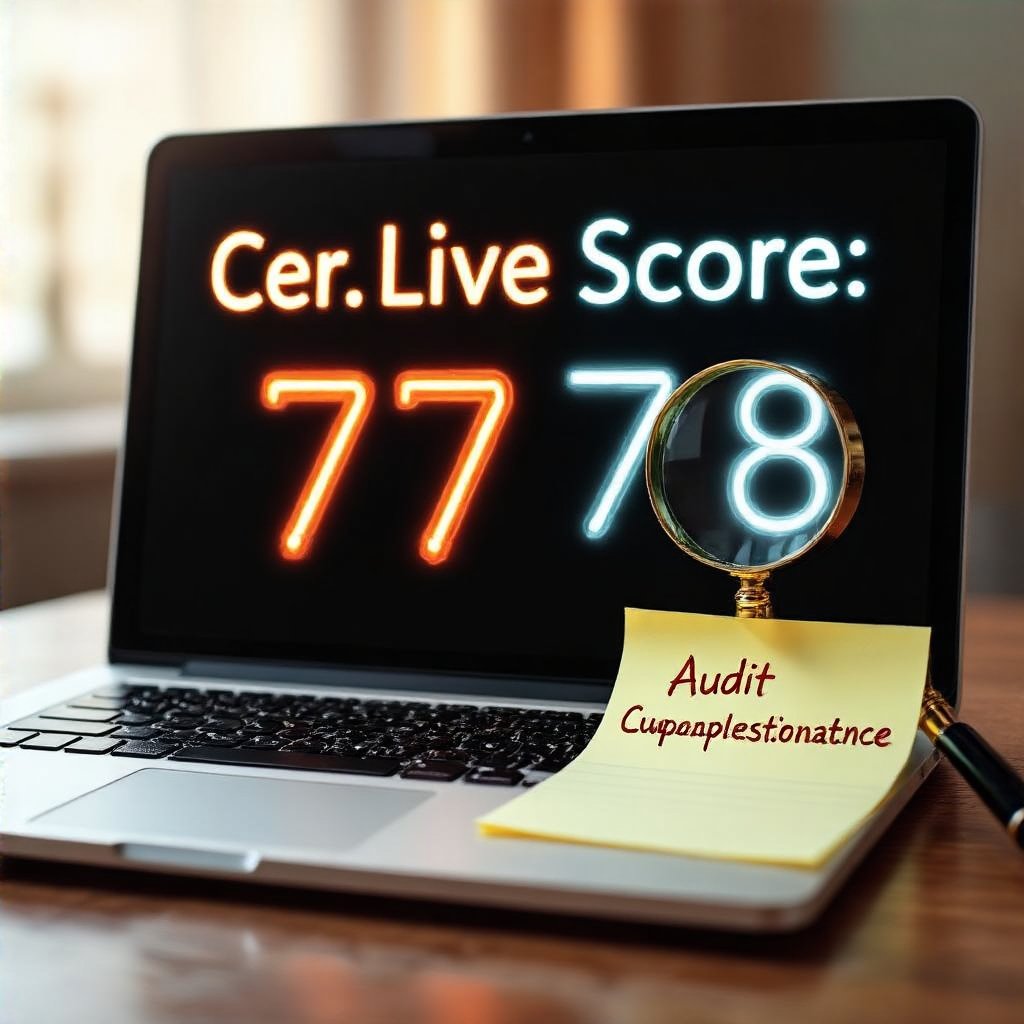

The Cer.live score compresses multiple signals into a single number, offering a quick snapshot of risk. It should be read as a guide, not a guarantee; always verify with source documents and on-chain activity. For deeper context, see our article on Cer.live audit scores.

Investors should look for what is counted or excluded and compare it to external audit findings. Cer.live is most useful when interpreted alongside actual contract code, historical exploits, governance processes, and ongoing monitoring signals.

How Cer.live Calculates Scores

Scores draw from on-chain behavior, vulnerability databases, auditing results, and developer activity signals. Weighing and thresholds determine the final figure, but limitations include data latency, sample size, and auditor scope. External insights from CoinDesk explain how industry analyses view security scoring in practice, while NIST Cybersecurity Framework provides a general risk-management lens that complements crypto-specific metrics.

In practice, you should also read our piece on DeFi yield strategies to understand how incentives and liquidity dynamics can influence perceived risk and signal trust when audits are favorable but code behavior diverges.

Practical Investor Takeaways

Use Cer.live as a starting point, then cross-check with audits, code reviews, and community signals. A cautionary reminder comes from abandonment case studies, which show that a high score can mask latent risk if the project later halts development or changes scope.

Look for explicit disclosures, ongoing monitoring, and strong governance. When evaluating DeFi projects, also consider token standards and cross-chain exposure, for example Solana SPL standards where applicable.

Integrating Cer.live with a Broader Security Review

In practice, combine Cer.live with multi-signal checks: third-party audits, on-chain analytics, and governance transparency. This approach aligns with a cautious risk framework and helps avoid overreliance on a single metric. For investors, this means validating scores against real-world outcomes and remediation timelines.

- Cross-verify with major audit findings and real-world exploit histories.

- Assess the team’s response and timelines for remediation.

- Consider cross-chain implications and token standards when evaluating DeFi projects.