High-Frequency Trading in DeFi: A Data-Driven Primer

In DeFi, data-driven traders pursue speed and signal fidelity to exploit tiny price disparities across on-chain venues. This guide expands the core ideas with statistical analysis and network graphs to reveal what’s truly happening beneath the hype.

- Technical Foundations

- Latency, Execution, and Proximity

- Risks: Market Microstructure

- Gas Fees and Cost Control

- Best Practices

- Outlook & Case Studies

- FAQ

Technical Foundations

High-frequency trading in DeFi relies on fast data streams, tight price discovery, and robust risk controls across on-chain venues. Oracles, automated market makers, and cross-chain messaging form the backbone, while block times bound the tempo. Ethereum’s finality cycle can be tens of seconds, whereas networks like Solana promise sub-second processing in practice. From a data-science lens, edge means fast, high-signal signals with low noise, not just raw speed. For broader market context, see the Solana memecoin market analysis.

Core components include on-chain price discovery, off-chain data feeds, and disciplined risk controls to prevent runaway positions. A growing topic is MEV (miner/extractor value) and how it redistributes opportunities, sometimes creating favorable signals but also elevating competition and risk.

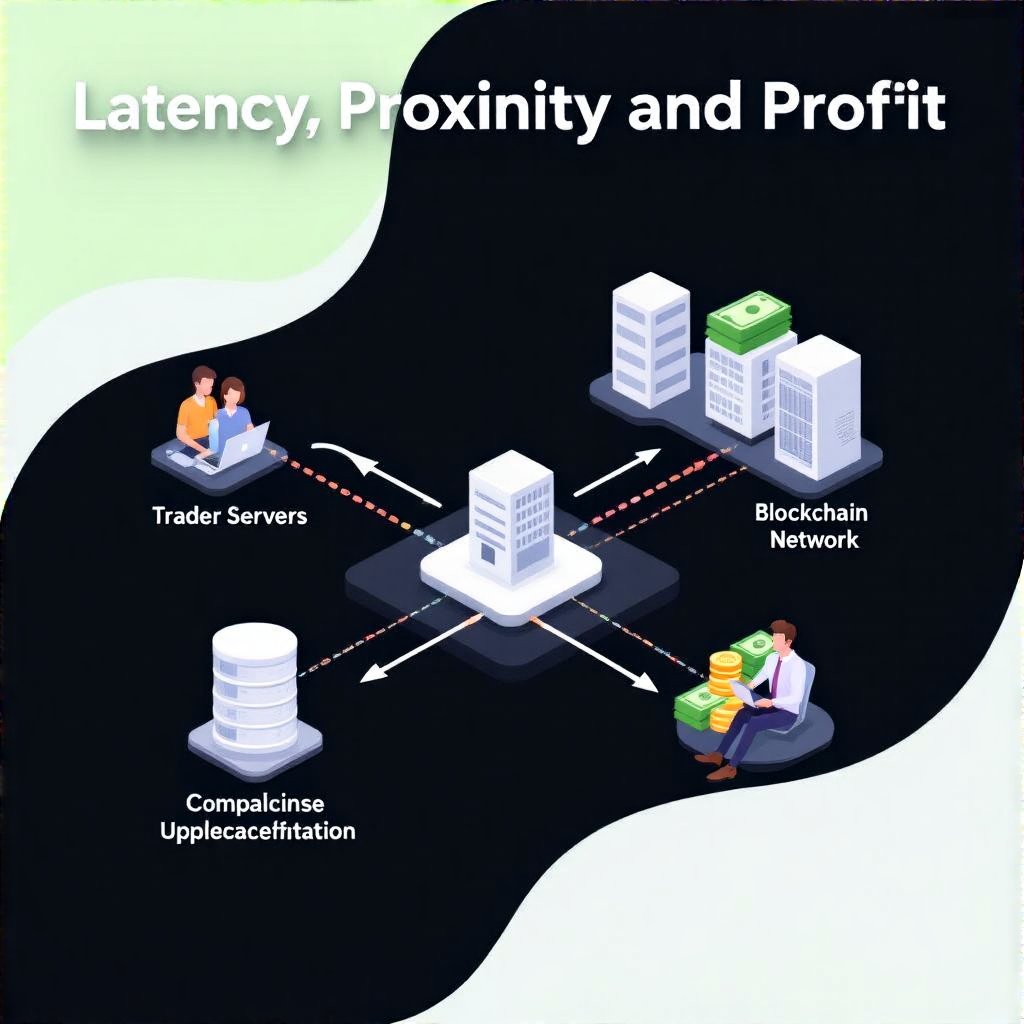

Latency, Execution, and Proximity

Speed remains critical. Market makers and arbitrage bots scan pools and DEXs, chasing fleeting mispricings. Latency and network congestion determine whether a bot captures or misses an opportunity. Traders optimize proximity—geographic and network—to nodes and endpoints to minimize jitter and improve predictability. The practical limit is a blend of hardware, software, and the chain’s consensus. For scaling context, see layer-2 scalability solutions for faster settlement and lower fees.

On-chain speed must be paired with reliability. Ecosystem analyses, including the Solana-oriented work mentioned above, illustrate how architecture choices shape edge and risk. See the Solana memecoin market analysis for concrete patterns in high-velocity markets.

Risks: Market Microstructure

DeFi markets are prone to manipulations such as wash trading rings and ghost buyers, distorting signals and creating a digital echo chamber. To counter this, traders validate signals across multiple venues, factor in MEV considerations, and stress-test strategies against abnormal activity. Visual analytics—network graphs and time-series decompositions—help separate visible hype from invisible data.

Gas Fees and Cost Control

Gas costs can erode profits when networks congest. Effective ordering, fee forecasting, and cross-chain/app-specific optimizations matter. Layer-2 channels and optimistic rollups can dampen fees and improve throughput. For a governance-aligned security framework, consult established practices like the blockchain data security best practices.

Best Practices

Adopt a structured workflow: monitor latency distributions, backtest rigorously, and implement guardrails that pause trading under abnormal conditions. A practical comparison of liquidity architectures informs design decisions: see Concentrated Liquidity vs Uniswap V2. Within governance-aware environments, consider DAO-informed decisions to align execution with protocol risk parameters, as discussed in internal governance insights here.

Outlook & Case Studies

The horizon includes faster consensus, smarter off-chain matching engines, and expanding layer-2 ecosystems. For a canonical view of Layer-2 architecture, reference layer-2 scalability solutions. Data-driven analyses reveal how hype diverges from signal, highlighting the concept of Visible Hype vs Invisible Data in real markets.

Case studies emphasize edge opportunities in scalable ecosystems, with considerations for capital efficiency and risk controls that are grounded in empirical data rather than headlines.

FAQ

Q: Can true HFT exist in DeFi given block finality?

A: Edge comes from timing, data integrity, and MEV-aware strategies, all bounded by risk controls and finality characteristics.

Q: How should a trader begin testing HFT ideas?

A: Start with backtesting on historical data, simulate network latencies, and validate results before live deployment.